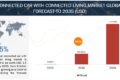

The global connected car market is projected to grow from USD 12.4 Billion in 2024 to USD 26.4 Billion by 2030 at a CAGR of 13.3%. The connected car market is experiencing exponential growth, driven by various factors. Foremost is the surging consumer demand for constant connectivity and reliance on technology, particularly among tech-savvy populations. This insatiable need for connectivity is being met by rapid advancements in automotive technology, such as the rollout of 5G networks and AI-powered features. Governments are also playing a catalyzing role, with regulations like the US Department of Transportation’s mandate for vehicle-to-vehicle communication technology in new cars. The popularity of automation, ridesharing, and mobility services is further propelling the connected car market. Finally, the increasing production and sales of vehicles, especially luxury models, supplement this dynamic sector’s growth.

ECU is the second largest market in the connected car market for hardware segment.

The Electronic Control Unit (ECU) is a critical component in the hardware of connected cars, playing a central role in managing various functions and systems within the vehicle. The importance of ECUs stems from their ability to process and control data from different sensors and subsystems, ensuring seamless operation and coordination of advanced vehicle functionalities. Modern connected cars often have multiple ECUs dedicated to specific tasks, such as engine control, transmission control, infotainment, and advanced driver-assistance systems (ADAS). For instance, the Audi A8 features over 90 ECUs that manage everything from the powertrain to the advanced safety features, illustrating the complexity and integration required for modern vehicle operation. Considering the recent developments, Robert Bosch (Germany) inaugurated a new semiconductor plant in July 2022. Dresden signifies a substantial investment in ECU production for connected and electric vehicles, showcasing the industry’s commitment to enhancing automotive electronics. Similarly, Visteon’s (US) expansion of ECU production in Morocco in September 2021 highlights the growing demand for sophisticated ECUs in the European and North African regions, reflecting the industry’s focus on meeting the evolving needs of connected car technologies.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=102580117

Cellular networks hold the fastest growing segment for the connected car market in the network segment.

Cellular connectivity, particularly 3G/4G and 5G, is being increasingly adopted by automakers for embedded and integrated connected car solutions due to several key advantages over DSRC. One of the main reasons is the ability to leverage existing cellular infrastructure, which allows automakers to utilize the already deployed network and avoid the costs of setting up dedicated DSRC hardware. This makes cellular a more cost-effective solution for connected car applications, as automakers can integrate the necessary modules into their vehicles. Another significant advantage of cellular connectivity is its improved safety and reliability. Cellular V2X (C-V2X) can provide greater capacity and lower the chance of interruptions in service, ensuring reliable communication for safety-critical applications. C-V2X also offers a more extensive communication range, enabling advanced applications like vehicle-to-home (V2H) and vehicle-to-cloud (V2C) communication. For example, Tesla has been using cellular connectivity to provide over-the-air updates and remote diagnostics for its vehicles, demonstrating the potential of cellular technology in enhancing the connected car experience.

North America is the second-largest region in the connected car market.

North America is the largest market for connected cars, driven by advanced technological infrastructure, a robust automotive industry presence, high consumer demand, and a supportive regulatory environment. Considering the vehicles sales in North America, the number of automobiles sold in the US rose from 14.4 million in 2022 to 16.1 million in 2023, in which premium automobile sales (E, F, and SUV – E) category sales went from 1.6 million in 2022 to 1.8 million in 2023, a rise of ~12.1%. Additionally, D-segment car sales in the US rose by 4% from 4.1 million units in 2022 to 1.5 million units in 2023. Improved cellular V2X systems, telematics systems, dynamic route optimisation, in-car Wi-Fi and internet access, and over-the-air software upgrades for sedans and premium vehicles are just a few of the technologies available in these high-end cars.

Key Players

Major manufacturers in the connected car market include Continental AG (Germany), Robert Bosch GmbH (Germany), Harman International (US), Airbiquity (US), and Visteon (US).

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=102580117