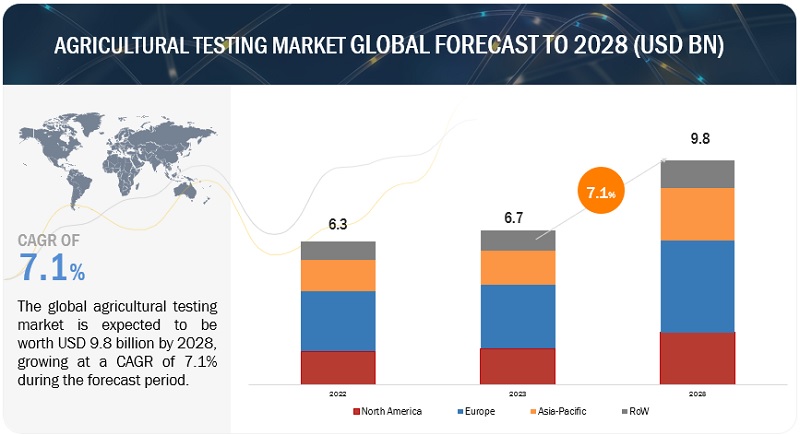

According to a research report “Agricultural Testing Market by Sample (Soil, Water, Seed, Compost, Manure, Biosolids, Plant Tissue), Application (Saftey Testing, Quality Assurance), Technology (Conventional, Rapid) and Region ( North America, Europe, APAC, Row) – Global Forecast to 2028″ published by MarketsandMarkets, the agricultural testing market is estimated at USD 6.7 billion in 2023 and is projected to reach USD 9.8 billion by 2028, at a CAGR of 7.1% from 2023 to 2028

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=203945812

The demand for agricultural testing is rising globally due to several reasons. there is an increasing awareness and emphasis on food safety and quality. Consumers are more concerned about the potential presence of contaminants, pesticides, and other harmful substances in their food. This has led to stricter regulations and standards for agricultural products, driving the need for comprehensive testing to ensure compliance. Globalization and international trade have expanded significantly in the agricultural sector. Different countries have varying import requirements and regulations for agricultural products. Testing is essential to demonstrate compliance with these standards and facilitate smooth trade relationships.

The safety testing in application segment accounted for the largest share of the agricultural testing market in 2023 in terms of value.

Safety testing of agricultural samples includes testing for targets such as toxins, pathogens, heavy metals, pesticides, GMOs, and organic contaminants. The presence of contamination in soil, water, seed, compost, and biosolids can lead to contamination of the agricultural produce, which can lead to foodborne illnesses and cause several health issues on consumption by humans. Thus, significant emphasis has been laid on safety testing of agricultural samples, with focus on addressing loopholes in safety laws, implementing good agricultural practices (GAP), and also continuing research to determine the maximum residue limits for contaminants in food. Further, due to increase in apprehension among consumers toward GM content in food and introduction of GM labeling mandates and regulations on specific GM traits, GMO testing for seeds is also an emerging driver for this market. Also, due to the disposal of toxic chemicals in water bodies through untreated wastewater and effluents is a major concern for the agricultural sector as irrigation of agricultural land with this contaminated water can lead to soil toxicity and public health concerns. As a result, safety testing of agricultural samples has gained importance over the years.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=203945812

The rapid technology of the technology segment accounted for the highest share of the agricultural testing market in 2023 to 2028 in terms of value.

Rapid technology is segmented into chromatography & spectrometry, PCR, ELISA, and X-ray fluorescence which are used to test and identify contaminants through different means. Rapid diagnostic tests provide results in a significantly shorter time compared to conventional methods. These tests employ techniques such as immunochromatography, lateral flow assays, or molecular-based methods like polymerase chain reaction (PCR). With rapid tests, agricultural professionals can quickly identify pathogens, contaminants, or diseases, allowing for swift decision-making and timely interventions. Rapid technology also enables testing to be conducted directly at the site of sample collection, eliminating the need to transport samples to a laboratory. Portable and handheld devices, such as biosensors or miniaturized PCR machines, are now available, enabling real-time analysis in the field. On-site testing reduces turnaround time, improves resource allocation, and allows for immediate actions to be taken based on test results.

The soil segment of the sample segment is estimated to grow at the highest in the agricultural testing market.

Soil sample testing enables precise nutrient management in agriculture. By determining the nutrient levels in the soil, farmers can apply fertilizers and soil amendments judiciously, avoiding overuse or underuse of nutrients. This targeted approach optimizes nutrient application rates, reduces fertilizer waste, and minimizes the environmental impact of excessive nutrient runoff. Effective nutrient management based on soil sample testing helps ensure sustainable agriculture practices, conserves resources, and reduces the risk of nutrient pollution in water bodies. Soil sample testing assists farmers in selecting appropriate crops and planning their planting strategies. Different crops have varying nutrient requirements and tolerances to soil conditions. By analyzing soil samples, farmers can identify which crops are best suited for their specific soil characteristics. They can make informed decisions regarding crop rotation, choosing crops that complement the soil’s nutrient content and address any deficiencies. Soil sample testing aids in optimizing crop selection, diversifying farming systems, and maximizing the utilization of available soil resources.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=203945812

The Asia Pacific region accounted for the fastest growing market, in terms of value, of the global agricultural testing market in 2028.

Major growth drivers of the Asia Pacific include increased adoption of advanced biotechnological methods and organic farming resulting in a need for agricultural testing services, and an increase in the number of exports from the region, necessitating agricultural testing for the produce. Agriculture is one of the prime industrial sectors in several countries in the region, further driving the growth of the market. While many countries have successfully adopted farm mechanization techniques that are used for crop production, harvest, and post-harvest operations such as packaging and marketing to help improve the quality of produce, there are many countries which are yet to adopt such mechanized technologies in an all-inclusive manner. Although the region has been able to successfully implement positive changes in their agricultural methodologies, the region’s yields continue to remain stunted, mainly owing to the deteriorating soil quality and water quality, increased use of fertilizers to maintain increasing yields, and the extensive use of chemical pesticides. This drives the need to adopt quality analysis technologies.

This report includes a study of the marketing and development strategies, along with the product portfolio of leading companies. These companies include SGS (Switzerland), Eurofins (Luxembourg), Intertek (UK), Bureau Veritas (France), ALS Limited (Australia), TUV Nord Group (Germany), Merieux (US), AsureQuality (New Zealand), RJ Hill Laboratories Limited (New Zealand), SCS Global (US), Agrifood Technology (Australia), APAL Agricultural Laboratory (Australia), Agvise Laboratories (US), LGC Limited (UK) and Water Agricultural Laboratories (US)