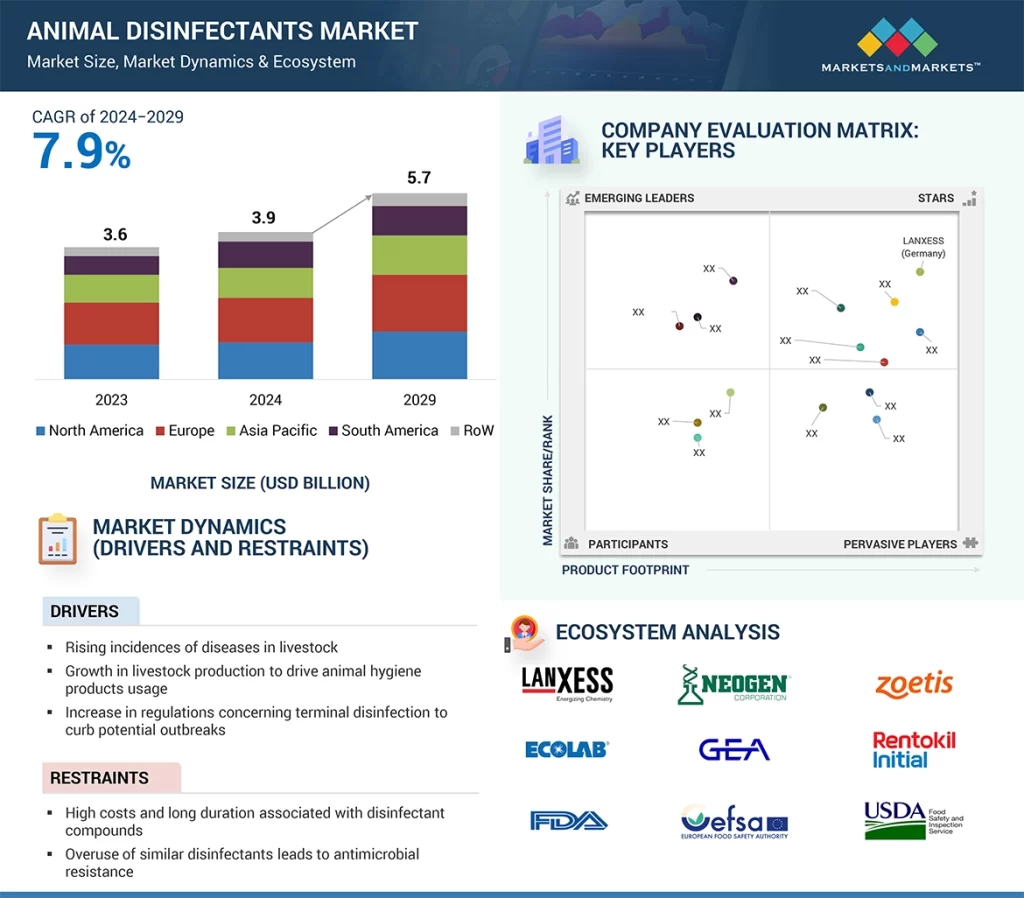

The global animal disinfectants market is valued at USD 3.9 billion in 2024 and is projected to grow to USD 5.7 billion by 2029, registering a CAGR of 7.9% during the forecast period. Known for their versatility and wide-ranging applications, animal disinfectants are integral to enhancing the health and welfare of livestock. These disinfectants effectively eliminate harmful microorganisms, including bacteria, viruses, fungi, and parasites, which can proliferate in animal housing, equipment, and surrounding environments.

Regular use of animal disinfectants helps reduce the risk of disease outbreaks, ensuring a safe and healthy environment for animals. They are widely employed in environments where cleanliness is paramount, such as farms, veterinary clinics, and animal shelters. Selecting the right disinfectant requires careful consideration of factors such as the type of microorganism targeted, the surface to be treated, and potential effects on humans or animals.

Effective disinfection, combined with proper hygiene and biosecurity measures, is essential for preventing and managing biohazards in animal care settings.

