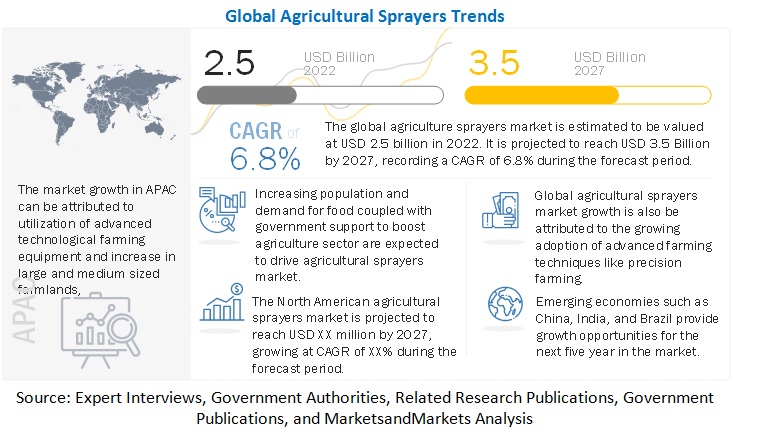

The global agricultural sprayers market is estimated at USD 2.5 billion in 2022. It is projected to reach USD 3.5 billion by 2027, recording a CAGR of 6.8% during the forecast period. Due to significant advancements in farming and spraying technology, the market for agricultural sprayers is growing. Sprayers are becoming more common in developing economies like China, Russia, and Brazil for crop protection. Farm operators now depend on sprayers to apply insecticides, herbicides, and fertilisers in the field pre and post harvest as needed. Farmers can apply chemicals more precisely and efficiently due to the technological developments in agricultural sprayers.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=46851524

The self-propelled segment by type is projected to achieve the highest CAGR growth in the agricultural sprayers market.

Self-propelled sprayers are used to meet the large-scale productivity demands of crops. Although self-propelled sprayers have slightly higher initial costs, its lower application costs contributes to a higher ROI. Self-propelled sprayers can do the same job as pull-type machines for the same or less money, depending on the number of acres covered. A self-propelled sprayer becomes more cost-effective as the acres covered increases.

By capacity, the high volume sprayers is projected to account for the highest CAGR 6.4% in the agricultural sprayers market.

The most common equipment for applying fertilizer and pesticides is high volume sprayers. The tanks capacity is significantly higher than that of other types of sprayers, which extends the spraying period by reducing the amount of time spent traveling and filling the tank. The benefit of using high volume sprayers is that they last longer and provide the crop with proper penetration and coverage of fertilizers, insecticides, and other chemicals.

Top Companies in the Agricultural Sprayers Market

The Agricultural sprayers market consists of a few globally established players such as John Deere (US), CNH Industrial NV (UK), Kubota Corporation (Japan), Mahindra & Mahindra Ltd (India), STIHL AG (Germany), AGCO Corporation (US), YAMAHA Motor Corporation (Japan), Bucher Industries AG (Switzerland), DJI (China), Exel Industries (France), Amazonen Werke (Germany), B group Spa (Italy), Case IH (US), HD Hudson Manufacturing Co (US), and Buhler Industries Inc (Canada). Strategic partnerships were the dominant strategy adopted by the key players, followed by expansions and new product launches. These strategies have helped them to increase their presence in different regions and industrial segments.

John Deere has been one of the leaders in the field of agricultural products since the introduction of automatic guidance equipment and yield monitors in the late 1990s. It manufactures equipment for the agricultural, construction, turf, and forestry industries. The company’s financial services, machinery parts services, power systems, and intelligent solution group businesses support and differentiate its equipment business. The agricultural product portfolio of the company consists of tractors, sprayers, mowers, loaders, shredders & cutters, scrapers, and precision agricultural technology. Agricultural variable-rate technology is offered as a part of the precision agriculture segment. The main subsidiaries of the company are Gan-Gvat Assets Ltd. (Israel), John Deere GmbH (Germany), Jenco Wholesale Nurseries Inc. (US), John Deere S.A. (Mexico), and John Deere Agricultural Machinery Co. Ltd. (China). The majority of John Deere’s business is concentrated in the North American countries of the US and Canada. Europe, Russia, India, Brazil, and China are the other key markets of the company.

CNH Industrial NV is among the global leaders in the manufacturing, designing, marketing, selling, and funding of farm machinery across the globe. The company has 12 brands that cater to the agricultural and construction industries. The company has a presence in around 180 plus countries across the globe, along with 49 research and development centers, and 64 manufacturing facilities. CNH Industrial NV specializes in offering specialty vehicles for firefighting, as well as defense. The agricultural equipment segment of CNH Industrial offers farm machinery and tools such as self-propelled sprayers, material handling equipment, two-wheel and four-wheel drive tractors, harvesters, planting & seeding equipment, hay & forage equipment, and soil preparation & cultivation implements. These equipment are marketed and manufactured under the New Holland Agriculture, Case IH Agriculture, and Steyr brands. As far as agricultural sprayers are concerned, they is marketed under the banner of Case IH Agriculture.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=46851524

Key Questions Addressed by This Report:

Which region is projected to account for the largest share of the agricultural sprayers market?

What is the current size of the global agricultural sprayers market?

Which are the key players in the market, and how intense is the competition?

What are the key factors driving the growth of the agricultural sprayers market?

What is an agricultural sprayer?

What are the major applications of agricultural sprayers?