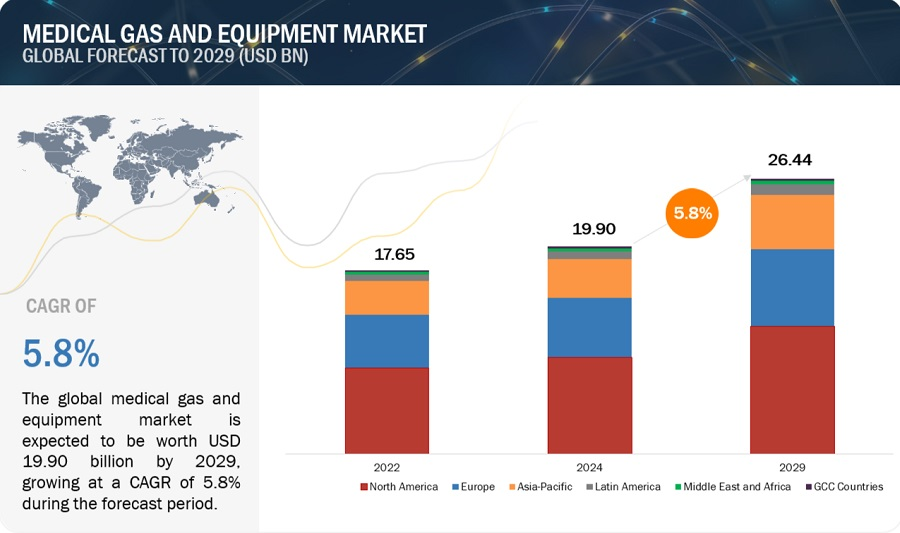

The global medical gas and equipment market is projected to expand from $19.90 billion in 2024 to $26.44 billion by 2029, growing at a CAGR of 5.8%. This market is driven by the rising need for therapeutic gases such as oxygen and medical air, along with equipment like gas regulators, flowmeters, and monitoring devices. The growing focus on home healthcare services and the increasing prevalence of respiratory diseases are major factors contributing to this growth. Additionally, regulatory support for safer gas handling and delivery systems is anticipated to further propel the market over the coming years.

Browse in-depth TOC on “Medical Gas and Equipment Market”

394 – Tables

60 – Figures

380 – Pages

By type, the medical gas and equipment market is segmented into medical gases and medical gas equipment. In 2023, the medical gas segment accounted for the largest share in the medical gas and equipment market due to the essential role of gases in various medical applications, including anesthesia, respiratory therapy, and medical imaging. The demand for medical gases like oxygen, nitrous oxide, and carbon dioxide has increased with the increasing prevalence of chronic respiratory diseases, expansion of healthcare infrastructure, and the growing need for emergency care and surgical procedures. Additionally, the rising geriatric population and the growing demand for home healthcare services have further contributed to the segment’s growth.

By application, the medical gas and equipment market is segmented into therapeutic applications, pharmaceutical manufacturing & research, diagnostic applications, and other applications. Therapeutic applications segment dominates the medical gas and equipment market due to the increasing incidence rates of chronic diseases as COPD, asthma or other respiratory conditions that require constant oxygen therapy among other medical gaseous for patient treatment. An aging population that is more vulnerable to such diseases additionally contributes to an increased demand for therapeutic gases including oxygen, nitrous oxide and medical air. Additionally, the advancement of transportable gas delivery devices and home healthcare to facilitate patient treatment outside hospitals has further contributed its growth.

By end user, the medical gas and equipment market is segmented into hospitals & clinics, home healthcare, pharmaceutical and biotechnology companies, academic & research institutions, and other end users. In 2023, the hospitals & clinics segment has emerged as the dominant force in the medical gas and equipment market owing to the rise in demand for their medical gases such as oxygen and nitrous oxide which play an important role in various therapies and diagnostic processes within these health care settings. This is because of the increasing number of surgical procedures being performed, the increasing prevalence of chronic respiratory diseases that require long term respiratory support as well as the rising number of hospitals and clinics around the world. Additionally, hospitals and clinics are the larger consumers of cutting-edge medical devices including gas dispensing systems due to the fact that they need dependable large-scale solutions for different patient care activities ranging from emergency cases to regular treatments.

In 2023, North American region accounted for the largest share of the medical gas and equipment market due to several factors, such as the region’s advanced healthcare infrastructure with high healthcare expenditure leads to significant demand for medical gases and related equipment. Moreover, the need for oxygen therapy, anesthesia and other medical gases has increased due to the aging population with a high prevalence of chronic respiratory diseases. Also, this region is aided by stringent regulatory standards, robust research and development programs, and presence of key market players in United States and Canada. All these factors combine to make North America a major player in the medicine gas and equipment market.

Additionally, the Asia-Pacific region is projected to witness the highest CAGR in the medical gas and equipment market due to an increase in the number of people who are getting old at a faster rate than ever before as well as chronic diseases like respiratory problems or heart problems becoming more common, medical gases and related devices are gaining acceptance hence driving their demand within this region. Furthermore, emerging economies such as China and India have been expanding their healthcare infrastructure thereby increasing their expenditure on healthcare services. Moreover, there has been rising awareness about advanced medical technologies which has made tourists traveling for medical reasons more frequent all of which combine to fuel the market growth in this region.

