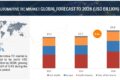

The automatic tire inflation system industry size is projected to grow from USD 82 million in 2023 to USD 138 million by 2028, at a CAGR of 10.7% during the forecast period.

Growth prospects would arise from the growing need for ATIS in heavy-duty vehicles and agricultural tractors to prolong tire life and minimize accidents caused by tire blowouts.

During the projection period, the largest off-highway ATIS system segment is anticipated to be ATIS for farm tractors.

At a compound annual growth rate (CAGR) of 5.0%, the farm tractor market is expected to increase from approximately USD 54 billion in 2022 to over USD 69 billion by 2027. Over the course of the projected period, tractors with horsepower between 130 and 250 are anticipated to expand at the quickest rate worldwide. Due to the growing demand for commercial agriculture and the increasing popularity of tractors with high pulling power, Europe is the greatest market for these tractors. The majority of these tractors with more than 130–250 horsepower have automatic tire inflation systems (ATIS). The biggest market for farm tractors with more than 250 horsepower is Europe. The market in the area is anticipated to grow as a result of the growing acceptance of commercial farming and the introduction of new products by several significant companies. The first agricultural tire on the market made especially for use with Central Tire Inflation Systems (CTIS) is the Michelin EVOBIB.

On the other hand, ATIS penetration is minimal in tractors with less than 130 horsepower because small tractors are primarily appropriate for farms with half to two acres. With the help of automatic tire inflation systems, farmers can maximize traction, control soil compaction, increase productivity, improve operator comfort, and safeguard their machinery. The market for ATIS will rise in the upcoming years due to the rising demand for high horsepower tractors, particularly in North America and Europe.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=52126096

In 2028, the OEM sales channel is anticipated to have the biggest market share.

Light- and heavy-duty cars sold through the OEM sales channel are included in the study’s scope. In the ATIS market, the OEM category has the most sales channel share. OEMs are using the ATIS system in automobiles and building the chassis to meet the specifications of the ATIS system. The quality, compatibility, and support of aftermarket automatic tire inflation systems can differ. Complexity, compatibility with current TPMS, sensor integration with current systems, and system cost are the main obstacles in aftermarket autonomous tire inflation systems. Certain aftermarket systems could necessitate extra installation procedures or vehicle modifications, which could nullify warranties. As a result, ATIS retrofitting is currently not very popular.

OE-fitted systems are made to smoothly integrate ATIS with the car’s current systems. In order to ensure compatibility and peak performance, ATIS manufacturers work with the car manufacturer to create these systems. The driver can more easily monitor and change tire pressure since OE-fitted systems are incorporated into the vehicle’s current interface, such as the infotainment system or dashboard, and are developed with the vehicle’s overall design in mind. The demand for ATIS in the OE market is anticipated to increase due to the advantages provided.

According to estimates, the greatest market for Automatic Tire Inflation Systems (ATIS) is North America.

Due to the region’s extensive farmlands and consequent demand for huge farm tractors, North America has the largest ATIS market in the world. Additionally, the area is one of the biggest markets for trucks and trailers, which travel great distances on concrete roadways, overheating tires and producing incorrect tire pressure variations. This may result in tire rupture or a reduction in tire life, which could cause accidents. Road safety laws, the focus on fuel economy, and the existence of large automakers are some of the factors driving the growth of the ATIS market in North America.

To improve vehicle safety, OEMs are equipping trucks and trailers with ATIS. Furthermore, the necessity for dependable tire repair systems is fueled by North America’s enormous transportation infrastructure and vast highway network. In addition to improving safety and fuel efficiency, automatic tire inflation systems efficiently maintain the right tire pressure. The demand for ATIS in North America will be fueled by these factors.

Key Market Players

The ATIS is a consolidated market with few players like Dana Incorporated (US), MICHELIN (France), IDEX Corporation (US), Enpro Industries (US), MERITOR (US), SAF-HOLLAND (Germany), and CLAAS (Germany) dominating the industry. New product development, partnership, and joint venture strategy have been the most dominating strategy adopted by major players from 2018 to 2023, which helped them to innovate their offerings and broaden their customer base.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=52126096