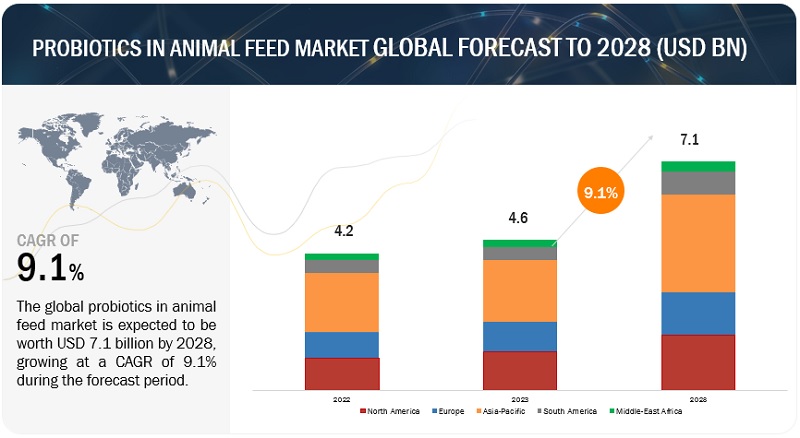

The probiotics in animal feed market industry is projected to reach USD 7.1 billion by 2028 from USD 4.6 billion by 2023, at a CAGR of 9.1% during the forecast period in terms of value. The demand for probiotics in animal feed is primarily driven by increase in production and demand of compound feed along with rising consumption of feed additives in emerging markets such as Asia Pacific and South America.

Probiotics in Animal Feed Market Trends

The probiotics in animal feed market is experiencing significant growth, driven by several key trends:

- Rising Awareness of Animal Health: Farmers are increasingly recognizing the importance of maintaining gut health in animals for optimal production. Probiotics are seen as a way to improve digestion, nutrient absorption, and overall well-being, leading to healthier and more productive livestock.

- Shift Towards Natural Alternatives: Concerns about antibiotic overuse in animal agriculture and the rise of antibiotic resistance are driving a shift towards natural alternatives for promoting animal health. Probiotics offer a safe and effective way to boost immunity and potentially reduce reliance on antibiotics.

- Growth of Compound Feed Production: The increasing demand for meat, poultry, and dairy products is fueling the production of compound feed, which often includes probiotics as an additive. This trend is particularly strong in developing regions like Asia Pacific and South America.

- Liquid Probiotics Gaining Traction: Liquid probiotics are becoming increasingly popular due to their ease of use and potentially faster absorption by animals. This segment is expected to see the highest growth rate in the coming years.

- Focus on Innovation: The market is seeing a rise in innovative probiotic products tailored to specific animal species and health concerns. This trend is driven by growing demand for targeted solutions that address the unique needs of different animals.

Probiotics in Animal Feed Market Opportunity: Abolition of Antibiotic Growth Promoters (AGPs)

In 2006, the European Union (EU) implemented a ban on antibiotics in animal feed. AGPs are chemicals or drugs that are added in animal feed in order to improve growth and the quantity of animal produce. According to the EU, the use of these drugs led to the development of antibiotic-resistant microbes to treat infections in humans and animals.

Antibiotic residues in meat and other animal products affect human health, due to which the human body becomes vulnerable to diseases when antibiotic-resistant microbes enter the system, resulting in weaker immunity. Along with the EU, the FAO has also restricted the use of antibiotics in animal feed. Such actions have made lucrative prospects of huge investment for probiotic manufacturers, as feed manufacturers are exploring alternatives to enhance the quality of animal feed and one such alternative being probiotics.

Increased prevalence of disease outbreaks to augment the market growth

Unsafe and adulterated feed ingredients reduce the immunity of animals, thereby causing productivity loss by affecting the quality of animal products. The increased prevalence of disease outbreaks has encouraged livestock farmers to purchase superior-quality feed products with additives. Safety and quality of products have always been a high priority for customers, as disease outbreaks can affect the production, trade, and consumption of livestock products, such as dairy products, meat, egg, and other by-products. Furthermore, regions affected by such outbreaks are banned from exporting products for a prolonged period until completely quarantined and controlled. In the recent past, the Asia Pacific region experienced outbreaks of SARA-CoV-2 virus (2019), H5N1 influenza virus (2014) and foot-and-mouth disease (2011), which impacted trade, and livestock producers incurred heavy losses due to increased awareness about animal welfare.

Health deterioration in animals due to the use of pharmaceuticals in animal feed has been a matter of concern, which has ultimately increased the demand for nutritive products by livestock farmers. Thus, the demand for probiotic animal feed is likely to rise at a rapid pace.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=85832335

Asia Pacific is expected to dominate the market during the forecast period.

Countries such as China, India, Japan, Australia & New Zealand, and rest of the Asia Pacific have been considered in this study. Some of the factors for the high demand of the market in Asia Pacific region includes growing population, rise in disposable incomes, and rapid urbanization. Increasing demand for meat and animal products among the growing population of the Asia Pacific region along with the rising affluence in the region resulted in high consumption of meat products. This has also resulted in intensified livestock production for meat, which in turn drives the need for improved animal health and performance.

The growth of the meat industry in developing economies such as India and China, as well as the increased consumption of quality meat products, are primary drivers for the Asian market. Augmented concern over livestock diseases and outbreaks of infections has further highlighted the importance of animal health and wellness to ensure the safety of end users. The advent of globalization and urbanization has caused a shift in consumer preferences, where consumers opt for nutritious, quality food products and like to experiment with food choices. These factors are expected to continue in the coming years, driving demand the for probiotics in animal feed market.

Probiotics in Animal Feed Companies

The key players in this market include ADM (US), International Flavors & Fragrances Inc. (US), CHR. HANSEN HOLDING A/S (Denmark), Evonik Industries AG (Germany), Land O’Lakes (US), DSM (Netherlands), Ohly (Germany), Novozymes (Denmark), Alltech (US), Kemin Industries, Inc. (US), Provita Animal Health (UK), Orffa (Netherlands), Lesaffre (France), Lallemand Inc. (Canada). These players have adopted various growth strategies such as partnerships, agreements, collaborations, and new product launches to increase their global market presence.