Animal Disinfectants Market Trends

Here are some key trends in the Animal Disinfectants Market:

- Rising Focus on Biosecurity

Increasing awareness about farm biosecurity measures is driving demand for effective animal disinfectants to prevent the spread of diseases.

Governments and organizations emphasize strict hygiene protocols in animal husbandry. - Shift Towards Eco-Friendly Products

Growing preference for biodegradable and non-toxic disinfectants to align with environmental sustainability goals.

Use of plant-based and natural disinfectants is gaining traction. - Emergence of Innovative Formulations

Development of advanced disinfectant formulations with extended effectiveness against pathogens.

Inclusion of multi-purpose disinfectants that work on various surfaces and conditions. - Impact of Livestock Disease Outbreaks

Frequent outbreaks, such as avian flu and swine fever, are increasing the adoption of disinfectants in farms and veterinary clinics.

Enhanced disease control measures are a critical driver in emerging economies. - Expansion of Aquaculture

Growth in aquaculture farming has led to the use of specialized disinfectants for water tanks and equipment to ensure fish health. - Technological Advancements

Adoption of automated spraying systems and drone technology for large-scale disinfection in poultry and livestock farms. - Regulatory Compliance and Standards

Strict regulatory guidelines for animal health management drive the development and use of certified disinfectants.

Companies focus on meeting standards set by WHO, EPA, and other regulatory authorities.

Animal Disinfectants Market Drivers: Increasing incidence of livestock diseases

The alarming increase in African Swine Fever (ASF) outbreaks in Europe underscores the severity of the situation. According to the 2022 ADIS report from the European Parliament, there were 537 outbreaks of ASF in domestic pigs across 12 European countries. Additionally, there were 7,442 outbreaks of ASF in wild boars reported in 15 European countries. The situation changed in 2023 with a rapid increase in the number of registered outbreaks. Between January 1, 2023, and July 22, 2023, ADIS recorded 902 outbreaks in domestic pigs across 16 European countries and 5,445 outbreaks in wild boar populations across 19 European countries. This steep increase reflects the rapidly accelerating danger from livestock diseases and has made the requirement for very strong disease prevention and control measures. The spread of ASF raises serious concerns about animal health, as well as its impact on the economy and food security in regions reliant on pig farming. This situation highlights the importance of biosecurity, disease surveillance, and proper disinfection practices in controlling such dreadful diseases.

Based on applications, the poultry segment is estimated to grow at a significant CAGR during the studied period.

Success in poultry farming heavily depends on maintaining a healthy and disease-free environment. A 2021 OECD study projects that global meat protein consumption will increase by 14% by 2030, with poultry meat expected to account for approximately 40% of all protein consumption. This growing demand for poultry meat will drive the need for more poultry farming, and consequently, an increased demand for poultry disinfectants to ensure cleanliness and hygiene. Disinfectants are applied after cleaning equipment to eliminate remaining pathogens. These disinfectants come in various forms, including fumigation, foam sprays, and liquid concentrates. Common disinfectant chemicals used in poultry facilities include phenolic compounds, iodine, chlorine compounds, quaternary ammonium compounds, and oxidizing agents. Viruses play a significant role in transmitting poultry diseases, with avian influenza posing a serious threat in recent times. Terminal disinfection is a crucial practice for maintaining poultry health. The Neogen Corporation (US) offers Quat-Chem, a range of virucidal disinfectants designed to control infectious diseases in poultry. According to the USDA, Germany is the leading exporter of poultry products in the European Union, making up 24% of the region’s total poultry exports.

North America is expected to hold a substantial portion of the animal disinfectants market.

The North American animal disinfectants market is primarily driven by regions such as the US, Canada, and Mexico. According to USDA, the export of poultry meat products in North America has risen significantly. In Mexico, production increased from 983.43 million to 1.25 billion between 2020 and 2022, while in Canada, production grew from 350.26 million to 563.94 million during the same period. This surge in poultry production reflects a growing demand within the regional market. As the poultry sector expands, there is an increased need for effective animal disinfectant products to maintain biosecurity and ensure livestock health. These products play a critical role in preventing diseases in densely populated farming environments, supporting the sustainability of poultry operations. Innovations like Neogen Corporation’s (US) launch of Neogen Farm Fluid MAX in April 2024 in Great Britain demonstrate the sector’s reliance on advanced solutions. This disinfectant, developed by Neogen’s Pathogen Programme to target serious pathogens such as Eimeria oocysts, highlights the importance of innovative products in fostering the continuous growth and productivity of the animal health industry, especially as the North American poultry sector continues to expand.

