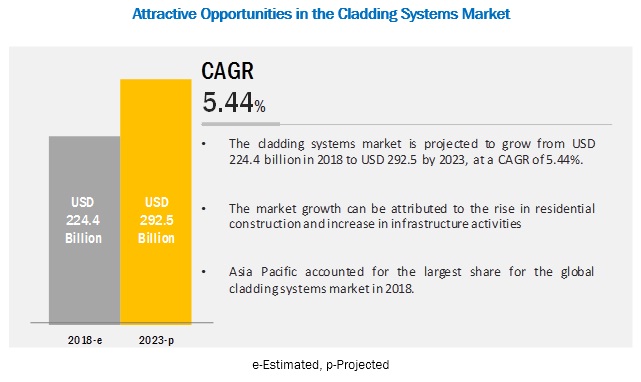

The Cladding Systems Market is projected to grow from USD 224.4 billion in 2018 to USD 292.5 billion by 2023, at a CAGR of 5.44% from 2018 to 2023. Cladding systems can be made from various types of materials which include stone, brick, wood, stucco, vinyl, metal, fiber cement, and others. The choice of cladding material determines the environmental performance of a building. Cladding systems market is expected to grow in accordance to the growth of construction industry across the globe. Cladding offers several benefits such as insulation, fire resistance, pollution prevention, and provides aesthetic appeal to a building. . Cladding can be installed over wall, roof, windows, doors, or any other component of a building which is exposed to external environmental forces.

Factors such as increase in the residential and commercial construction and infrastructure activities, along with the demand for durability of cladding systems with the ability to withstand various weathering actions and resist chemical attacks & deterioration are expected to support market growth during the forecast period.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=148899031

Compagnie de Saint-Gobain S.A. (France), DowDuPont (US), Tata Steel Limited (India), Arconic (US), Westlake Chemicals (US), Etex Group (Belgium), James Hardie Industries PLC (Ireland), CSR Limited (Australia), Nichiha Corporation (Japan), Boral Limited (Australia), Cembrit Holding A/S (Denmark), Louisiana Pacific Corporation (US), and Kingspan PLC (UK) are key players operating in the cladding systems market.

In terms of volume, the ceramic segment is estimated to lead the cladding systems market in 2018.

Ceramic is mainly used for tile cladding, hence play a major role in the construction industry. The ceramic tiles enhance the overall atmosphere of a residential or commercial landscape. The selection of the type of these tiles is based on several factors such as ease of maintenance, durability, comfort, safety, style, and design templates. Foot traffic plays an important role in the selection of the type of ceramic tiles. The wall tiles are employed in the interior as well as the exterior of the building to meet the requirement of decoration or aesthetics. The usage of ceramic tiles ranges from bathrooms and kitchens in households to laboratories, restaurants, medical centres, shopping centres, schools, and government buildings.

In terms of both value and volume, the wall cladding segment is projected to grow at the highest CAGR from 2018 to 2023.

Wall claddings are designed to protect the exterior wall from the effects of weathering and also to enhance the appearance of the walls in a building. Brick, stucco, and EIFS wall cladding trends have declined over the years due to their increasing price, whereas wood and fiber cement wall cladding are gaining momentum, especially in residential buildings. In commercial buildings such as warehouses and manufacturing plants, concrete and metal form the main wall cladding systems. Concrete cladding such as slabs and precast panels are widely used in industrial applications. Metal cladding, such as steel, is also used in other industrial buildings such as cool stores and freezing units.

In terms of value, the residential segment is estimated to lead the cladding systems market in 2018.

The residential sector is estimated to account for the majority of the market share, considering the fact that the builders and contractors have realized the importance of cladding systems, as it protects the building from external environmental forces and also enhances the appearance of the building; these are the attributes that home owners demand. Also, the growing trend of developing the green building in order to combat global warming and increasing energy cost provides huge opportunities for the growth of the cladding system market. Most favorable materials for residential cladding systems include fiber cement, vinyl, bricks, and timber wood. The spending in residential construction is estimated to witness a surge, particularly in the emerging Asia Pacific and South American regions; there is a trend of urbanization observed in these regions, resulting in a higher growth rate for the residential construction market, as compared to developed markets.

Asia Pacific region is projected to account for the largest share in the cladding systems market during the forecast period

The Asia Pacific region is projected to lead the cladding systems market, in terms of both, value and volume, from 2018 to 2023. Factors such as increasing availability of raw materials and manpower, along with sophisticated technologies and innovations have driven the cladding systems market growth in the Asia Pacific region. In addition, growing construction sector, particularly in rapidly-growing countries such as China and India and huge foreign investments drives the Asia Pacific cladding market. However, consumers in this region are price-conscious and lay a lot of importance on this criterion in every aspect of their purchase. Manufacturing cost-effective cladding systems is a challenge faced by players operating in this region.

These companies account for significant shares, backed by their extensive product portfolios, wide geographical presence, and adoption of growth strategies. Expansions, acquisitions, investments, and new product developments are some of the major strategies adopted by these key players to enhance their position in the cladding systems market.

Key Questions Addressed by the Report:

- What are the global trends in the cladding systems market? Would the market witness an increase or decline in the demand in the coming years?

- What is the estimated demand for different types of cladding systems products?

- Where will the strategic developments take the industry in the mid to long-term?

- What are the upcoming industry applications and trends for cladding solutions market?

- Who are the major players in the cladding solutions market globally?

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=148899031