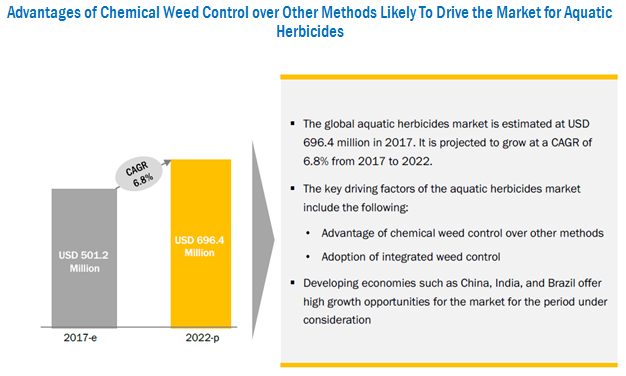

The aquatic herbicides market was valued at USD 501.2 Million by 2017. It is projected to reach USD 696.4 Million by 2022, growing at a CAGR of 6.8% from 2017. The market has largely driven the growing adoption of integrated weed control. It is used when long-lasting weed control is required at inexpensive costs and with less undesired side effects. The advantages of using aquatic herbicides over other treatment methods such as manual and mechanical methods are also driving the market for aquatic herbicides.

Download PDF brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=182444792

The glyphosate segment is projected to dominate the market through the forecast period. Glyphosate is an important segment of the market as the formulation of glyphosate is less expensive than the mechanical or manual removal of aquatic weeds; it also provides long-term control of weeds when compared to other biological and mechanical methods.

The foliar segment is estimated to dominate the market as foliar application takes less time and ensures better weed cover as compared to the submerged application. More herbicides are registered for foliar application, which is projected to drive the foliar segment in the market.

The Asia Pacific region is projected to be the fastest-growing market for aquatic herbicides over the next five years, owing to an increase in overall economic growth, the use of glyphosate to control emergent, free-floating, and floating-leaf weeds, and the fact that the use of aquatic herbicides is more effective and economical than other mechanical methods. In this region, countries such as Australia and New Zealand hold a major share of more than 60% of the Asia Pacific aquatic herbicides market. India is one of the fastest-growing markets for aquatic herbicides in the Asia Pacific region, due to varied agricultural climate and relatively inexpensive labor.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=182444792

This report studies the marketing and development strategies, along with the product portfolios of leading companies such as Dow Chemical (US), BASF (Germany), Monsanto (US), Syngenta (Switzerland), and Nufarm (Australia). Other significant players include Lonza (Switzerland), Land O’Lakes (US), UPL (India), Platform Specialty Products (US), SePRO Corporation (US), Albaugh (US), Valent (US), and SANCO INDUSTRIES (US).