The global automotive transmission market size was valued at USD 62.4 billion in 2023 and is expected to reach USD 4.2 billion by 2028, at a CAGR of 6.2% during the forecast period. The growth in the market is primarily driven by technological advancements leading to more efficient transmission systems and stringent emissions regulations necessitating the adoption of fuel-efficient transmission solutions. Additionally, increasing vehicle production, rising demand for automatic transmissions, and the expanding market for electric and hybrid vehicles contribute to the market’s growth.

CVT is estimated to be the fastest-growing transmission market regarding the number of forward gears during the forecast period.

Continuously Variable Transmission (CVT) is an automatic transmission technology that uses two pulleys connected by a steel belt. It adjusts the size of these pulleys to change gear ratios smoothly, avoiding jolts during shifts and providing a comfortable driving experience. With the increasing popularity of SUVs globally, automatic transmissions like CVTs are becoming more preferred for city driving. CVTs provide an excellent opportunity for transmission manufacturers because they offer better fuel efficiency and lower carbon emissions than other automatic transmission types. CVTs are mainly used in hybrid and electric vehicles, which are in higher demand due to environmental concerns. Considering the trends in the market, companies like Bosch are also introducing upgraded products like eCVT, introduced in September 2023. This eCVT combines CVT technology with an electric motor for better efficiency and performance in electric vehicles.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1063

OPPORTUNITY: Increasing adoption of automatic transmissions and development of hybrid drives

The automotive industry is witnessing a significant shift towards automatic transmissions, driven by urbanization, rising disposable income in developing automotive transmission markets, and technological advancements enhancing fuel efficiency and performance. Additionally, government regulations favoring lighter, more efficient vehicles and the integration of automatics with hybrid and electric powertrains further accelerate this trend. Furthermore, the increasing adoption of hybrid drives presents substantial growth opportunities fueled by environmental concerns, government incentives, and the potential for significant fuel savings and performance improvements. With expanding infrastructure and emerging markets, coupled with the potential synergy between automatic transmissions and autonomous driving systems, the future of the automotive industry is poised for transformative growth.

CHALLENGE: Reduction in costs for lightweight and efficient transmission

The dilemma faced by the automotive industry is between technological innovation and cost reduction. The automotive industry faces a crucial dilemma in harmonizing technological advancements with cost efficiency, particularly concerning lightweight and efficient transmission systems. While incorporating advanced materials like aluminum and carbon fiber composites shows potential for enhancing fuel economy and complying with emission standards, their higher costs pose significant obstacles. Manufacturing intricate components with these materials demands specialized techniques and equipment, further driving up production expenses. Additionally, challenges stemming from limited economies of scale and volatile raw material prices complicate efforts to attain cost competitiveness for lightweight transmission solutions.

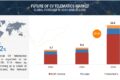

The Asia Pacific automotive Transmission market is projected to hold the largest share by 2028

The Asia Pacific automotive transmission market is driven by robust growth, rising disposable incomes, and evolving consumer preferences favoring automatic transmissions. The region’s rapid expansion in vehicle sales, particularly in countries like China and India, fuels demand for transmissions, with a notable shift towards automatics due to increasing urbanization and stringent government regulations on fuel efficiency and emissions. Localization efforts and cost competitiveness further propel this growth as international and domestic transmission manufacturers establish production facilities in APAC to cater to the growing market demand.

Key Market Players

The automotive transmission market companies are Aisin Corporation (Japan), ZF Friedrichshafen AG (Germany), Magna Iternational Inc. (Canada), JATCO Ltd. (Japan), Borgwarner Inc. (US), Eaton Corporation (Ireland), Hyundai Transys (South Korea), Allison transmissions (US), Vitesco Technologies (Germany), Schaeffler AG (Germany), GKN Automotive (UK), and more.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=1063