The global blower industry is on track to reach $4.6 billion by 2028, growing at a CAGR of 4.8% from $3.7 billion in 2023. This growth is fueled by rising demand across manufacturing, construction, and wastewater treatment industries. Positive displacement blowers, known for their adaptability, are expected to dominate the market. Additionally, energy efficiency and air handling technologies are gaining importance. With strong contributions from North America, Asia-Pacific, and Europe, key players like Atlas Copco and Ingersoll Rand are driving innovation in the market.

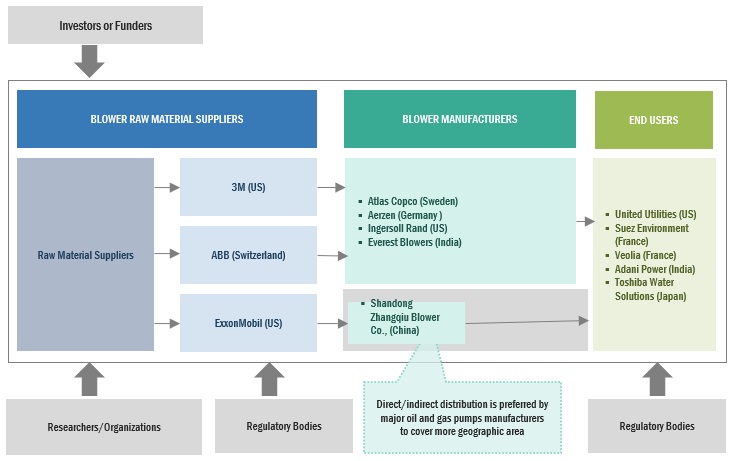

Blower Industry Ecosystem

The major players in the blower industry are Atlas Copco (Sweden), Ingersoll Rand (US), Kaeser Kompressoren (Germany), Aerzen (Germany), and Xylem (US).

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=23329060

Increasing financial allocations toward water and wastewater treatment presents a promising avenue for the blower market. An increase in financing for water treatment infrastructure is necessary as more governments and businesses realize how important it is to manage water resources effectively. The market for blowers, which are vital to aeration systems that are necessary for wastewater treatment, is expected to grow substantially. Increased funding would lead to innovations in blower efficiency and design as well as technical breakthroughs. This might thus result in the creation of blowers that are more ecologically and energy-efficient, in line with the objectives of global sustainability.

Blowers are loud and can generate a significant amount of noise pollution, especially conventional blowers. Legacy blowers with high ratings generally tend to have a noise level above 120 decibels (dB). On the other hand, new models have a rating between 40 dB to 80 dB. Some end-use industries need blowers with a higher power rating depending on the load required for applications. However, high rating blowers have a higher noise level. Companies prefer to select blowers with low noise levels to enable quieter operations to reduce costs associated with constructing a separate enclosure for the blower. Maintaining low noise levels may be challenging for manufacturers that use older blowers as well as blowers with high power ratings.

Key Stakeholders

- Government & research organizations

- Institutional investors and investment banks

- Investors/shareholders

- Environmental research institutes

- Consulting companies in the energy & power sector

- Raw materials and component manufacturers

- Blower manufacturers, dealers, and suppliers

- Manufacturers’ associations

- Process industries and power industry associations

- Refinery operators

- Manufacturing industry

- Energy efficiency consultancies

- Air system manufacturers’ associations

- Water & Wastewater Treatment Associations

- Water & wastewater treatment companies

- Original equipment manufacturers (OEMs) and system integrators

- Engineering, procurement, and construction (EPC) contractors

- Standardization and testing firms

Blowers are equipment or devices that increase the velocity of air or gas when passed through equipped impellers. Effectively, a blower is designed to move air and gas at low to high pressure to perform a specific function. In a blower, the inlet pressure is low and is higher at the outlet. The kinetic energy of the blades increases the pressure of the air at the outlet.

This research report categorizes the blower industry by product type, pressure, end-use industry, distribution channel, and region

On the basis of product type:

- Positive Displacement Blowers

- Centrifugal Blowers

- High-speed Turbo Blowers

- Regenerative Blowers

On the basis of pressure:

- Up to 15 psi

- 15–20 psi

- Above 20 psi

On the basis of the end-use industry:

- Cement

- Steel

- Mining

- Power

- Chemicals & Petrochemicals

- Pulp & Paper

- Food & Beverage

- Pharmaceuticals

- Water & Wastewater Treatment

- Others

On the basis of the distribution channel:

- Online

- Offline

On the basis of region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Ask Sample Pages of the Report: https://www.marketsandmarkets.com/requestsampleNew.asp?id=23329060

Europe is expected to be the second-largest blower industry during the forecast period. The European region has been subdivided into five key countries: the UK, Germany, France, Italy, Spain, and the Rest of Europe. High and medium-voltage products are crucial to industries as they enable efficient power transmission over long distances from generation centers to transformer substations. The revitalization of the European industrial sector and the establishment of new industrial set-ups and facilities are also expected to fuel the demand for high & medium-voltage products in the region.