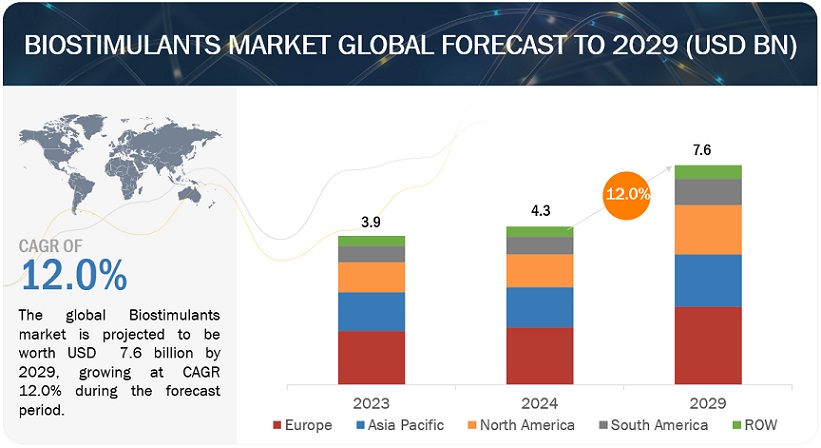

The global biostimulants market is expected to grow from USD 4.3 billion in 2024 to USD 7.6 billion by 2029, reflecting a compound annual growth rate (CAGR) of 12.0% over the forecast period. These substances boost plant growth, enhance nutrient absorption, and increase stress resilience, resulting in higher crop yields and better quality. Farmers are increasingly turning to biostimulants to optimize their crop productivity and profitability. Many biostimulants are sourced from natural ingredients and are suitable for organic farming practices, providing organic growers with effective tools to improve crop performance while maintaining organic certification standards.

Biostimulants Market Growth Drivers:

- Increasing Demand for Organic Products: With growing awareness about health and environmental concerns, there’s a rising demand for organic agricultural products. Biostimulants offer a natural and sustainable approach to enhancing crop productivity and quality, aligning with the preferences of consumers and regulations promoting organic farming practices.

- Need for Sustainable Agriculture: Biostimulants play a crucial role in sustainable agriculture by improving nutrient uptake, stress tolerance, and overall plant health. As conventional farming practices face scrutiny due to their environmental impact, the adoption of biostimulants as part of integrated crop management strategies becomes more attractive.

- Advancements in Biotechnology: Ongoing research and development in biotechnology have led to the discovery of novel biostimulant products with enhanced efficacy and specificity. Biostimulant formulations tailored to address specific crop needs and environmental conditions are gaining traction among farmers seeking optimized solutions.

- Government Support and Regulations: Governments worldwide are introducing policies and incentives to promote the use of biostimulants as a sustainable alternative to traditional agrochemicals. Regulatory frameworks that define and standardize biostimulant products provide clarity to manufacturers and farmers, facilitating market growth and investment.

- Climate Change Challenges: Climate change-related factors such as unpredictable weather patterns, drought, and soil degradation pose significant challenges to global food security. Biostimulants offer a means to mitigate these challenges by enhancing crop resilience to abiotic stressors and improving yield stability in adverse conditions.

- Growing Adoption of Precision Agriculture: The integration of technology in agriculture, including precision farming practices, drives the demand for biostimulants. Biostimulant applications can be optimized through precision agriculture techniques, enabling targeted delivery and efficient use of resources while minimizing environmental impact.

Biostimulants Market Opportunities: Increase adoption of precision agriculture.

An emerging opportunity in the biostimulants market is the growing adoption of precision agriculture technologies. These technologies use data-driven methods, including remote sensing, GPS guidance systems, and data analytics, to enhance crop management and improve resource efficiency. Biostimulants can enhance precision agriculture by offering targeted solutions to specific agronomic challenges revealed through the analysis of precision farming data.

By mode of application, the soil treatment segment is expected to hold a significant market share in the biostimulants market.

Soil treatment with humic substances from various sources has been widely shown to improve iron nutrition in crop plants. Humified organic matter in soil sediments helps create a reservoir of iron by releasing metal ligands and forming Fe-humic substance complexes, which plants can easily absorb. Recently, enzymatic hydrolysis has been used to produce various biostimulants from materials such as sewage sludge, chicken feathers, okra, and rice bran. These biostimulants are employed in soil bioremediation to address contamination from pesticides like chlorpyrifos, MCPA, oxyfluorfen, 2,4-D, and dicamba. Overall, using biostimulants in soil treatment provides multiple benefits, including improved iron nutrition for crops and effective remediation of pesticide-contaminated soils.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1081

What factors are contributing to Europe’s dominance in the biostimulants market during the forecast period?

