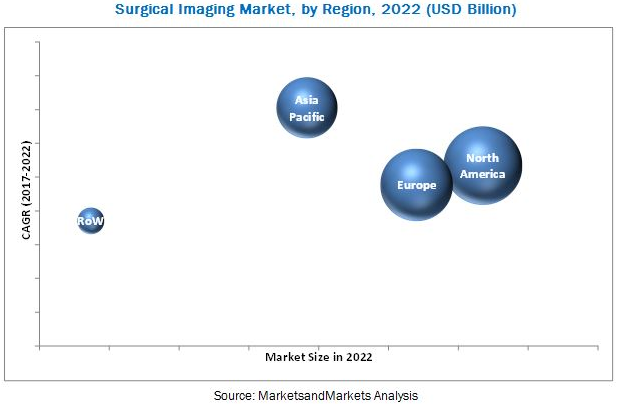

The global surgical imaging market is projected to reach USD 1.63 Billion by 2022 from an estimated value of USD 1.25 Billion in 2017, at a CAGR of 5.5%.

The key factors driving the growth of this market are growing popularity of Flat Panel Detector C-arms (FPD C-arms) owing to advantages of FPDs over image intensifiers, reimbursement cuts on analog radiography systems, and increasing demand for minimally invasive procedures. The growing demand for data integrated imaging systems and high growth in emerging markets like Asia Pacific is an opportunity for the market to grow. However, the high cost of these instruments is restraining the growth of the global market.

Download the PDF Brochure for More Details@ http://bit.ly/2IxOQ1z

The surgical imaging market is emerging and fragmented in nature with various regional and international players. In 2016, the surgical imaging market was dominated by a few large players and several small players. Players in this market compete with each other to deliver superior quality products that are technologically advanced and to provide well-regulated customer service functions. Major companies in this market are GE Healthcare (UK), Siemens AG (Germany), Koninklijke Philips (Netherlands), and Ziehm Imaging (Germany).

Agreements, collaborations, alliances, and partnerships were the key strategies adopted by players from 2014–2017. The players that adopted these strategies are Koninklijke Philips, Ziehm Imaging, GE Healthcare, Siemens, OrthoScan, Toshiba Medical Systems, and Medtronic. Koninklijke Philips accounted for a share of 38% of the total number of agreements, collaborations, alliances, and partnerships in the surgical imaging market. This high share of the company can be attributed to its increasing number of partnerships and collaborations with hospitals which are the primary end users of C-arms.

GE Healthcare held the first position in the global surgical imaging market in 2016. Its leading position in the market is attributed to the highest number of installed systems and its wide and diverse platform of mobile C-arms. The company’s product portfolio of mobile C-arm includes OEC 9900 Elite, its flagship product. The OEC 9900 Elite provides improved image quality and optimal dose management which improves patient care. The product portfolio also includes OEC Brivio 865 Advance which was developed as an affordable option for orthopedic surgical imaging. The strong, wide, and diversified portfolio of mobile C-arms is an asset to the company.

Siemens acquired the second largest share of the global surgical imaging market in 2016. The company offers a comprehensive range of mobile C-arms. To maintain its leading position and increase its customer base in the surgical imaging market, the company mainly focuses on strategic partnerships with hospitals and other healthcare organizations. From 2014 to 2017, the company has partnered with many hospitals in the US, the UK, India, and Chile to offer its services and imaging systems.

Some of the other players competing in this market are Hologic (US), Shimadzu Corporation (Japan), OrthoScan (US), Medtronic (US), Toshiba Medical Systems Corporation (Japan), GENORAY (South Korea), Eurocolumbus (Italy), Allengers Medical Systems (India), and MS Westfalia (Russia).

Target Audience:

- C-arm manufacturers and distributors

- Healthcare institutions (hospitals, medical schools, group practices, individual surgeons, and governing bodies)

- Medical device vendors/service providers

- Research institutes

- Niche companies manufacturing imaging systems

- Research and consulting firms

- Venture capitalists

Read the Detailed Article@

https://www.marketsandmarkets.com/Market-Reports/surgical-imaging-market-210534462.html