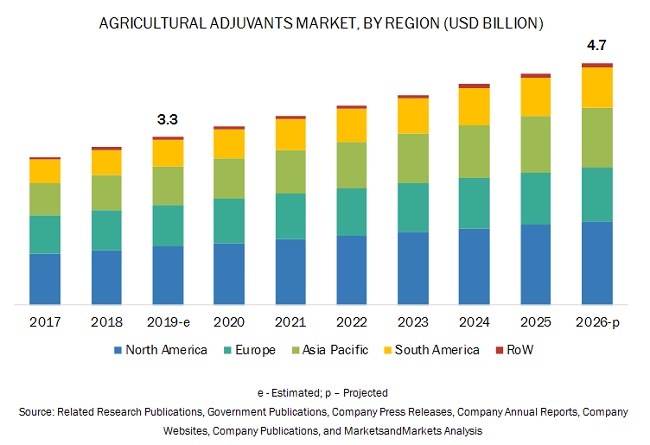

The report “Agricultural Adjuvants Market by Function (Activator and Utility), Application (Herbicides, Insecticides, and Fungicides), Formulation (Suspension Concentrates and Emulsifiable Concentrates), Adoption Stage, Crop Type, and Region – Global Forecast 2026″, is estimated to be valued at USD 3.3 billion in 2019 and is expected to reach a value of USD 4.7 billion by 2026, growing at a CAGR of 5.3% during the forecast period. Factors such as the rising demand for improved crop varieties is driving the growth of the agricultural adjuvants market.

Increasing need for green adjuvants

Most adjuvants that are added in crop protection chemicals are derived from petroleum or other chemical sources. The surplus use of these chemically derived adjuvants in pesticide affects the environment and human health. For example, nonylphenol ethoxylate, a wetting and dispersing agent, is still used in some agrochemical applications. This surfactant causes endocrine toxicity in animals and is also toxic to aquatic organisms. Hence, government authorities and adjuvant manufacturers have been shifting their focus on renewable and sustainable products. This trend will lead to high demand for naturally derived products that pose a negligible threat to the environment as compared to conventional petroleum-derived products that are toxic in nature and can lead to bioaccumulation within the ecosystem.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1240

The herbicides segment is estimated to witness the fastest growth in the agricultural adjuvants market, in terms of value from 2017 to 2026

Herbicides are used to kill or control unwanted plants. They have largely replaced mechanical methods of weed control in countries where intensive and highly mechanized agriculture is practiced. Adjuvants are the substances which are either added in a herbicide formulation or to the spray tank that helps in modifying the herbicidal activity or application characteristics, such as spray retention and droplet drying, increasing droplet coverage, increasing herbicide cuticle penetration, better mixing and handling, as well as cellular accumulation which reduces the leaching of herbicide through the soil profile, etc. The benefits associated with herbicides are the major factors contributing to the fastest growth of this market, globally.

The cereals & grains segment, by crop type, is estimated to account for the largest market share, by value, in 2019

Cereals & grains accounted for the largest consumption of herbicides in North America and Asia Pacific, owing to the high cultivation of corn and wheat in countries such as the US and China. Adjuvants are added to the commercial formulae of herbicides to improve their efficacy by increasing the adhesion properties of herbicides to the leaf surface, as well as aiding transport across the waxy cuticle membrane and into the plant. Adjuvants used in herbicide treatment solutions for cereals & grains aim to improve spray droplet retention and penetration of active ingredients into the plant foliage. Thus, cereals and grains are estimated to be the most popular crop type in the agricultural adjuvants market.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=1240

Asia Pacific is projected to grow at the highest CAGR during the forecast period

The market for agricultural adjuvants in the Asia Pacific region is expected to grow at the highest CAGR from 2019 to 2026, owing to the increasing investments by key players in countries such as China, India, and Thailand, and also the rising adoption of adjuvant technology by the crop growers for insecticide applications. Due to these factors, the market in the Asia Pacific region is projected to record the highest growth from 2019 to 2026.

This report includes a study on the marketing and development strategies, along with a study on the product portfolios of the leading companies operating in the agricultural adjuvants market. It includes the profiles of leading companies such as Miller Chemical and Fertilizer, LLC (US), Precision Laboratories (US), CHS Inc (US), Winfield United (US), Kalo Inc. (US), Nouryon (Netherlands), Corteva Inc. (US), Evonik Industries (Germany), Nufarm (Australia), Croda International (UK), Solvay (Belgium), BASF (Germany), Huntsman Corporation (US), Clariant (US), Helena Agri-Enterprises (US), Stepan Company (US), Wilbur-Ellis Company (US), Brandt (US), Plant Health Technologies (US), and Innvictis Crop Care (US).