European farmers and policymakers are placing a greater emphasis on sustainable agricultural practices to tackle environmental issues, minimize chemical use, and bolster food security. Biostimulants are a key component in this shift, as they help enhance soil health, crop resilience, and yield stability. With consumers in Europe increasingly seeking eco-friendly and sustainably produced food, there is a rising market demand for crops treated with biostimulants. This trend is driving farmers to incorporate biostimulants into their farming methods.

Key players within this market consist of reputable and financially robust biostimulants manufacturers. These entities boast extensive industry tenure, offering diversified product portfolios, advanced technologies, and robust global sales and marketing networks. Prominent companies in this market include BASF SE (Germany), UPL (India), FMC Corporation (US), Rallies India Limited (India), Sumitomo Chemical Co., Ltd. (Japan), Corteva. (US), Nufarm (Australia), Syngenta Crop Protection AG (Switzerland), PI Industries (India), ILSA S.p.A. (Italy), Coromandel International Limited (India), Haifa Group (Isarel), T.Stanes and Company Limited (India), Gowan Company (US), and Koppert (The Netherlands).

UPL (India)

UPL is a leading provider of comprehensive crop solutions dedicated to ensuring global food security. Its operations are divided into the Agrochemical Products and Industrial Chemicals segments. Within the Agrochemical activities segment, UPL offers a range of services including biostimulants, seeds, crop protection solutions, post-harvest solutions, aquatics, farmer engagement, and other related businesses. With a presence in over 138 countries and 48 manufacturing plants, UPL’s ProNutiva program stands out by combining natural BioSolutions, such as bioprotection, biostimulants, and bionutrition, with traditional crop protection products to meet or exceed real-world needs. UPL utilizes acquisitions as a key strategy to solidify its market presence.

In May 2022, UPL announced a strategic partnership with Kitesca M660 Innovation Center, marking a significant advancement in the biostimulants market, particularly in North America. The collaboration aims to commercialize innovative BioSolutions technologies, providing tailored solutions for optimal plant development, improved yields, and enhanced crop quality. This long-term agreement underscores the strategic importance of biosolutions in UPL’s global vision, demonstrating their commitment to sustainable food production and grower profitability. Through this partnership, UPL plans to introduce five biostimulants and innovative nutrition products, including ALFA, MOTO, VELEXI, SERENIS, and CEVO, targeting specific crops and offering diverse solutions for agricultural needs. This partnership solidifies UPL’s position as a major player in the biostimulants market and addresses the growing demand for sustainable agriculture practices.

FMC CORPORATTION (US)

FMC Corporation provides innovative solutions to growers in crop protection, plant health, professional pest control, and turf maintenance. Originally, the company operated in three segments: agricultural solutions, health & nutrition, and lithium, with agricultural solutions contributing about 69% of its revenue. Following the acquisition of DuPont’s crop protection business in November 2017 and the divestment of the health and nutrition business to DuPont, FMC Corporation now focuses on two segments: agricultural solutions and lithium.

These segments encompass herbicides, fungicides, plant health, and insecticides. Recently, FMC Corporation rebranded its plant health business segment as Biologicals by FMC, specializing in biostimulants, biofungicides, and other plant health products. Operating across North America, Europe, South America, the Middle East, and the Asia Pacific, FMC Corporation’s sales are predominantly concentrated in Europe, North America, and Asia. Some of its subsidiaries include FMC Agricultural Products International AG (Switzerland), FMC Agroquimica de Mexico S.A. de C.V., FMC Foret S.A. (Spain), FMC (Shanghai) Chemical Technology Consulting Co. Ltd. (China), FMC Australasia Pty. Ltd. (Australia), FMC Chemicals (Thailand) Limited, FMC Chemicals KK (Japan), and FMC BioPolymer UK Limited (UK).

In June 2022, FMC Corporation’s unveiling of the “Biologicals by FMC” brand underscores its dedication to the expanding realm of biological crop protection, highlighting substantial investment and a robust pipeline of groundbreaking products. With a portfolio of over 50 biological solutions available in 50 countries, including award-winning biostimulants and bionematicides, FMC aims to equip farmers with science-driven solutions for sustainable crop management. The recent launch of Zironar biofungicide/bionematicide in the US and Proxilar biofungicide in Brazil, along with plans for four global biopesticide releases in the next four years, solidifies FMC’s position as a major player in the biostimulants market, reaffirming its commitment to tackling agricultural challenges with innovative biological technologies.

Schedule a call with our Analysts to discuss your business needs: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=1081