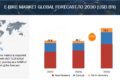

The Electric Bus Market Share is projected to experience substantial growth, reaching a value of $37.5 billion by 2030. This increase is fueled by global trends toward eco-friendly and sustainable public transportation solutions, with many countries adopting strict emission reduction policies. Governments and municipalities worldwide are investing heavily in electric bus infrastructure to reduce carbon footprints and improve air quality, which is significantly driving the adoption of electric buses. Additionally, technological advancements in battery efficiency and charging infrastructure have made electric buses increasingly practical and economically viable, contributing to their growing share in the broader bus market.

The Electric Bus Market Share is particularly strong in regions such as Europe, North America, and parts of Asia, where demand for zero-emission public transport is accelerating. In addition to environmental benefits, electric buses provide lower operational costs over time due to reduced fuel expenses and maintenance requirements, making them an attractive option for transit agencies. The market is expected to witness an influx of new models, especially from established automotive manufacturers and emerging players, further enhancing market competitiveness.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=38730372

The electric school bus segment by application is projected to be the second fastest-growing segment during the forecast period.

care becoming increasingly popular with the 2nd fastest growing market driven by incentives and policies promoting zero-emission vehicles in school districts and communities concerned with air quality and environmental impact. North America is estimated to be the fastest and largest market for electric school buses.As many states in US provide grants and incentives to encourage the use of electric school buses, the US is leading the world in their implementation. For instance, the Los Angeles Unified School District (LAUSD) recently made the largest order for electric school buses ever placed by Blue Bird Corporation, ordering 180 units. In January 2024, Lion Electric Company started delivering the LionD, a new all-electric school bus that can accommodate 83 students, in California.Lion Electric was awarded USD 38 million for 97 buses and the associated charging infrastructure under the EPA’s Clean School Bus Program. Through the EPA’s Clean School Bus Rebate Program, over 2,300 electric buses have been funded in all 50 states and territories, totaling more than UAS 900 million. Such incentives within the area are what are promoting growth in the market for electric school buses, for example, the Clean School Bus Rebate Program of the EPA and incentives in California.

The above 400 kWh battery capacity segment is projected to be the fastest-growing market for electric buses from 2024 to 2030.

Above 400 kWh battery capacity electric buses are estimated to grow at the fastest CAGR during the forecast period. This range is usually offered in electric buses for intercity or long-distance commutes. Developments in battery technologies and the reduction in prices of batteries have positively impacted the growth of above 400 kWh batteries. Severe weather has a negative impact on battery performance, requiring larger capacities to maintain efficiency and range. Buses having larger battery capacities can travel more without recharging often, which is important in regions with tough weather and limited charging infrastructure. Long-range electric buses with large capacity batteries are particularly useful in locations with unreliable infrastructure for charging. It is expected that government financing and incentives for electric public transportation projects will favour buses that have larger battery capacities in order to maximise the efficiency and effectiveness of these vehicles. The market is anticipated to expand due to falling battery costs and continuous improvements in battery components.

Asia Pacific is estimated to be the largest market for electric buses.

The Asia Pacific region is projected to account for the largest share of the electric bus market during the forecast period. According to IEA, China has become a global leader in the electric bus market, producing almost 60% of all electric buses globally in year 2023. Although this share has decreased from nearly 90% in 2020, China will continue to dominate the market. The decline is due to a drop in demand for both electric and ICE buses and increased sales in other parts of Asia Pacific, Europe, and North America. China is still at the top of the market because of its wide network of original equipment manufacturers (OEMs) that specialise in electric vehicles (EVs) and its established battery and other EV component supply chain. Companies such as BYD, Yutong, and Zhongtong have played a pivotal role in propelling innovation and augmenting production levels within the electric bus industry. These OEMs benefit from China’s strategic push for electric mobility, which includes incentives, subsidies, and strict emission regulations that are speeding up adoption in urban areas. The introduction of the ‘PM-eBus Sewa’ initiative in India, aiming to implement 10,000 electric buses in urban areas through a public-private partnership (PPP) approach, has enhanced the nation’s green transportation efforts. India aims to increase the number of electric buses to forty percent by 2030, with the help of programs like FAME I and II, which have approved 5,595 e-buses for public transportation. South Korea, Japan, and Singapore are also making plans to enhance their public and private bus fleets by incorporating electric vehicles. Companies such as Ashok Leyland, Mitsubishi Fuso Truck and Bus Corporation, JBM Group, Tata Motors, and Mitsubishi Fuso Truck and Bus Corporation are introducing electric bus models in an effort to cut emissions and rely less on fossil fuels. The market’s expansion is further driven by huge expenditures in research and development and also in charging infrastructure. The Asia Pacific region remains at the forefront of sustainable urban transportation solutions because of its large production and sales volumes, along with ongoing technological innovations aimed at enhancing performance and cost-effectiveness.

Key Market Players:

The report profiles key players such as BYD Company Ltd. (China), Yutong Co., Ltd. (China), VDL Groep (Netherlands), AB Volvo (Sweden) and CAF (Solaris Bus & Coach sp. z o.o.) (Spain). These companies adopted new product development, and supply contract strategies to gain traction in the terminal tractor market.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=38730372