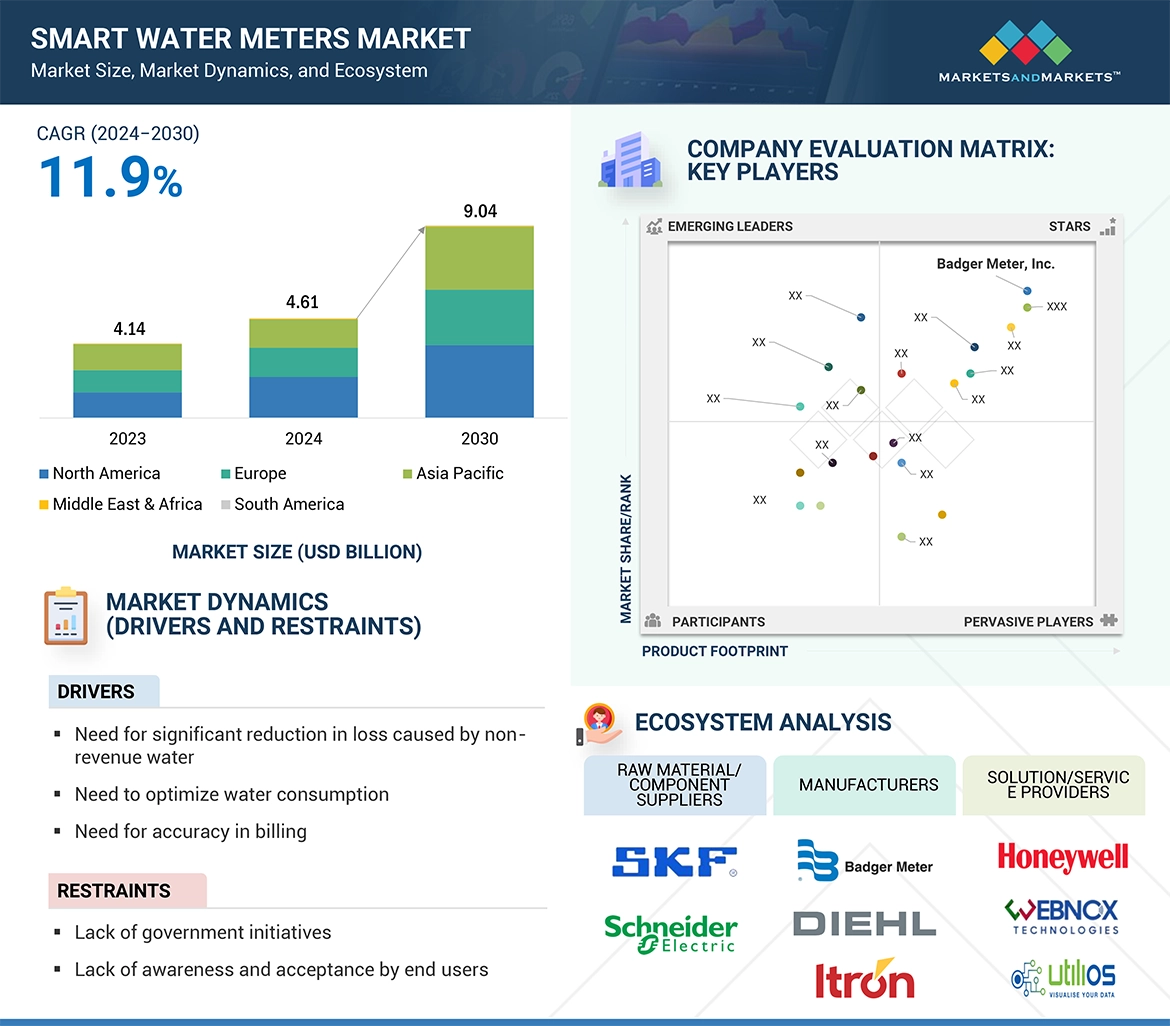

The global Smart Water Meters Market is anticipated to grow from estimated USD 4.61 billion in 2024 to USD 9.04 billion by 2030, at a CAGR of 11.9% during the forecast period. The rising urban population is creating opportunities for the development of smart cities, which ultimately is driving the demand for smart water metering infrastructure development on a larger scale. The increasing urban population is opening up avenues for smart cities. In addition, several factors include NRW losses, including incorrect mechanical meters, manual meter reading, and unmetered consumption. Water loss mainly occurs due to leaks, theft, storage tank overflows, unauthorized usage, and the provision of free water to certain consumers. Governments and utilities across the globe are increasingly mandating advanced metering infrastructure as a strategic approach to sustainable water management, which is driving rapid adoption of smart water meters.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=250996975