Animal Disinfectants Manufacturers:

Key Market Players in this include Neogen Corporation (US), GEA Group Aktiengesellschaftv (Germany), Lanxess (Germany), Zoetis (US), Solvay (Belgium), Stockmeier Group (Germany), Kersia Group (France), Ecolab (US), Albert Kerbl GmbH (Germany), PCC Group (Germany), DeLaval Inc. (Sweden), Diversey Holdings Ltd. (US), Virbac (France), Kemin Industries Inc. (US) and Fink Tec GmbH (Germany).

Zoetis (US)

Zoetis specializes in the discovery, development, and production of animal health medications and vaccines. In addition to these core products, the company provides diagnostic tools, genetic testing, biodevices, and various services tailored to the needs of veterinarians, livestock producers, and pet owners. Zoetis’ product offerings include treatments for infections, vaccines, parasite control products, medicated feed additives, and other non-pharmaceutical solutions for both pets and livestock. Initially part of Pfizer (US) as its animal health division, Zoetis became an independent company in February 2013 after being spun off.

The company has a broad distribution network that covers more than 100 countries across North America, Europe, Africa, the Middle East, Latin America, and the Asia Pacific region. Some of its key subsidiaries include Pharmag AS (Norway), Alpharma LLC (US), Zoetis B.V. (Netherlands), Zoetis Canada Inc. (Canada), and Zoetis Korea Ltd. (South Korea).

Neogen Corporation (US)

Neogen Corporation specializes in the development, manufacturing, and marketing of products focused on animal and food safety. The company distributes its products through its sales teams across the United States, Canada, Mexico, Central America, Brazil, Argentina, Uruguay, Chile, the United Kingdom, China, India, and Australia.

Neogen’s offerings are categorized into food safety and animal safety products. The Animal Safety division focuses on creating, manufacturing, marketing, and distributing a variety of veterinary tools, pharmaceuticals, vaccines, topical treatments, diagnostic tools, rodenticides, cleaners, disinfectants, insecticides, and genomics testing services. These consumable products are primarily sold through veterinarians, retailers, livestock producers, and distributors of animal health products. In the disinfectant sector, Neogen’s portfolio includes a diverse range of active ingredients designed to target specific pathogens and accommodate various pH levels, providing solutions for cleaning and disinfecting animal environments.

Animal Disinfectants Industry Development:

- In April 2024, Neogen launched Farm Fluid MAX Disinfectant, which is a powerful and versatile solution designed to meet the rigorous needs of livestock and poultry markets across Great Britain. It effectively eliminates pathogens and maintains high standards of hygiene in farm environments. In January 2022, STOCKMEIER Group acquired New Química S.L., which specializes in the storage, sales, and distribution of chemical products. This acquisition will help STOCKMEIER to expand its geographic footprint in Spain. In May 2021, Kersia Group acquired Bioarmor, a manufacturer of enzyme-based hygiene products for cleaning and disinfecting buildings, equipment, and animal water and environmental solutions for pig, poultry, ruminant, and horse farms. Bioarmor has a commercial presence in France, and this acquisition strengthens that presence.

- In October 2022, Diversey acquired Tasman Chemicals, an Australian manufacturer of professional hygiene and cleaning solutions. This acquisition would strengthen Diversey’s operational presence and customer experience in New Zealand and Australia, facilitating the expansion of the company’s reach. In June 2022, Kemin Industries introduced two new chlorine-dioxide-based antimicrobial and disinfectant solutions, KEEPER and OXINE, in Asia. These solutions can be applied to food, water, food-contact surfaces, processing equipment, and food production environments.