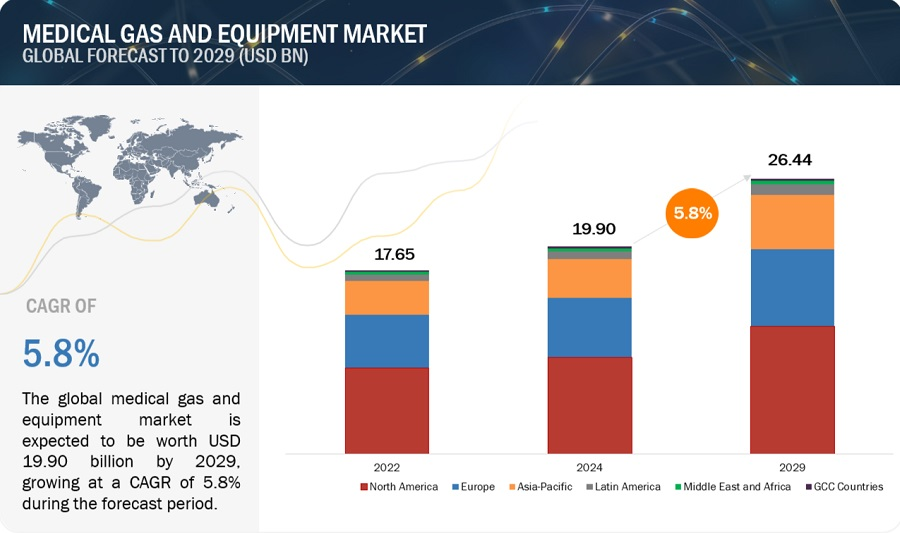

The global medical gas and equipment market growth forecasted to transform from USD 19.90 billion in 2024 to USD 26.44 billion by 2029, driven by a CAGR of 5.8%. Healthcare institutions utilize medical gas and equipment to supply, manage, and monitor gases required for patient care. Medical gases for therapeutic or anesthetic use, including oxygen, nitrous oxide, and medical air, are administered to the patients. The equipment involved in these systems includes cylinder tanks for gas delivery, regulators, flowmeters, storage devices, distribution devices, and associated monitoring devices. These tools are vital for accurate dosing, safe handling, and efficient delivery of gases in any treatment plan or procedure applied in hospital settings or homecare environments.

The medical gas and equipment market is expanding significantly due to rising respiratory illnesses that necessitate frequent medical gas treatment and growing demand for effective and safe gas delivery systems. Increased emphasis on home healthcare services and regulatory support for safer gas delivery methods are expected to boost market growth.

Browse in-depth TOC on “Medical Gas and Equipment Market”

394 – Tables

60 – Figures

380 – Pages

Medical gas and systems are a network of equipment and devices used to deliver gases across several clinical settings such as hospitals, home care, independent clinics, and ambulatory surgical centers, among others, for treating, diagnosing, or preventing diseases among patients. The growth of the medical gas and equipment market is primarily driven by the increasing prevalence of cardiovascular diseases, rising elderly population, and growing healthcare infrastructure in emerging economies. Furthermore, expanding home healthcare services are fuelling market growth since they require portable and easy-to-use medical gas devices. Moreover, improvements in medical gas delivery systems, monitoring equipment, and safety advancements have made these systems more efficient and safer, encouraging their adoption in hospitals and healthcare facilities, further propelling market growth. However, the high operational costs, and stringent regulations hinder the market growth.

Medical gases segment is expected to account for the largest share, by type in the medical gas and equipment market during the forecast period.

The medical gases segment holds the largest share in the medical gas and equipment market, as most gases, including oxygen, nitrous oxide, carbon dioxide, and nitrogen, find their way into almost all healthcare settings. Oxygen is an important element required in respiratory care therapy, anesthesia, and life support, thus dominating the products under this segment. Nitrous oxide is used for anesthesia and pain management, and carbon dioxide is used for surgeries, like laparoscopy. Moreover, growing cases of chronic respiratory diseases and cardiovascular disorders, along with an aging population, contribute to an increase in demand for medical gases, thereby fuelling the market growth.

Therapeutics application segment is expected to account for the largest share, by application in the medical gas and equipment market during the forecast period.