The prominent players in the medical gas and equipment market are Air Liquide (France), Linde Plc (Germany), Taiyo Nippon Sanso Corporation (Japan), Air Products and Chemicals Inc. (US), Atlas Copco AB (Sweden), GCE Group (Sweden), Messer SE & Co. KGaA (Germany), SOL Spa (Italy), Rotarex (Europe), Norco Inc. (US), Genstar Technologies (US), Southern Gas Limited (India), Calox Inc. (US), Ellenbarrie Industrial Gases (India), Steelman Gases Pvt. Ltd. (India), Butler Gas Products Company (US), SCI Analytical (US), Amico Group of Companies (US), Oxygen & Argon Works Ltd. (Israel), AOPL (India), Apex Medical Gas Inc. (US), Chengdu Taiyo Industrial Gases Co., Ltd. (China), Carbide and Chemicals (India), Holston Gases (US), and MEC Medical Ltd. (UK). These players have adopted various growth strategies such as product launches, acquisition, collaboration, agreements, and expansion to increase their presence and reach in the medical gas and equipment market.

Air Liquide:

Air Liquide is one of the leading supplier of industrial, medical, and specialty gases, technologies, and services. The company operates through three segments, namely, Gas & Services, Engineering & Construction, and Global Markets & Technologies. Air Liquide’s Gas & Services business unit is further classified into different geographical areas of Europe, the Americas, the Asia Pacific, and the Middle East & Africa and into business areas, namely, Large Industries, Industrial Merchant, Healthcare, Electronics, and Engineering. The company offers medical gas products under its healthcare business. It provides pure gases, specialty gases, and research gases, which include cryobiology and hyperbaric oxygen solutions. Moreover, the company is present in 73 countries and serves more than 3.9 million customers and patients.

Linde Plc:

Linde Group is a gas and engineering company that consists of two major product lines, namely, Industrial Gases and Engineering. Linde organizes its industrial gas operations based on geography, comprising three reportable segments, namely, Americas, EMEA (Europe/Middle East/Africa), and APAC (Asia/South Pacific). The company’s Engineering business operates globally and manufactures equipment for air separation and other industrial gas applications tailored for end customers across all geographic segments. The company’s medical gases business is operated through the Industrial Gases division. The company produces, sells, and distributes atmospheric, process, and specialty gases to a different group of industries, including aerospace, chemicals, food, and beverage. The company’s healthcare sector serves a variety of end users, including hospital care, home care, gas therapies, and care concepts. The Linde Group operates across the Americas, the Asia Pacific, the Middle East, and Africa.

Taiyo Nippon Sanso Corporation:

Taiyo Nippon is one of the leading companies in the medical gas and equipment operating through its Matheson Tri-Gas Inc. subsidiary. The company has three business segments, namely, Industrial Gases, Electronics, and Thermos, which are operated & promoted by five reportable segments, namely, Japan, United States, Europe, Asia & Oceania, and Thermos. The company addresses the bulk requirements for gases, for a variety of end users across the aerospace, agriculture, aquaculture, automotive, biofuels, chemical processing, energy, food and beverage, manufacturing, medical and healthcare, metal processing, oil and gas, pharmaceutical and biotechnology, power generation and transmission, semiconductor, universities and research institutes, and welding and fabrication industries. Some of Taiyo Nippon’s major subsidiaries include Matheson Tri-Gas Belgium (SPRL) (Belgium), Continental Carbonic Products, Inc. (US), Taiyo Nippon Sanso Clark, Inc. (Philippines), and Nippon Cutting & Welding Equipment Co., Ltd. (Thailand).

For more information, Inquire Now!

Recent Developments

- In June 2024, Messer Group GmbH (Germany) acquired the Federal Helium System, including the Federal Helium Reserve, Cliffside Field, its gathering and well system, and other operational assets. Through the acquisition, both organizations will ensure a smooth operation of the Helium System and continue to serve the many industries, such as medicine and aerospace, that rely on this vital resource.

- In June 2023, Nippon Gases (Japan) acquired most of the share of the Spanish medical equipment manufacturer Noxtec Development SL. This will enable the two companies to work together on technological improvements in medical equipment used for nitrous oxide treatment.

- In March 2023, Atlas Copco AB (Sweden) acquired the operating assets of FS Medical. The acquisition complemented Atlas Copco’s existing service footprint in the West Coast region. The business was integrated into BeaconMedaes LLC, part of the Medical Gas Solutions Division in the Compressor Technique Business Area.

- In January 2023, ESAB Corporation (a subsidiary of GCE Group (Sweden)) acquired Ohio Medical, a global leader in oxygen regulators and central gas systems. This acquisition enhanced the offerings of the company in medical gas control products and services, expanding the selection available through Ohio Medical and GCE Group.

- In July 2022, Air Liquide (France) expanded its Home Healthcare activities by acquiring entities in Belgium and the Netherlands, reinforcing its presence and service offerings in these countries. This acquisition supported the strategic focus of Air Liquide on Home Healthcare, which specializes in treating respiratory insufficiency and sleep apnea and providing infusion or nutrition treatments.

Content Source:

https://www.marketsandmarkets.com/PressReleases/medical-gases-equipment.asp

https://www.marketsandmarkets.com/Market-Reports/medical-gases-equipment-market-217979261.html