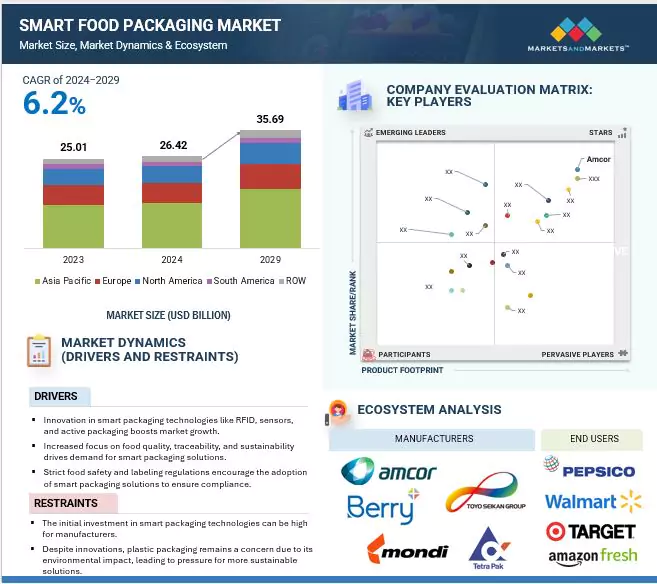

The global smart food packaging market is estimated to be valued at USD 26.42 billion in 2024 and poised to achieve a 6.2% CAGR, reaching USD 35.69 billion by 2029, and is experiencing transformative shifts and innovations. The global smart food packaging market is witnessing a healthy rise due to the demand among consumers for sustainability, convenience, and better food safety. As consumers become increasingly ecologically conscious, they move toward more eco-friendly packaging materials, such as biodegradable, recyclable, and even edible packaging. Moreover, the increase in food ordering through online delivery services as well as e-commerce further creates demands for packaging solutions that ensure food freshness and food safety during transit.

Technological innovations such as temperature sensors, RFID tags, and intelligent packaging that enhance shelf life and reduce food waste are shaping the industry. The companies are being compelled to come up with sustainable packaging solutions due to regulatory pressures to reduce plastic use and minimize food waste. Market players are also looking into enhancing consumer engagement through interactive packaging, which promises a very bright future for the smart food packaging market across regions.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=103797679

The Modified Atmosphere Packaging segment is expected to account for the largest share during the forecast period.

Modified atmosphere packaging (MAP) holds a significant share in the smart food packaging market due to its effectiveness in preserving freshness and extending the shelf life of food products. MAP involves altering the atmosphere inside the packaging, typically by adjusting the levels of oxygen, carbon dioxide, and nitrogen, to slow down the degradation process and maintain food quality. This technology is widely adopted in fresh produce, meat, and dairy products, where maintaining optimal freshness is crucial. As consumer demand for longer shelf life and food safety increases, MAP continues to be a key driver in the growth of the smart food packaging market. There have been various developments in the smart food packaging sector, particularly in the use of MAP to address food spoilage and enhance product shelf life. For instance, in June 2023, ProAmpac launched its innovative fiber-based MAP, known as the RAP Sandwich Wedge, in the North American market. This packaging solution is designed specifically for sandwiches and wraps, bringing the benefits of MAP to a fiber-based format. The packaging aims to address the rising demand for reducing food spoilage and enhancing sustainability, as it combines the advantages of MAP with eco-friendly fiber materials.

The Meat, Poultry & Seafood is the having a largest share within the application sector of the smart food packaging market.

Due to growing global demand, meat, poultry, and seafood account for the highest market share of application in the smart food packaging market. Its needs lie in extending shelf life, safety, and traceability. As per data provided by the USDA from October 2024, Brazil dominates global chicken meat exports during 2025, as the production will be 11.8 million tons. Australia’s poultry production will increase by 2 percent to 2.6 million tons, as high global demand is expected. Beef exports from Australia will also reach a record 1.9 million tons in the year as its demand increases in the US. These trends point towards the increasing international meat trade and export opportunities.

Increased production and exports require more advanced smart packaging technologies, such as modified atmosphere packaging and active packaging, for freshness, less food waste, and greater safety. This will fuel innovation and adoption of smart packaging solutions, especially in global markets like East Asia and North America.

North America dominated the smart food packaging market share.

North America has a well-established food supply chain and strict food safety regulations, which significantly contribute to the growth of smart food packaging technologies. There is an increasing focus on extending shelf life, especially for perishable goods in the export-import trade, further solidifying the region’s leading position in the market. As a crucial player in the global food export-import trade, North America benefits from smart food packaging technologies like MAP and active packaging. These solutions are particularly effective in preserving perishable items during long-distance transportation, ensuring the quality and safety of food products across borders.

The stringent food safety regulations enforced in the US and Canada, including guidelines from the FDA and other local authorities, have raised the standards for food packaging. Smart packaging aids in meeting these requirements by improving product traceability and ensuring the safe transportation and storage of food. Consequently, North America remains the leading region in the smart food packaging market, with the US and Canada making significant contributions in market size, technological innovations, and regulatory support.

Top 10 Companies in the Smart Food Packaging Market:

- Amcor plc (Switzerland)

- Sealed Air (US)

- Berry Global Inc. (US)

- THE TETRA LAVAL GROUP (Switzerland)

- Mondi (UK)

- Toyo Seikan Group Holdings, Ltd. (Japan)

- Crown (US)

- 3M (US)

- Timestrip UK LTD (UK)

- MITSUBISHI GAS CHEMICAL COMPANY, INC. (Japan)

Recent Developments of Smart Food Packaging Industry

- In August 2024, Amcor’s launch of AmFiber Performance Paper packaging in North America, a curbside-recyclable, high-barrier paper solution, strengthened its position in the smart food packaging market. By offering improved barrier properties and easy recyclability, AmFiber caters to consumer demand for sustainable packaging while maintaining operational performance. This innovation supports Amcor’s commitment to sustainability, enabling brands to meet consumer preferences for eco-friendly solutions without compromising on functionality, thus enhancing Amcor’s competitive edge.

- In March 2024, Berry Global and Mitsubishi Gas Chemical partnered to develop MXD6, a recyclable barrier resin recognized for compatibility with polypropylene recycling streams. This innovation enhanced food packaging by extending shelf life without using EVOH and reducing food and plastic waste. It advanced sustainability in smart food packaging, addressing performance limitations and improving recyclability for tubes, jars, and bottles.

- In January 2024, SEE’s CRYOVAC compostable overwrap tray revolutionizes smart food packaging with its biobased, USDA-certified resin and industrial compostability. This sustainable alternative to EPS foam trays maintains strength and performance while reducing environmental impact. The tray aligns with processors’ existing production lines, advancing SEE’s commitment to innovation and sustainability, and supporting customers’ eco-friendly goals in the smart protein packaging market.