The oilfield services market is expected to grow at a CAGR of 3.35%, from 2017 to 2022, to reach a market size of USD 125.51 billion by 2022. Increasing shale gas production, growing global E&P spending, and lifting of Iranian oil export sanctions are the major drivers of the oilfield services market.

The oilfield services market is dominated by a few major players that have a wide regional presence and are established brand names. Leading players in the oilfield services market, such as Baker Hughes Incorporated (U.S.), Halliburton Company (U.S.), Schlumberger Limited (U.S.), Weatherford International, PLC (Switzerland), Superior Energy Services, Inc. (U.S.), and GE Oil & Gas (U.K.), have either acquired regional companies or made a joint venture with the ones operating in the oilfield services market to bolster their product portfolio and to enhance their global reach.

With regard to the application segment, the offshore segment is expected to constitute the fastest growing market from 2017 to 2022. In terms of market size, the onshore segment would dominate the oilfield services market. Onshore application is quite famous in the Middle East and North America, where a maximum number of oilfields are located onshore.

Drivers

- Shale Gas Extraction

- Lifting of Iranian Oil Export Sanctions

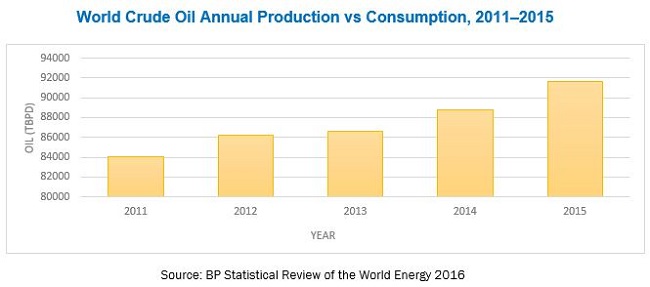

- Increase in Oil & Gas Production

Restraints

- Decline in Drilling Activities and Rig Count

- Fluctuating Crude Oil Prices

- Increasing Focus on Renewable Energy

Opportunities

- New Oilfield Discoveries

- Redevelopment of Aging Reservoirs

Challenges

- Strict Government Regulations on E&P Activities

The report segments the oilfield services market, based on services type, into pressure pumping services, OCTG services, wireline services, well completion equipment and services, well intervention services, drilling and completion fluids services, drilling waste management services, and coiled tubing services. The pressure pumping services would account for the maximum share in the oilfield services market. This particular market is expected to grow in the future as a result of shale gas exploration and production activities in North America. Moreover, Asia-Pacific and Africa also present opportunities as offshore exploration activities are on rise in these regions.

Leading oilfield service providers are developing sustainable and innovative solutions for enhancing the efficiency of various operations in the oilfield services market to drive the industry forward

Onshore

Onshore applications are highly popular in the Middle East and North America, especially in countries such as Saudi Arabia, Kuwait, the U.S., and Canada, where the maximum number of oilfields are located onshore. As per Baker Hughes’ International Rig Count, as of April 2017, the number of onshore rotary rigs globally was 1,693 compared with 218 offshore rigs. Moreover, the onshore environment in regions, such as Europe and North America has witnessed a technology-driven revolution. The Middle Eastern and North American regions are currently the world’s largest crude oil producer, as most of the oilfields in these regions are located onshore. The increasing production activities are likely to boost the oilfield services market during the forecast period.

Offshore

Activities in offshore oilfield environments are comparatively more complex than onshore oil & gas fields. Offshore activities require advanced technologies, making the offshore market a capital-intensive segment. Further, the cost of oilfield services at offshore fields is much higher than onshore oil or gas wells. The increasing growth rate is fueled by new exploration & production activities being carried out in offshore areas.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=263907746

The market in Asia-Pacific is estimated to be the fastest growing market for oilfield services from 2017 to 2022. Increasing offshore exploration activities and shale gas exploration, especially in China and India are driving the demand for Oilfield Services Market in this region. The growing need for oil & gas and the continuing efforts to find new oil & gas reserves are also expected to spur the growth of the market and represent a promising opportunity for major oilfield services providers.