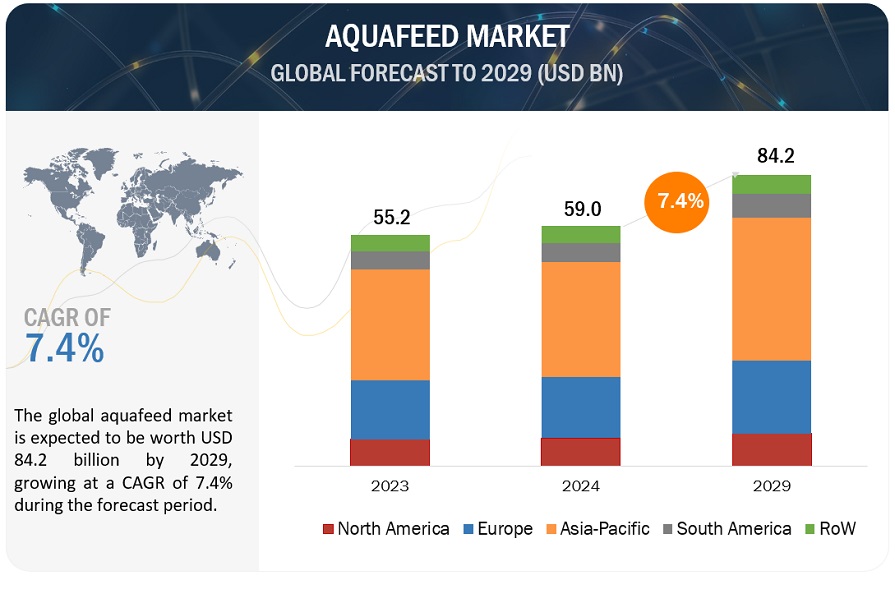

The aquafeed industry is expected to grow from USD 59.0 billion in 2024 to USD 84.2 billion by 2029, reflecting a CAGR of 7.4% during this forecast period. This growth is fueled by increasing seafood demand and advancements in aquaculture technologies. According to the FAO, global aquaculture production hit a record 130.9 million tonnes in 2022, accounting for 51% of total fish production. This increase in aquaculture has driven the need for high-quality aquafeed to promote optimal growth and health in farmed aquatic species.

Here are some current trends in the Aquafeed Market:

- Sustainable Ingredients: There’s a growing shift towards using sustainable and alternative protein sources, such as plant-based proteins, insect meal, and microbial proteins, to reduce dependence on fishmeal.

- Health and Nutrition: Increasing focus on the nutritional content of aquafeeds, including omega-3 fatty acids and probiotics, to enhance fish health and growth rates.

- Technology Integration: Adoption of advanced technologies, including precision nutrition and AI-driven feed formulation, to optimize feed efficiency and reduce waste.

- Regulatory Changes: Stricter regulations regarding the use of certain additives and ingredients, pushing manufacturers to innovate cleaner and safer feed products.

- Rising Demand for Seafood: With the global demand for seafood increasing, aquaculture is expanding, leading to a higher demand for quality aquafeeds.

- Traceability and Transparency: Consumers are demanding greater transparency regarding the sourcing and sustainability of aquafeed ingredients, prompting companies to adopt traceability measures.

Aquafeed Market Drivers: Rise in Seafood Trade Propelling Demand

In 2022, global fish production reached 179 million tonnes, with the Food and Agriculture Organization reporting that 89% of this was for human consumption. The rising demand for fish has led to an increased need for high-quality feed, benefiting the specialized aquafeed market by enhancing fish yields and quality. As aquaculture expands, the requirement for effective and nutritious feed intensifies, contributing to improved fish production outcomes. Notably, the share of farmed fish in global production has grown significantly, rising from 25.7% in 2000 to over 46% in 2022, underscoring the vital role of aquafeed in the industry. Government support, particularly in countries like China— the largest producer of aquaculture products— has fostered innovation and sustainability in aquafeed. Additionally, the surge in seafood trade is driving demand for aquafeed and prompting advancements in feed formulation to meet strict export standards and consumer preferences. The aquafeed market is anticipated to grow alongside the seafood industry, with a focus on the specific nutritional requirements of various fish species, ultimately providing high-quality and sustainable seafood products for the global market.

Grower Feed in Lifecycle Segment to be Dominant Market During Forecast Period.

Grower aquafeed is designed to meet the needs of aquatic species as they transition to a more advanced growth stage, typically containing 30–40% protein. This formulation supports ongoing development while promoting synchronized growth at reduced rates. It is cost-effective, offering a balanced nutritional profile optimized for fish growth. The pelletized form enhances feed efficiency, minimizes waste, and improves nutrient absorption, leading to better growth and lower feed costs—making it an economical choice for large-scale aquaculture operations. The advanced feeding skills of fish contribute to improved feed utilization and reduced waste. Innovations in grower feeds, including the addition of probiotics and prebiotics, further enhance performance and ensure animal health, solidifying the significance of this stage within the industry. The prominence of grower feeds in the aquafeed lifecycle is a result of their ability to meet the nutritional demands of fish, thereby supporting the sustainability and efficiency of aquaculture.

China Set to Retain Leading Role in the Asia Pacific Aquafeed Market Throughout the Forecast Period.

China is poised to maintain its leadership in the global aquafeed market thanks to its unmatched production scale, strategic government backing, and ongoing technological innovations. As the largest producer and consumer of seafood worldwide, China accounts for about 60% of global fish production (FAO, 2023). In 2023 alone, the country produced around 80 million metric tons of farmed fish, driving significant demand for aquafeed. The Chinese government’s 14th Five-Year Plan reinforces this position by emphasizing sustainable aquaculture and technological advancements, including investments in innovative feed formulations and infrastructure (China’s Ministry of Agriculture and Rural Affairs). Breakthroughs in high-performance feed with functional additives are improving feed efficiency and fish health, ensuring China’s continued market leadership. Moreover, with aquaculture exports valued at approximately USD 30 billion in 2023, China’s export-oriented strategy highlights its essential role in the global seafood supply chain (China Customs). Together, these elements contribute to China’s enduring dominance in the aquafeed market.

The key players in this market include ADM (US), Cargill, Incorporated (US), dsm-firmenich (Switzerland), Nutreco (Netherlands), Alltech (US), Ridley Corporation Limited (Australia), Purina Animal Nutrition LLC (US), Adisseo (France), Aller Aqua Group (Denmark), Avanti feeds Limited (India), The Waterbase Limited (India), JAPFA LTD (Singapore), Charoen Pokphand Foods PCL (Thailand), BioMar Group (Denmark), and Norel Animal Nutrition (Spain).