Factors such as significant partnerships between biopharma companies and CROs, rising number of clinical trials, availability of advanced CTMS solutions, growing customer base for CTMS solutions, and rising government funding & grants to support clinical trials are driving the overall demand for CTMS across key markets. However, budget constraints and limited awareness among researchers about the advantages of CTMS solutions are the major factors restraining the growth of CTMS market.

Major Growth Restraints:

# Budget constraints

# Limited awareness among researchers about the advantages of CTMS solutions

Opportunities:

# Increased outsourcing of clinical trial processes by industrial researchers to Asian countries/ developing countries CROs

# Increasing use of platform-as-a-service (PaaS) and mobile computing

Challenges:

# Lack of skilled professionals

Searching for More Details? | Download the PDF Brochure@ http://bit.ly/2Q3u1RG

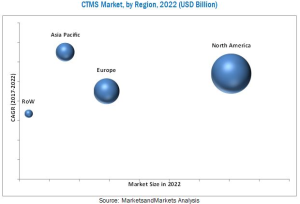

The global clinical trial management system (CTMS) market is expected to grow at a CAGR of 12.6% between 2017 and 2022.

Analysis of the market developments between 2014 and 2017 revealed that several growth strategies such as product launches, enhancements, strategic acquisitions, agreements, partnerships, collaborations, and expansions were adopted by the market players to strengthen their product portfolios and maintain a competitive position in the CTMS market. Among these business strategies, product enhancements, agreements, and partnerships were the most widely adopted growth strategies by the players in the CTMS market.

Oracle (US) held the leading position in the global CTMS market in 2016. The company is one of the top players in the CTMS market due to its diversified geographic presence and large customer base, strong brand image, and selective and active acquisition program and alliances. The company offers cloud-based CTMS. The company has a strong geographic presence in over 175 countries across North America, Europe, Asia, Africa, and South America. The company mainly focuses on expansions and acquisitions to strengthen its dominant position in the market. For instance, in 2017, Oracle opened its Oracle Cloud EU Region in Germany, with the addition of modern infrastructure as a service (IaaS) architecture and new IaaS and platform as a service (PaaS) cloud services.

Medidata Solutions, Inc. (US) held the second position in the CTMS market in 2016. The company is one of the leading providers of cloud (software-as-a-service) solutions and has strong partnerships with CROs and pharmaceutical customers. Medidata is present in more than 130 countries with more than 849 customers across the globe. The company primarily adopts the strategy of partnerships to expand its presence in the CTMS market. In 2017, the company partnered with Karyopharm Therapeutics (US) to renew its Medidata Clinical Cloud platform.

Major players in this market include Oracle Corporation (US), Medidata Solutions, Inc. (US), PAREXEL International Corporation. (US), Bioclinica. (US), Bio-Optronics, Inc. (US), and IBM (US). Product launches, partnerships, collaborations, agreements, and market expansions were the key strategies adopted by players to grow and expand their presence in the CTMS market.

You Can Also Request for the Customized Information as per Your Request@ http://bit.ly/2A1RSqH

Major Market Developments:

- In October 2017, MedNet Solutions released the latest version of iMedNet with enhanced features.

- In November 2017, Medidata Solutions and Karyopharm Therapeutics partnered in order to integrate and develop their solutions, namely, CTMS and eRegulatory Solutions

- In May 2017, Oracle opened its Oracle Cloud EU Region in Germany, with the addition of modern infrastructure as a service (IaaS) architecture and new IaaS and platform as a service (PaaS) cloud services.

- In September 2017, Pamplona completed the acquisition of Paraxel and bought its shares in order to help PARAXEL increase its productivity

Target Audience:

- Healthcare IT service providers

- Pharmaceutical/biopharmaceutical companies

- Clinical research organizations

- Research and development (R&D) companies

- Medical device companies

- Business research and consulting service providers

- Academic medical centers/universities/hospitals