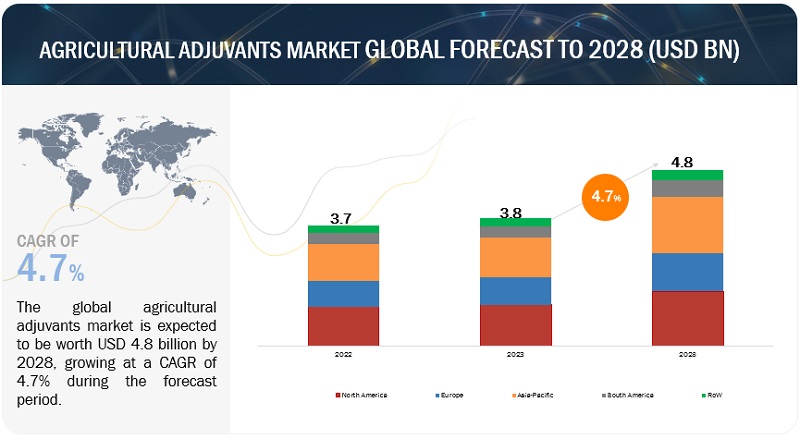

The agriculture adjuvants industry is projected to grow from USD 3.8 billion in 2023 to USD 4.8 billion by 2028 growing at a CAGR of 4.7% during the forecast period. The agricultural adjuvants industry is growing because of the growing demand for sustainable pest management of farming operations. Additionally, the increased focus on food security is projected to fuel the development of agricultural adjuvants.

Agriculture Adjuvants Market Trends

The agriculture adjuvants market is expected to see continued growth in the coming years, driven by several key trends:

- Increasing demand for food: A growing global population with rising incomes will put pressure on food production. Adjuvants can help farmers improve crop yields to meet this demand.

- Focus on sustainable agriculture: There’s a growing emphasis on environmentally friendly farming practices. Adjuvants can help by increasing the effectiveness of pesticides, allowing farmers to use less of them.

- Precision agriculture: Advancements in agricultural technologies like precision farming are creating a need for more targeted and efficient crop protection strategies. Adjuvants can play a role here by improving the application and efficacy of crop protection products.

Agriculture Adjuvants Market Opportunities: Precision farming techniques to boost the application of adjuvants

Precision farming techniques, including aerial spraying, smart irrigation, and variable rate application, are becoming increasingly popular worldwide. Agriculture adjuvants enhance the effectiveness of these methods by improving the coverage, absorption, and penetration of agrochemicals. This optimization creates significant opportunities for adjuvant manufacturers.

Based on application, the herbicides segment accounted for the largest share of the agriculture adjuvants market.

Herbicides are widely used in agriculture for weed control. Weeds compete with crops for resources such as nutrients, sunlight, and water, leading to reduced crop yields. The rise of herbicide-resistant weeds is a significant concern in agriculture. Herbicide-resistant weed populations have been increasing globally, making weed control more challenging. To manage these challenges, agricultural adjuvants are increasingly being used.

Based on crop type, cereal & grain accounted for the fastest market share of the agriculture adjuvants market.

Cereal and grain crops, such as wheat, corn, rice, barley, and oats, are staple food crops cultivated extensively worldwide. Cereal and grain crops have high commercial value due to their widespread consumption as food, animal feed, and raw materials for various industries. The large-scale cultivation of these crops leads to significant demand for crop protection products, including adjuvants, to ensure optimal yield and quality.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1240

The North American market is projected to contribute the largest share of the agricultural adjuvants market.

The demand for agriculture adjuvants in North America is experiencing notable growth due to the increasing use of precision farming in the region. This creates a favorable business environment for adjuvants manufacturers and consumers in the region. North America has the presence of major agricultural adjuvants companies, that offer a wide range of products catering to different crop types and application requirements.

Agriculture Adjuvants Companies

The key players in the agriculture adjuvants market include Corteva Agriscience (US), Evonik Industries AG (Germany), Croda International Plc (UK), Nufarm Limited (Australia), Solvay SA (Belgium), BASF SE (Germany), Huntsman International LLC. (US), Clariant AG (Switzerland), Helena Agri-Enterprises, LLC (US), WILBUR-ELLIS AGRIBUSINESS (US), Precision Laboratories, LLC (US), and CHS Inc. (US). A primary focus was given to new product development to meet the growing demand from farmers. Additionally, acquisitions and deals were other key strategies adopted by these players to expand their presence in the agricultural adjuvants space.