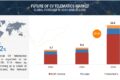

The global future of CV telematics market size is projected to grow from USD 5.4 Billion in 2024 to USD 12.8 Billion by 2030, at a CAGR of 15.2%. The surge in e-commerce and last-mile delivery services is driving the demand for advanced telematics solutions that offer real-time tracking, enhanced customer service, and improved delivery efficiency. Additionally, the Rising fuel prices and the need for cost-effective transportation solutions are driving the demand for CV telematics.

Based on Solution Type: The embedded segment of the future of CV telematics market is poised to emerge as the largest market during the forecast period, driven by its inherent integration within vehicle systems, ensuring seamless functionality and reliability. The launch of Mobilisights’ Fleet Management Data Pack service in March 2024 highlights the growth of embedded solutions in this market. This service, included in all 2024 model year LCVs from Stellantis Pro One brands (Citroen, FIAT Professional, Opel, Peugeot, and Vauxhall), offers up to four years of integrated telematics data services, enhancing fleet management through a subscription model already included in the vehicle price. Such innovations highlight the increasing demand for embedded solutions, which are pivotal in streamlining fleet management through advanced analytics and actionable intelligence. As a result, embedded telematics continues to witness robust growth, meeting evolving industry needs and expanding its footprint in the commercial vehicle sector.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=227143770

By Vendor Type: The aftermarket segment of the future of CV telematics market covers solutions and systems added to vehicles post-purchase rather than during manufacturing. Enterprises like Samsara Inc. (US), Verizon Connect (US), and Targa Telematics (Italy) offer a diverse selection of post-purchase telematics and fleet management options. These options provide numerous advantages, such as adaptability, personalization for different vehicle categories and fleet requirements, and the capacity to enhance and incorporate new technologies. The aftermarket industry is growing quickly because of the rising request for affordable telematics options, the desire for improved fleet management features, and the simplicity of installing advanced telematics technology on current vehicles. The aftermarket telematics market is growing due to factors like increased focus on operational efficiency, safety, and regulatory compliance. Another key reason for this growth is the increasing need for flexible and customizable telematics solutions across diverse vehicle fleets. Companies like Geotab Inc. (US), Verizon Connect (US), and Teletrac Navman US Ltd. (US) offer a variety of products and solutions as part of aftermarket telematics, catering to specific fleet management needs. Recent developments, such as Teletrac Navman’s launch of the IQ Camera in May 2024, which features driver distraction detection, cell phone usage monitoring, and drowsiness alerts, highlight the growing demand for advanced telematics solutions

By Region: The commercial vehicle telematics market in Asia Pacific is rapidly expanding, driven by technological advancements and a high demand for effective fleet management solutions. This section will explore the current state of the commercial vehicle telematics market in Asia Pacific, which includes the China, India, Japan, and South Korea, focusing on its growth, key players, and prospects. Businesses are more and more utilizing telematics to improve route planning, driver safety, and fuel efficiency, leading to lower operational expenses and better service provision. Its significant effect is creating a lively environment of creativity and financial support in the Asia Pacific area, establishing it as a top center for advancements in commercial vehicle telematics. As a result, many players are focusing on expanding in this region to strengthen their footsteps in the region. For example, in April 2024, Sasken Technologies (India) and Joynext (China) announced a collaboration to develop platforms for in-vehicle systems like navigation, digital cockpit, 5G telematics, and off-vehicle cloud services. Likewise, in April 2024, Marelli Holdings Co., Ltd. (Japan) introduced ProConnect at Auto China in Beijing, a fully integrated cluster with infotainment and 5G telematics targeted at the Chinese market. ProConnect aims to optimize performance and cost by integrating cockpit and telematics functions, eliminating redundant components, and reducing costs by up to 40% compared to traditional architectures. These advancements indicate robust growth in the region’s telematics market.

Key Players

The commercial vehicle telematics market is dominated by global players such as Verizon (US), Geotab Inc. (Canada), Samsara Inc. (US), MiX by Powerfleet (US), Omnitracs (US), and Teletrac Navman US Ltd. (US), among others. These companies adopted new product development strategies, expansions, partnerships & collaborations, and mergers & acquisitions to gain traction in the market.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=227143770