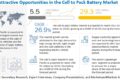

The Battery Swapping Market Size is projected to grow significantly, reaching $11.8 billion by 2027 from an estimated $4.3 billion in 2022, at a compound annual growth rate (CAGR) of 22.2% during the forecast period. This rapid growth is driven by the increasing adoption of electric vehicles (EVs), particularly in regions where infrastructure constraints make battery swapping an attractive alternative to conventional charging stations. The ability to swap out depleted batteries with fully charged ones in a matter of minutes enhances convenience and minimizes downtime for EV users, making the concept appealing for commercial fleets and urban mobility solutions.

The expanding Battery Swapping Market Size is also influenced by supportive government policies and investments aimed at promoting clean energy and reducing carbon emissions. Countries in Asia-Pacific, such as China and India, are leading the way in implementing battery-swapping infrastructure, while regions like Europe and North America are exploring its potential. The growth of this market is further bolstered by advancements in battery technology, improved standardization, and collaborations between automakers and energy providers, which are helping to address challenges related to compatibility and scalability.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=2482807

The automated segment is estimated to have significant share of the battery swapping market during the forecast period

Battery swapping requires an electric car that is suitable and has a battery architecture built for the swap. In an automated battery swap station (BSS), customers can not only swap out their electric vehicles but also schedule the battery swap ahead of time to ensure that a battery pack will be available. When a vehicle arrives at the BSS, the process officially begins.

The electric vehicle (EV) is placed in the right place in the right direction in an automated battery swapping station and the vehicle is turned off. In the next step, the EV is lifted with the vehicle lift (as shown in the figure below) and the jack pads are drawn by the lift sheets to offer help in the lifting mechanism. When the vehicle is lifted, the bottom of the vehicle covering the battery is loosened up, giving access to the battery that sits underneath the vehicle. The battery lift is lifted till it touches the underside of the battery pack, which helps in battery removal. When the battery pack is positioned accurately above the lift, the battery removing process starts. Next, battery transport is brought underneath the battery lift. The used battery is brought down by the lift, and this battery is swapped for a new one from a battery rack. This charged battery is then lifted and placed under the vehicle. The battery is again positioned and placed accurately. With all the bolts locked and the underbody cover fixed again, the battery is good to go.

The Subscription segment to be the largest segment by service type during the forecast period

Subscription service in battery swapping is a more sustainable approach to the use of battery swapping. This allows users to swap batteries at much lower rates compared to the pay-per-use model. Most battery swapping providers offer this kind of battery swapping service as well as provide great offers to long-term users. An important aspect of the battery-swapping subscription service is the number of swaps available as part of the service per month. Most 2- and 3-wheeler swapping providers provide 12-18 swaps per month, depending upon the battery power capacity, number of batteries in the vehicle, and other factors. Four-wheeler battery swap providers on the other hand provide 4-6 swaps (e.g. NIO Power) as that much is usually sufficient for monthly EV usage.

While most users opt for monthly subscriptions, annual subscriptions and quarterly subscriptions are also available from top battery-swapping providers such as Gogoro and Immotor. Gogoro, for instance, charges around USD 10-30 per month for 2-wheelers in the Asia Pacific region. Immotor provides subscription services for battery swapping for around USD 5-10 per month for 2-wheelers. NIO Power on the other hand provides around 4-6 swaps as part of a USD 135 subscription.

The Europe market is projected to to grow at faster rate during the forecast year

Europe was one of the fastest-growing regions in the battery swapping market, NIO Power, a leading manufacturer of electric vehicles in China, recently announced plans to grow operations and introduce its line of electric vehicles to Europe, including the UK. NIO co-founder Lihong Qin revealed that the company will introduce its ET5, ET7, and EL8 electric vehicles in the UK toward the end of next year after doing so in Germany, the Netherlands, Denmark, and Sweden.EU initiatives for greener transportation and high funding achieved by local players like Swobbee and others are also expected to drive the electric vehicle battery swapping market in this region.

Key Market Players

The battery swapping market is dominated by players such as NIO Power (China), Gogoro (Taiwan), Immotor (China), Aulton (China), and Sun Mobility (India). These battery swapping companies adopted new product launches, partnership, and supply contracts to gain traction in the market.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=2482807