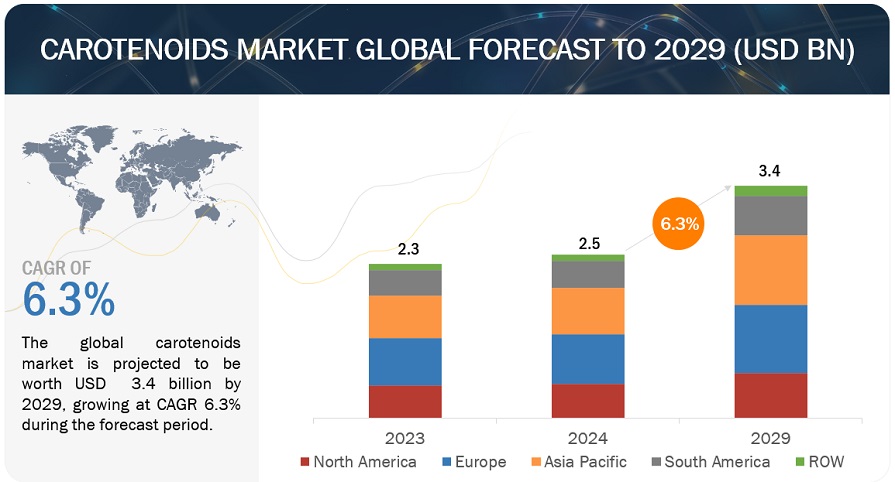

The carotenoids market size is projected to reach USD 3.4 billion by 2029 from USD 2.5 billion by 2024, at a CAGR of 6.3% during the forecast period in terms of value. Demand for dietary supplements is increasing, leading to higher consumption of natural carotenoids. There is a growing need for sustainable, natural, clean label, natural carotenoids that contribute to market expansion. Changing dietary preferences and the awareness of health and wellness further propel market growth. Overall, these trends highlight the growing significance and adoption of carotenoids.

Carotenoids Market Trends

Here are some of the carotenoids market trends–

- Growing Demand in Food and Beverage Industry: Carotenoids are widely used as natural colorants and nutritional additives in various food and beverage products. The increasing consumer preference for natural ingredients has been driving the demand for carotenoids in this sector.

- Health and Wellness Trends: Carotenoids such as beta-carotene, lycopene, and astaxanthin are renowned for their antioxidant properties and health benefits. With the rising awareness of the importance of nutrition in maintaining health and preventing diseases, the demand for carotenoid-rich supplements and functional foods has been on the rise.

- Expansion in Cosmetics Industry: Carotenoids are also utilized in the cosmetics industry for their skin-enhancing properties. They are incorporated into skincare and beauty products due to their antioxidant and anti-inflammatory characteristics. The trend towards natural and organic cosmetics has further boosted the demand for carotenoids in this sector.

- Technological Advancements in Production: Continuous advancements in biotechnology and extraction techniques have enabled more efficient and sustainable production of carotenoids. This has contributed to an increase in the availability of carotenoid-rich ingredients for various applications.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=158421566

Carotenoids Market Drivers: Increased use of natural carotenoids as food and beverage colorants.

The shift towards natural and clean label ingredients in the food industry has spurred increased utilization of natural carotenoids as food colorants. Carotenoids, found in fruits, vegetables, and algae, serve as appealing substitutes to synthetic colors due to their perceived health benefits and clean label appeal. Consumers seek products with recognizable, natural ingredients like beta-carotene, lycopene, and astaxanthin, which not only provide vibrant colors but also offer antioxidant properties. With a growing demand for natural ingredients and a preference for brightly colored foods, food manufacturers must prioritize understanding these trends to effectively meet consumer expectations and influence purchasing decisions. Consequently, incorporating natural carotenoid extracts across dairy, bakery, confectionery, beverages, and snacks enables versatile color applications in response to evolving consumer preferences.

The Asia Pacific region is expected to grow at the highest CAGR in the carotenoids market during the forecast period.

The carotenoid market in the Asia-Pacific region is experiencing the highest growth rate due to several key factors. Firstly, rising consumer awareness of health and wellness, coupled with changing dietary preferences towards natural and functional ingredients, drives the demand for carotenoids in food, beverages, and dietary supplements. Secondly, rapid urbanization and increasing disposable incomes in emerging economies fuel the expansion of the food and beverage industry, creating opportunities for carotenoid manufacturers. Additionally, the growing prevalence of chronic diseases and aging populations amplify the demand for carotenoids, known for their antioxidant properties and health benefits, further propelling market growth in the region.

- DSM (Netherlands)

- BASF SE (Germany)

- Cyanotech Corporation (US)

- Givaudan (Switzerland)

- ADM (US)

- NHU (China)

- Divi’s Laboratories Limited (India)

- Allied Biotech Corporation (Taiwan)

- Lycored (US)

- Kemin Industries, Inc. (US)

- Fuji Chemical Industries Co., Ltd. (Japan)

- EW Nutrition (Germany)

- Döhler GmbH (Germany)