The therapeutics application segment holds the highest share in the medical gas and equipment market because of large usage of medical gases such as oxygen, nitrous oxide and mixtures of gases in various therapeutic procedures across all health institutions. These gases play a significant role in treating respiratory disorders, providing anesthesia during surgeries and managing chronic diseases such as COPD or asthma. Additionally, this segment holds a high market share due to the increasing number of respiratory diseases, and rising elderly population that require demand for advanced respiratory care at hospitals and homecare settings.

Hospitals and clinics segment is expected to account for the largest share, by end user in the medical gas and equipment market during the forecast period.

The hospitals and clinics segment commands the highest share in the medical gas and equipment market as there is a high and continuous demand for medical gases and relevant equipments in these sectors. Hospitals and clinics require oxygen, nitrous oxide, medical air, and other medical gases for different uses like anesthesia, respiratory therapy as well as surgical procedures. The growing number of patients seeking medical attention, rising incidences of chronic illnesses which need long-term oxygen therapy and surgeries being carried out in such institutions lead to more demand for medical gases and devices. Moreover advanced medical equipment and modern healthcare technologies being applied in hospitals and clinics further enhance the market growth.

In 2023, North America accounted for the largest share of the medical gas and equipment market.

The medical gas and equipment market is segmented into five major regions, namely, North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa, and the GCC Countries.

North America holds the highest share in the medical gas and equipment market due to their advanced healthcare systems, high expenditure on healthcare services, and most importantly, key players that operate in the area. The North American region includes the US which has an exhaustive network made up of hospitals, research institutions together with its aging population that needs medical gases such as oxygen and nitrous oxide among others. Moreover, strict regulations have also contributed to the manufacturing of quality medical instruments and gases because they ensure patient safety. Additionally, there has been an increase in chronic diseases like COPD, and asthma that demand for continuous innovation in gas delivery systems, thereby boosting the market growth.

Key Market Players :

The key players in the global medical gas and equipment market are Air Liquide (France), Linde Plc (Germany), Taiyo Nippon Sanso Corporation (Japan), Air Products and Chemicals Inc. (US), Atlas Copco AB (Sweden), GCE Group (Sweden), Messer SE & Co. KGaA (Germany), SOL Spa (Italy), Rotarex (Europe), Norco Inc. (US), Genstar Technologies (US), Southern Gas Limited (India), Calox Inc. (US), Ellenbarrie Industrial Gases (India), Steelman Gases Pvt. Ltd. (India), Butler Gas Products Company (US), SCI Analytical (US), Amico Group of Companies (US), Oxygen & Argon Works Ltd. (Israel), AOPL (India), Apex Medical Gas Inc. (US), Chengdu Taiyo Industrial Gases Co., Ltd. (China), Carbide and Chemicals (India), Holston Gases (US), and MEC Medical Ltd. (UK).

For more information, Inquire Now!

Recent Developments

- In June 2024, Messer Group GmbH (Germany) acquired the Federal Helium System, including the Federal Helium Reserve, Cliffside Field, its gathering and well system, and other operational assets. Through the acquisition, both organizations will ensure a smooth operation of the Helium System and continue to serve the many industries, such as medicine and aerospace, that rely on this vital resource.

- In June 2023, Nippon Gases (Japan) acquired most of the share of the Spanish medical equipment manufacturer Noxtec Development SL. This will enable the two companies to work together on technological improvements in medical equipment used for nitrous oxide treatment.

- In March 2023, Atlas Copco AB (Sweden) acquired the operating assets of FS Medical. The acquisition complemented Atlas Copco’s existing service footprint in the West Coast region. The business was integrated into BeaconMedaes LLC, part of the Medical Gas Solutions Division in the Compressor Technique Business Area.

- In January 2023, ESAB Corporation (a subsidiary of GCE Group (Sweden)) acquired Ohio Medical, a global leader in oxygen regulators and central gas systems. This acquisition enhanced the offerings of the company in medical gas control products and services, expanding the selection available through Ohio Medical and GCE Group.

- In July 2022, Air Liquide (France) expanded its Home Healthcare activities by acquiring entities in Belgium and the Netherlands, reinforcing its presence and service offerings in these countries. This acquisition supported the strategic focus of Air Liquide on Home Healthcare, which specializes in treating respiratory insufficiency and sleep apnea and providing infusion or nutrition treatments.

Content Source:

https://www.marketsandmarkets.com/PressReleases/medical-gases-equipment.asp

https://www.marketsandmarkets.com/Market-Reports/medical-gases-equipment-market-217979261.html