The water utilities segment, by application

Water utilities dominate the largest share of global smart water meters market. The water grid used for the distribution of water is a key part of water utilities infrastructure. Of all the utilities, today water leakage remains to be the major problem. This problem requires more effective leak detection and prevention processes. Smart meter of water is playing an integral part in this regard, enabling utilities to monitor consumption, detect early leakage systems, and become efficient overall. Given its continuous innovations with regard to smart metering technology, such a market is growing phenomenally, as more utilities are investing in modern versions to reduce water waste and improve their operations.

The meter and accessories segment, by component

The meters & accessories segment comprise flow meters, endpoints, encoders, registers, transmitters, radio modules, and antennas, important for accurate water consumption measurement. The size and type of meters vary according to the specific application and amount of water consumed among various residential, commercial, and industrial needs. Advanced metering infrastructure (AMI) permits real-time monitoring, automated data collection, and analytics that reduce labor and metering costs. In automation, R&D investments by manufacturers will tend to flourish as manual readings will be almost negligible. All these will transform and trigger innovations to move the segment.

Regional Analysis

Europe, in 2023 is the third largest market. In the region, the demand for intelligent water metering infrastructure is accelerating due to increasing water tariffs, which suffer heavily due to poor water management and soaring water losses. Under the water policies of the EU, all the member states have an obligation to implement efficient incentives for water conservation. Water utilities have thus targeted the development of smart water management infrastructure and replacing the old systems with smart water meters to minimize losses. In some countries like the Netherlands, Spain, and France, high consumption is registered with a huge proportion coming from the residential sector. Consequently, the management of residential water use is an area where the utilities focus more. To minimize manual intervention and ease data collection, utilities are increasingly using advanced metering infrastructure technology. These factors are driving the European smart water meters market.

Key Players

The smart water meters market is dominated by major players that have a wide regional presence. Some of the key players in the smart water meters market are Badger Meter, Inc. (US), Sensus (Xylem) (US), Diehl Stiftung & Co. KG. (Germany), Landis+Gyr (Switzerland), and Itron, Inc. (US), ZENNER International GmbH & Co.KG (Germany), Sagemcom (France), Arad Group (Israel), Honeywell International Inc. (US), Aclara (Hubbell) (US), Kamstrup (Denmark), and Wasion Holdings International (China) among others.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=250996975

Badger Meter

Badger Meter, Inc. is one of the leading suppliers of smart metering solutions for water consumption. The company operates through two major business divisions: municipal water and flow instrumentation. It manufactures flow measurement and control technologies and, through this, reaches water utilities, municipalities, and residential, commercial, and industrial customers round the city.

Sensus

Sensus, a Xylem brand that focuses on cutting-edge technology solutions for utilities and public-sector service providers, is an industry giant in metering solutions for water, gas, electric, and heat utilities through the provision of communication, metrology, and software solutions. The company boasts a very wide range of products, which include water meters, flow sensors, turbo meters, electric meters, among others, with synchronized accessories.

Itron

Itron, Inc. is a global leader in providing secure and reliable solutions for critical infrastructure, with over 200 million devices deployed across utilities and cities worldwide. Its portfolio includes software, smart meters, sensors, and services designed to optimize energy and water usage data for customers. The company specializes in the design and manufacture of Automatic Meter Reading (AMR) systems and computer-based electronic meter reading systems. Operating through three key business segments—Device Solutions, Network Solutions, and Outcomes—Itron offers smart meters under the Device Solutions segment, while its smart meter analytics and meter data management services fall under the Outcomes segment.

For more information, Inquire Now!