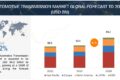

The global automotive transmission market is projected to grow from USD 62.4 billion in 2023 to USD 84.2 billion by 2028, at a CAGR of 6.2% during the forecast period. The growth in the automotive transmission market is primarily driven by technological advancements leading to more efficient transmission systems and stringent emissions regulations necessitating the adoption of fuel-efficient transmission solutions. Additionally, increasing vehicle production, rising demand for automatic transmissions, and the expanding market for electric and hybrid vehicles contribute to the market’s growth.

CVT is estimated to be the fastest-growing transmission market regarding the number of forward gears during the forecast period.

Continuously Variable Transmission (CVT) is an automatic transmission technology that uses two pulleys connected by a steel belt. It adjusts the size of these pulleys to change gear ratios smoothly, avoiding jolts during shifts and providing a comfortable driving experience. With the increasing popularity of SUVs globally, automatic transmissions like CVTs are becoming more preferred for city driving. CVTs provide an excellent opportunity for transmission manufacturers because they offer better fuel efficiency and lower carbon emissions than other automatic transmission types. CVTs are mainly used in hybrid and electric vehicles, which are in higher demand due to environmental concerns. Considering the trends in the market, companies like Bosch are also introducing upgraded products like eCVT, introduced in September 2023. This eCVT combines CVT technology with an electric motor for better efficiency and performance in electric vehicles.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1063

Major car brands from Japan, South Korea, and China – Hyundai, Kia, Toyota, Honda, Nissan, Geely, BYD, and Great Wall Motors- offer CVT options in their popular models. Luxury sedans like the Lexus NX 250 and Mercedes-Benz A-Class offer CVT options for a balance of fuel efficiency and power. In the SUV segment, the Audi Q3 and Range Rover Evoque provide CVTs for a smooth and quiet urban driving experience. Hybrid and electric vehicles like the Toyota Prius and Nissan Leaf e+ utilize CVTs for seamless integration of power sources and efficient performance.

The CVTs are estimated to gain a significant market share in coming years with advantages such as adaptability to various driving conditions, optimized power delivery, compact design, reduced emissions, and consumer acceptance.

Passenger car segment is estimated to be the largest segment during the forecast period.

According to ACEA, global passenger car production witnessed a notable 8.7% increase in 2022 compared to the previous year. Asia Pacific emerges as the dominant region in the passenger car market, with China and Japan leading the pack. Projections from the International Energy Agency (IEA) highlight a significant surge in passenger car ownership, particularly in India, which is expected to contribute substantially to global vehicle production. The IEA forecasts a staggering 775% increase in passenger car ownership in India over the next 24 years, with the number of vehicles per 1,000 inhabitants rising from 20 to 175. Hatchbacks are popular in Europe and some parts of Asia Pacific due to their practicality, maneuverability, and cost-effectiveness. Traditional automatic transmissions (ATS) with 6-10 speeds are prevalent in the mid-size and large cars segment, prioritizing comfort and handling. Automatic transmissions are gaining popularity in the passenger car market due to their convenience and effortless driving experience, especially in congested urban areas. Advancements in technology have improved fuel efficiency and performance, making them appealing to a broader range of consumers. Options like continuously variable transmissions (CVTs) and dual-clutch transmissions (DCTs) further enhance their appeal, offering seamless acceleration and rapid gear shifts. Certain models like the Toyota Camry and Honda Accord may opt for continuously variable transmissions (CVTs) to optimize fuel efficiency. As consumer preferences evolve towards comfort and convenience, automatic transmissions will continue dominating the market.

Asia Pacific is estimated to be the fastest-growing market for automotive transmission in 2023

The Chinese market is the largest in the Asia-Pacific region and is experiencing notable growth in the demand for premium vehicles. This trend is driven by rising disposable incomes among consumers, contributing to increased sales of high-end automobiles. According to the China Passenger Car Association (CPCA), retail sales of luxury cars surged by 17 percent year-on-year and 35 percent month-on-month, reaching 270,000 units. China is on track to become the fastest-growing market for luxury and ultra-luxury vehicles by 2031, with automatic transmissions witnessing growth driven by the expanding luxury car and SUV segments. This growth in luxury car sales in China is expected to fuel demand for automatic transmissions as consumers increasingly prefer the convenience and comfort they offer. This surge in demand will drive the expansion of the automatic transmission market in the region. In parallel, India and South Korea are witnessing increased vehicle production due to rising disposable incomes and significant investments in R&D, particularly in EV technology and autonomous driving. In the Asia-Pacific region, hybrid vehicle sales are expected to surpass pure EVs due to factors like limited charging infrastructure and consumer preferences, thus driving the demand for automatic and CVT transmissions, which are set to dominate the market. Additionally, strict government regulations, such as tighter fuel efficiency standards in China, further boost the adoption of automatic transmissions. While the transmission market in APAC remains diverse, with both manual and automatic options catering to specific regional and segment preferences, the future appears to favor automatic transmissions, supported by ongoing urbanization, changing consumer preferences, and continuous technological advancements.

Key Market Players:

Key players in the market include Aisin Corporation (Japan), ZF Friedrichshafen AG (Germany), Magna International Inc. (Canada), JATCO Ltd. (Japan), BorgWarner Inc. (US). These companies have a strong track record in developing and manufacturing automotive transmissions and its components. They have facilities and manufacturing centers across all regions, such as North America, Asia Pacific, and Europe.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=1063