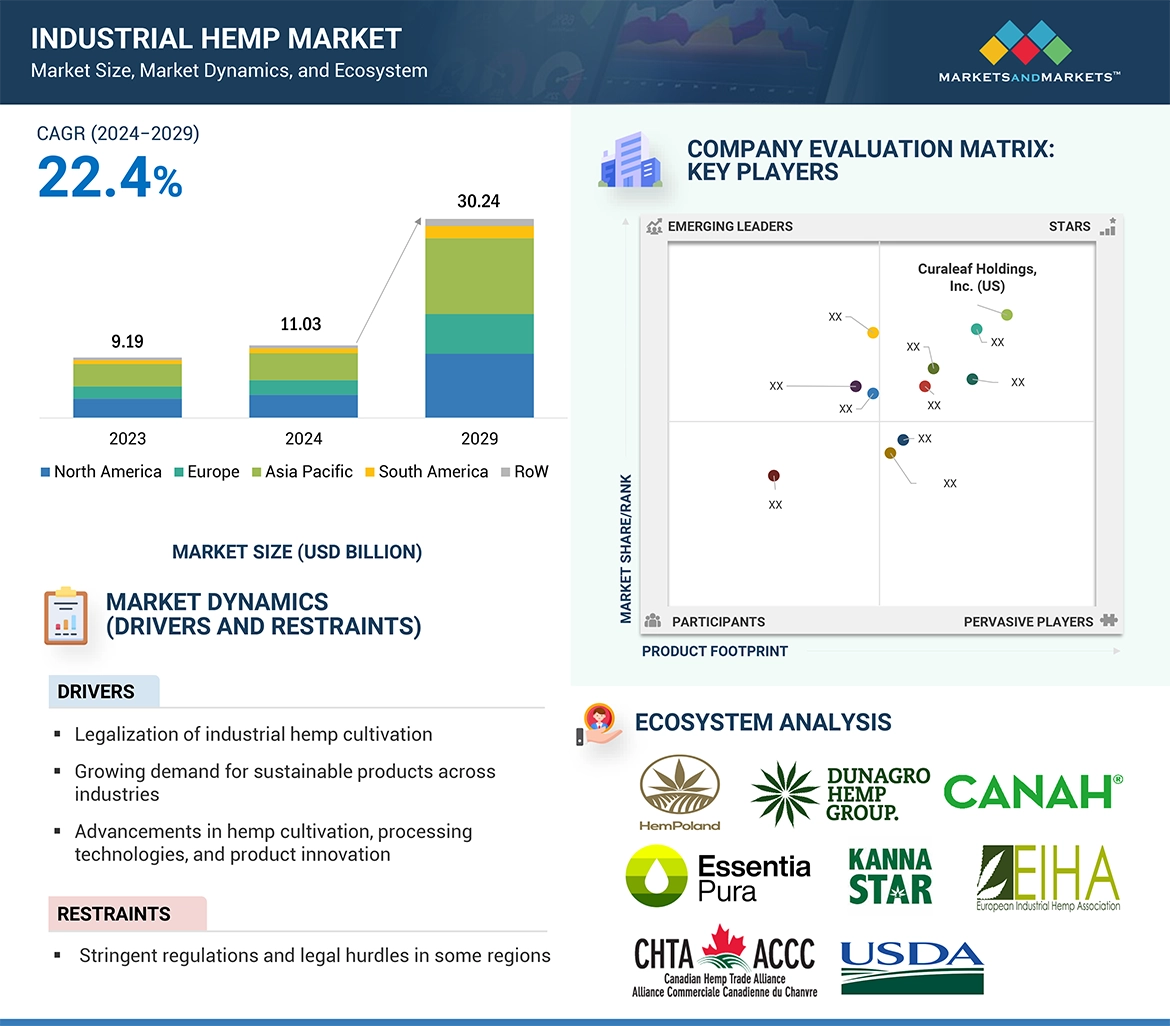

The industrial hemp market size is estimated at USD 11.03 billion in 2024 and is projected to reach USD 30.24 billion by 2029, at a CAGR of 22.4% from 2024 to 2029. Increasing investments in research and development are driving the industrial hemp market, which unlocks new applications and enhances product quality. The rising interest in hemp as a rotational crop also contributes to increasing adoption among farmers because of its ability to enhance soil health and support sustainable agriculture.

