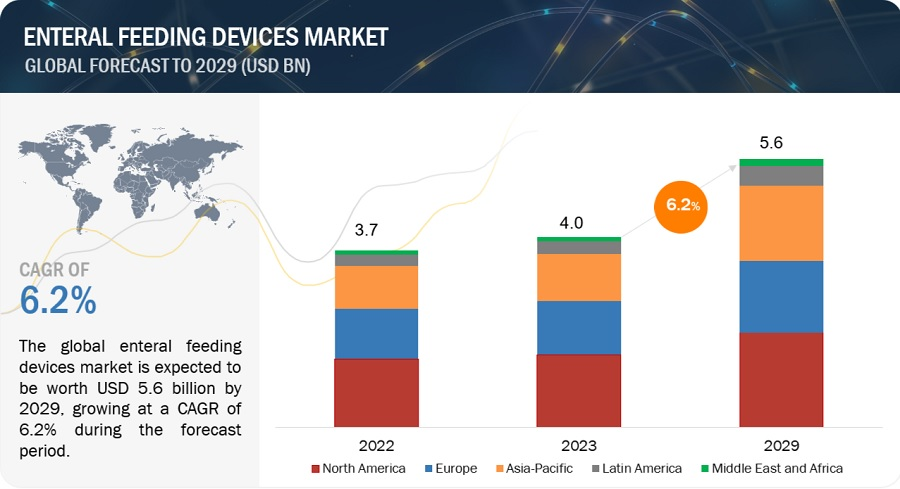

Enteral Feeding Devices Market in terms of revenue was estimated to be worth $4.0 billion in 2024 and is poised to reach $5.6 billion by 2029, growing at a CAGR of 6.2% from 2024 to 2029 according to a latest report published by MarketsandMarkets™.

The rising technological advancements and increasing geriatric population is driving the growth of the market. The As the global population ages, the number of individuals requiring enteral feeding is expected to rise.

Elderly patients often experience age-related decline in appetite or swallowing difficulties, making enteral feeding a vital support system.

Download an Illustrative overview: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=183623035

Enteral Feeding Devices Market Dynamics

Driver: Rapid growth in geriatric population and age-related chronic diseases

Global life expectancy is increasing, leading to a larger proportion of older adults (aged 65 and above) in the population. This demographic shift is particularly pronounced in developed countries, advancements in healthcare, improved living standards, and declining birth rates contribute to the rise of the geriatric population. As people age, they become more susceptible to chronic illnesses and experience a decline in appetite or swallowing difficulties. Enteral feeding devices provide a reliable way to deliver essential nutrients, preventing malnutrition and promoting overall health in elderly patients

Restraint: Lack of Patient Awareness

Enteral feeding often isn’t openly discussed in public forums, leading to a general lack of knowledge about its existence and benefits. Healthcare campaigns often prioritize raising awareness about specific diseases rather than treatment options like enteral feeding also patients unfamiliar with enteral feeding might be hesitant or apprehensive about starting therapy due to fear of the unknown which is expected to restrain the market growth.

Opportunity: Growing demand for enteral feeding in the home care sector

Improvements in enteral feeding devices are making them more user-friendly, portable, and reliable for home use. This includes quieter pumps, disposable feeding sets, and remote monitoring capabilities also the healthcare landscape is moving towards home-based care, offering greater convenience and cost-effectiveness for patients and healthcare systems. Enteral feeding devices enable patients to receive essential nutrition in the comfort of their own homes which is expected to create opportunities for the growth of the market.

Challenge: Dearth of skilled professionals and endoscopy specialists

The growing demand for enteral feeding might outpace the availability of nurses, dietitians, and other healthcare professionals trained in their proper placement, management, and monitoring Placing some enteral feeding tubes, particularly gastrostomy (G-tubes) and jejunostomy (J-tubes), often requires endoscopic procedures. A shortage of endoscopy specialists can create bottlenecks in timely device placement which is expected to challenge the market growth.

Request for FREE Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=183623035

Based on type, the enteral feeding devices market is segmented into enteral feeding tubes, enteral feeding pumps, administration sets, enteral syringes and consumables. The enteral feeding tubes accounts for the largest share in the enteral feeding devices market, Enteral feeding tubes are a crucial component of enteral feeding devices. They act as a conduit to deliver liquid nutrition directly into a patient’s stomach or small intestine, bypassing the mouth and esophagus. Enteral feeding tubes are essential components of enteral feeding devices, providing a safe and reliable way to deliver essential nutrients to patients who cannot consume food orally which is expected to drive the segment growth.

Based on application, the enteral feeding devices market is segmented into oncology, gastrointestinal diseases, nuerological diseases, diabetes, hypermetabolism and other applications. The oncology accounts for the largest share in the enteral feeding devices market, cancer and its treatment (surgery, radiation, chemotherapy) can significantly impact a patient’s appetite and ability to absorb nutrients. Enteral feeding ensures they receive the necessary calories, proteins, vitamins, and minerals to support their immune system, fight infection, and promote healing which is expected to drive the market growth.

In 2023, North America accounted for the largest share of the enteral feeding devices market, followed by Europe and Asia Pacific. The United States and Canada have well-equipped hospitals and a strong focus on advanced medical care, which supports the adoption of enteral feeding devices, also compared to established markets like North America and Europe, the Asia Pacific region often offers lower labor costs, making it an attractive option for companies seeking to optimize manufacturing expenses.

Additionally, several countries in the region, like China and India, have developed a robust infrastructure for manufacturing pharmaceuticals and medical devices which is expected to lead to Asia Pacific growing at the fastest rate during the forecast period.

The key players in the enteral feeding devices market include include Fresenius SE & Co. KGAA. (Germany), Cardinal Health, Inc. (US), Nestlé S.A. (Switzerland), Avanos Medical, Inc. (US), Danone S.A. (France), Becton, Dickinson and Company (US), B. Braun Melsungen AG (Germany), CONMED Corporation (US), Cook Medical (US), Moog Inc. (US), Boston Scientific Corporation (US), Baxter International Inc. (US), Vygon (France), and Other players in the enteral feeding devices market are Applied Medical Technology (US), Amsino International Inc. (US), Omex Medical Technology (India), Danumed Medizintechnik (Germany), Medline Industries, Inc. (US), Fuji Systems (Japan), Kentec Medical (US), Dynarex Corporation (US), Vesco Medical LLC (US), Medela AG (Switzerland), Alcor Scientific (US), and Romsons (India)

Request 10% Customization: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=183623035

Recent Developments of Enteral Feeding Devices Market

- In September 2022, Cardinal Health, Inc. (US) announced the partnership with Kinaxis (Canada) to enhance the Kinaxis RapidResponse Platform used for supply chain agility and medical product visibility.

- In November 2022, Boston Scientific signed an agreement for the acquisition of Apollo Endosurgery, Inc.,. This agreement includes devices, which are used during endoluminal surgery (ELS) procedures, to close gastrointestinal defects, manage gastrointestinal complications, and aid in weight loss for patients suffering from obesity.

- In March 2021, Applied Medical Technology, Inc. (US) launched its gastric-jejunal enteral feeding tube family (G-JETs) to include the low-profile micro-G-JET to link up the enteral nutrition needs of pediatric patients.

- In March 2022, Vygon Group (France) announced the acquisition of distributor Macatt Medica (Peru). The acquisition is expected to grow the presence of Vygon Group (France), in the South American region, specifically for its broad range of enteral feeding products.