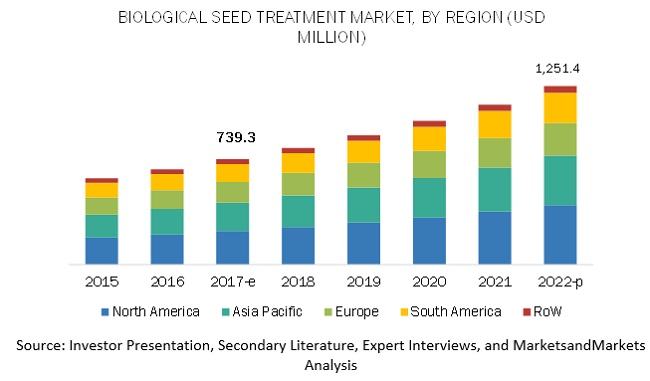

The biological seed treatment market is projected to reach USD 1,251.4 Million by 2022, at a CAGR of 11.10% from 2017. The market has been growing at a significant rate due to the increasing need for a sustainable approach in agricultural operations in developed countries. Strong research funding by key manufacturers on product development such as compatible combinations of biological and chemical components is expected to drive the growth of the market over the next five years.

Opportunity: Bio encapsulation technologies for improved environmental persistence

Research and developments in the field of agricultural practices have been moving toward the production of inoculants, which could eventually lead to the advent of improved and advanced formulations to ease application processes and improve the viability of products. Conventional forms of formulations, solid or liquid, lead to several problems related to the low viability of microorganisms during the storage and application process. However, this problem can be addressed by the immobilization of microorganisms. This immobilization highly improves the shelf-life and efficacy of the formulation, keeping it viable for a longer duration. Bioencapsulation technologies could also result in a controlled microbial release, thereby improving application efficacy. Such technologies have the ability of greatly improving the persistence of biological seed treatments in the soil environment and thereby, leading to a thriving market for the product.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=162422288

Challenges: Limited shelf life

Biological seed treatments aimed at seed protection provide targeted control of certain pests and fungal diseases during the early seedling stage. Very low amount can also affect the efficacy of these seed treatments when the pest pressure remains very high during the important stages of crop establishment.

The effective period of biologicals in the seed treatment is also very short-lived which makes the product unattractive for the crop growers. Most of the products available in the market cease to remain viable after a certain period of time which completely incapacitates the product, and this can also make the products ineffective even without reaching the crop fields.

As the short life-span of these biologicals can hinder the market growth, some players in the biological and polymer coating sectors have been developing encapsulation technologies that can preserve the microbials for a longer period. In order to counter these measures, customized services from seed suppliers at farm fields during the pre-sowing period can serve as temporary solution for the crop growers.

North America is projected to be the fastest-growing market

The major reason for the biological seed treatment market experiencing such a high growth rate is the highly streamlined product registration process, which makes it easier for most private companies to launch their products easily. Lower investment requirement and limited gestation period involved in the development and commercialization of biological products are key factors attracting a large number of startup companies in the industry. Additionally, growing awareness among consumers against synthetic chemicals has also led to a higher adoption of these products.

Request for Customization: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=162422288

This report includes a study of marketing and development strategies, along with the product portfolios of leading companies. It also includes the profiles of leading companies such as BASF (Germany), Bayer (Germany), Syngenta (Switzerland), Monsanto (US), DuPont (US), Valent BioSciences (US), Verdesian Life Sciences (US), Plant Health Care (US), Precision Laboratories (US), Koppert (Netherlands), Italpollina (Italy), and Incotec (Netherlands).