It also opens new avenues for the demand of biodegradable and renewable raw materials for industries such as packaging and automotive. Strategic collaboration between the key players and improvements in extraction technologies are further driving efficiency and innovation, thereby making hemp a versatile commodity with high potential.

Industrial Hemp Market Driver: Legalization of industrial hemp cultivation

The legalization of industrial hemp farming has, in turn, significantly spurred market growth, primarily in the US, Europe, and other geographies. The 2014 US Farm Bill legally separated hemp from marijuana by establishing the threshold for THC at below 0.3%, although it originally limited its cultivation to research purposes. The 2018 Farm Bill eased the restrictions and thus created the Domestic Hemp Production Program, which paved the way for the cultivation and sale of hemp. With this legalization, farmers can now add hemp to their sustainable farming practices to produce eco-friendly alternatives to plastics and other materials. In the same manner, in the European Union, for example, countries such as France, Poland, and Romania implemented coupled income support for the farming of hemp within their CAP Strategic Plans. The practice allows additional financial incentives for farmers to grow hemp. In India, for instance, industrial hemp farming is legalized in the State of Uttarakhand and standard hemp seeds have been adopted by the Food Safety and Standards Authority of India, thus encouraging the industry. The latest step toward the same, in 2024, saw Germany sanctioning a draft legislation that legalized industrial cultivation. This will make production much easier for farmers, but it also extends its use in such diversified sectors of industry. ’It is an important factor stimulating the market for industrial hemp.

Industrial Hemp Market Trends:

The industrial hemp market is witnessing robust growth, driven by several key factors:

- Rising Demand for Sustainable Materials: As industries prioritize eco-friendly alternatives, hemp’s fast growth and low water usage make it an attractive choice for various sectors.

- Expanding Legalization: The global movement toward legalizing hemp cultivation is unlocking new markets and boosting investor confidence.

- Versatility of Hemp Products: Hemp fibers are used in textiles, construction materials, and bioplastics, offering a wide range of applications and market potential.

- Technological Advancements: Innovations in farming, processing, and product development are improving hemp yields and the quality of its fibers and seeds.

- Health and Wellness Trends: The growing health and wellness movement is driving demand for hemp-based personal care products, supplements, and CBD, further expanding the market.

- Regulatory Developments: New regulations, such as Italy’s ban on producing and trading cannabis flowers—including non-psychotropic industrial hemp—are influencing the market.

These trends highlight a dynamic and evolving industrial hemp market, with both opportunities and challenges stemming from technological advancements, regulatory changes, and shifts in consumer behavior.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=84188417

By type, hemp seed oil to account for significant market share during forecast period.

Hemp seed oil is set to account for a significant market share in the industrial hemp sector due to its wide range of applications. It is extracted from cold-pressed hemp seeds in a colorless or slightly greenish form with a nutty taste and remains unrefined to maintain its natural properties. This is important because hemp seed oil is often confused with CBD oil, which is derived from the same plant, Cannabis sativa. Unlike CBD oil, hemp seed oil contains no THC and only trace amounts of CBD, the psychoactive compound associated with the “high” of cannabis.

Hemp seed oil, having its profile rich in essential fatty acids and omega-3s, is being put into food products, culinary usage, and formulations within the beauty industry because it’s nutrient-dense. Like other seed oils—from sunflower oil to rape-seed oil—mechanical extraction is used to produce the seed oil, and a by-product results: hemp seed cake. With a potential use for it as commercial feed for laying hens, it is considered “Generally Recognized as Safe” (GRAS) by the US. The advancement of new technologies in extraction methods has made the quality and yield of oil higher, thus creating an eco-friendly way of production in line with global sustainability initiatives. With the health benefits and industrial applications coming into the limelight, hemp seed oil continues to fuel expansion in the industrial hemp market across different sectors.

Top 10 Companies in the Industrial Hemp Market

- Curaleaf Holdings, Inc. (US)

- Green Thumb Industries (US)

- Canopy Growth Corporation (Canada)

- AURORA CANNABIS INC. (Canada)

- The Cronos Group (Canada)

- Ecofibre Ltd (Australia)

- HempFlax Group B.V. (Netherlands)

- Dun Agro Hemp Group (Netherlands)

- Fresh Hemp Foods Ltd. (Canada)

- GenCanna (US)