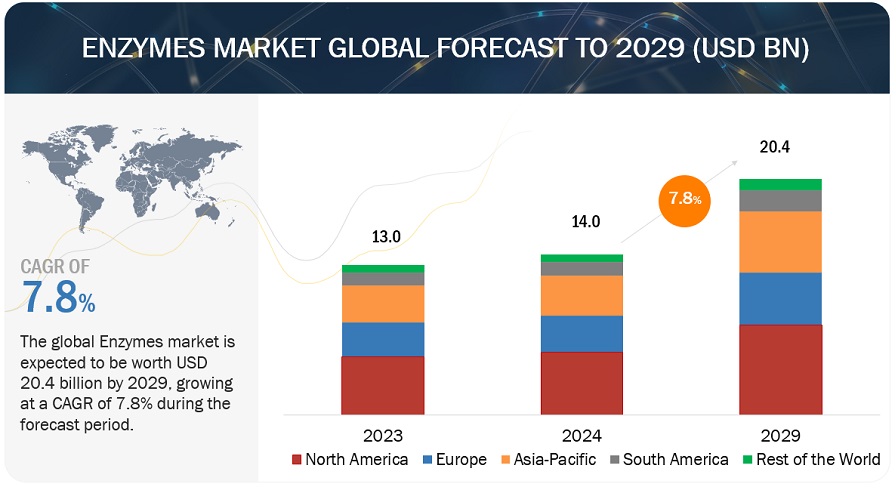

The enzymes market size is expected to grow from USD 14.0 billion in 2024 to USD 20.4 billion by 2029, reflecting a CAGR of 7.8% during this period. This growth is driven by increasing global demand for enzymes across various industries. In the food and beverage sector, enzymes improve product quality and consistency, while in biofuels, they promote more efficient and sustainable production methods. The pharmaceutical industry leverages enzymes for drug formulation and disease treatment. Furthermore, the rising emphasis on eco-friendly and cost-effective industrial processes is boosting enzyme applications in detergents and textiles. Innovations in biotechnology are also leading to the development of specialized enzymes for targeted uses, enhancing their demand. Overall, the versatility and effectiveness of enzymes across multiple sectors are fueling their increasing global demand, with market players actively engaging in partnerships for industrial and specialty enzymes.

Here are some trends currently shaping the enzymes market:

- Increased Demand in Food and Beverage: The rise in health-conscious consumers has led to higher demand for enzymes in food processing, enhancing flavor, texture, and nutritional content.

- Biotechnology Advancements: Innovations in biotechnology are leading to more efficient enzyme production processes, improving yield and reducing costs.

- Sustainable Practices: There’s a growing emphasis on sustainability, driving the use of enzymes in eco-friendly applications like biofuels, biodegradable plastics, and waste management.

- Pharmaceutical Applications: The use of enzymes in drug formulation and as therapeutic agents is expanding, particularly in personalized medicine and biosimilars.

- Animal Feed Enzymes: The demand for animal feed additives, particularly enzymes that improve nutrient absorption and digestion, is on the rise due to the growing livestock industry.

- Personal Care Products: Enzymes are increasingly being incorporated into personal care and cosmetics for their ability to enhance product efficacy and skin benefits.

Specialty Enzymes Expected to Capture a Major Enzymes Market Share During the Forecast Period.

Specialty enzymes are crucial in the pharmaceutical and biotechnology sectors, particularly in biopharmaceutical production involving monoclonal antibodies and gene therapies, where precision and specificity are vital. For example, proteinase K is commonly used in DNA and RNA extraction for genomic research, a field that has seen heightened demand due to advancements in personalized medicine and diagnostics. This segment of specialty enzymes benefits from substantial R&D investments and innovations. Companies such as Novozymes A/S (Denmark) and dsm-firmenich (Switzerland) are focused on creating novel enzymes with enhanced stability and activity tailored for specific industrial uses. A notable example is dsm-firmenich’s launch of Maxilact Next in May 2023, which improves lactose-free dairy production efficiency by 25% without compromising taste. Additionally, supportive regulatory frameworks for biopharmaceuticals and the rising incidence of chronic diseases that require advanced treatments further drive the growth of specialty enzymes, reinforcing their market leadership.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=46202020

Plant-Derived Enzymes Capture a Major Share of the Enzymes Market.

Amylase, derived from barley and wheat, plays a vital role in the brewing industry by breaking down starches into fermentable sugars, enhancing both the efficiency and quality of beer production. In the juice and wine sectors, pectinase sourced from fruits such as apples and oranges is widely used to clarify beverages and boost juice yield. Plant enzymes are also essential in the expanding market for plant-based and vegan products. For example, transglutaminase from plant sources improves texture and binding in meat alternatives, addressing the growing consumer demand for sustainable and ethical food choices. This trend is reinforced by the increasing popularity of plant-based diets, which further drives the demand for plant-derived enzymes. Companies like Novozymes have made significant investments in developing enzyme solutions tailored to specific industry needs. In March 2020, Novozymes A/S (Denmark) launched Saphera Fiber, a plant-derived lactase enzyme aimed at increasing fiber content in dairy products while lowering sugar levels, catering to health-conscious consumers.

Enzymes Market Forecast: Asia Pacific to Experience the Highest Growth Rate

The Asia-Pacific region is poised for significant growth in the enzyme market, influenced by unique industry dynamics and regional trends. A major driver is the biopharmaceutical sector, especially in countries like South Korea and Singapore, where the demand for enzymes in drug manufacturing and bioprocessing is rising. These enzymes are vital for processes such as protein expression, purification, and modification, which are crucial for producing biologics like monoclonal antibodies and vaccines. Additionally, the burgeoning healthcare and diagnostic sectors in the region are rapidly increasing the need for specialty enzymes, particularly for diagnostic assays, genetic testing, and therapeutic applications, fueled by heightened investments in healthcare infrastructure and research. Moreover, the thriving textile and detergent industries in countries like Bangladesh and Vietnam present promising opportunities for enzyme manufacturers. Enzymes are increasingly utilized in textile processing for fabric softening, de-sizing, and denim finishing, as well as in detergent formulations for enhanced stain removal and fabric care. As these sectors evolve in response to changing consumer preferences and regulatory standards, the demand for enzymes is expected to rise sharply, establishing the Asia-Pacific region as a key driver of growth in the global enzyme market.

Key players in this market include BASF SE (Germany), International Flavors & Fragrances Inc. (US), dsm-firmenich (Switzerland), Associated British Foods plc (England), Novozymes A/S (Denmark), Kerry Group plc. (Ireland), Dyadic International Inc. (US), Advanced Enzyme Technologies (India), Aumgene Biosciences (India), Amano Enzyme Inc. (Japan), F. Hoffmann-La Roche Ltd (Switzerland), Codexis, Inc. (US), Sanofi (France), Merck KGaA (Germany), Adisseo (China).

Enzymes Industry News:

- In January 2024, Novozymes and Chr. Hansen has completed their merger, resulting in the establishment of Novonesis. As a bio solutions partner, Novonesis aims to enhance business, promote healthier lives, and support a healthier planet. The combined expertise of the company spans over 30 different industries.

- In December 2023, IFF and Kemira (Finland) are collaborating to commercialize renewable polymers from IFF’s Designed Enzymatic Biomaterials (DEB) technology, integrating production into Chemigate Ltd’s biorefinery in Finland by mid-2024. This innovation addresses the demand for sustainable alternatives in pulp, paper, water treatment, and other markets. By expanding DEB technology, IFF will offer high-performance, sustainable materials, enhancing its enzyme industry presence and supporting a circular bioeconomy.