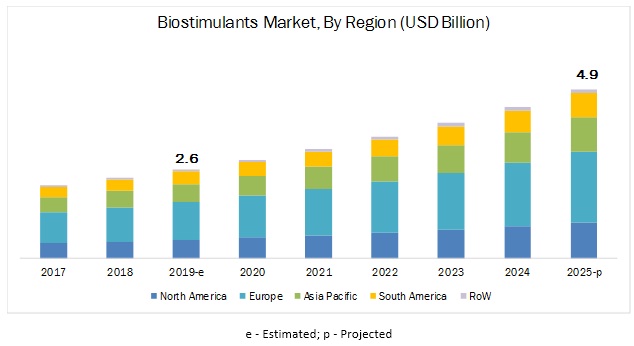

The report “Biostimulants Market by Active Ingredient (Humic Substances, Amino Acids, Seaweed Extracts, Microbial Amendments), Crop Type (Fruits & Vegetables, Cereals, Turf & Ornamentals), Application Method, Form, and Region – Global Forecast to 2025″ The market for biostimulants is projected to reach USD 4.9 billion by 2025, at a CAGR of 11.24% during the forecast period. It is driven by seaweed extract-based biostimulants, abundant growth in seaweed cultivation near major biostimulant markets, and rise in their adoption by key players in biostimulant formulations.

On the basis of active ingredient, the amino acids segment has been estimated to occupy the major share, in terms of value, in 2019.

Price differences in active ingredients is a major factor, due to which, the amino acids segment is projected to remain dominant in the market, in terms of value. In terms of volume, the dosage rate plays an integral role in the effectiveness of biostimulants. Since the dosage rate of humic substances is much higher in comparison, as they are mostly preferred for foliar applications, they dominate the market, in terms of volume, in 2018. Earlier, biostimulant products were majorly offered as a single active ingredient, which imparted specific functions such as stress tolerance or enhancement of crop quality. However, due to intense research on this market, formulations for blending multiple active ingredients have been developed by players such as Valagro (Italy).

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1081

The increasing awareness of nutritional benefits associated with biostimulants and their application on broad-acre crops have widened the scope of growth within the biostimulants market.

The usage of biostimulants has evolved immensely from high-value crops such as fruits & vegetables to broad-acre crops such as cereals, pulses, and fiber crops. It has been observed that biostimulants enhance the uptake of nutrients, develop tolerance to abiotic stresses, and increase the vigor and yield of crops such as wheat, rice, and barley. The immense possibility in the application of biostimulants for these broad-acre crops can lead to the significant growth of this market. Many domestic manufacturers have begun to realize the prospective demand in the coming years, with several launches targeted on crops such as rice, corn, and wheat.

With the introduction of stringent regulations, Europe is estimated to dominate the biostimulants market in 2019.

The biostimulants market in Europe is driven by the adoption of modern agricultural technology such as precision farming, plant biotechnology, and organic-based active ingredients. The increasing awareness of consumers about the benefits of biostimulants is expected to contribute to market growth. Moreover, the European legislation is in the process of recognizing biostimulants as important plant nutrition, and have paved the way toward a regulated environment for these products. Moreover, biostimulant products were initially applied only on high-value crops such as fruits and vegetables in Europe. However, the industrial importance has transformed some broad-acre crops such as corn and wheat into high-value crops, resulting in the increased use of biostimulants for these crops.

This report includes a study of the development strategies of leading companies. The scope of this report includes a detailed study of biostimulant manufacturers such as BASF (Germany), Isagro (Italy), Valagro (Italy), Bayer (Germany), Italpollina (Italy), and UPL (India).

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=1081

Recent Developments:

- In February 2019, UPL (India) acquired Arysta LifeScience Corporation (US), a part of Platform Specialty Products Corporation (US). The acquisition helped the company to broaden its footprint in the biologicals market, and broaden its geographical presence.

Key questions addressed by the report:

- How would the biostimulants market be dependent on the biologicals and crop nutrition industries, and which crop type would adopt maximum usage of biostimulants?

- Which region will account for the highest share in the biostimulants market?

- Which active ingredient of biostimulants holds high potential for growth in each key country?

- What are the trends and factors responsible for influencing the adoption rate of biostimulants in key emerging countries? What is the level of support offered by the governments across these countries to the manufacturers?

- Which are the key players in the market and how intense is the competition?