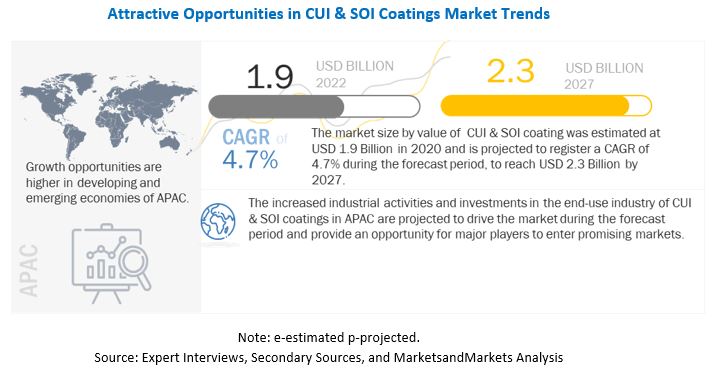

The global Corrosion Under Insulation (CUI) & Spray-on Insulation (SOI) Coatings Market size is projected to grow from USD 1.9 billion in 2022 to USD 2.3 billion by 2027, at a CAGR of 4.7% during the forecast period. The growing demand for CUI & SOI coatings from end-use industries, such as marine; oil & gas, and petrochemical; energy & power; and others, drives the CUI & SOI coatings market. Demand for these coatings is encouraged by many companies to formulate various developmental strategies in the CUI & SOI coatings market to increase their footprint in the growing market. The companies have adopted various strategies, such as investment, expansion, partnership, collaboration, and new product development to increase their global presence and maintain sustained growth in the CUI & SOI coatings market.

CUI & SOI coatings find major applications in marine; oil & gas, and petrochemical; energy & power, etc. The oil & gas, and petrochemical industry accounted for the major share of the CUI & SOI coatings market in 2021. The major share is due to the high volumes of CUI & SOI coatings used in the oil & gas & petrochemical industry. The oil fields development in the South China Sea and the growing investments in the oil & gas industry in China, Japan, Indonesia, India, and other countries are projected to drive the demand for CUI & SOI coatings.

To know about the assumptions considered for the study download the pdf brochure

The CUI & SOI coatings market in the Asia Pacific is projected to register a higher CAGR, in terms of value, between 2022 and 2027. The growth in the region is ascribed to the growing oil & gas, and petrochemical; marine; energy & power industries. The rapid growth of emerging economies in the region makes Asia Pacific an alluring market for CUI & SOI coatings manufacturers.

There are various players operating in the CUI & SOI coatings market. The major market players include Akzo Nobel N.V. (Netherlands), PPG Industries, Inc., (US), Jotun A/S (Norway), The Sherwin-Williams Company (US), Hempel A/S (Denmark), Kansai Paint Co., Ltd (Japan), Nippon Paint Co., Ltd. (Japan), and RPM International Inc (US). The developmental strategies adopted by major players are partnership & collaboration, new product launches, investments, and expansion to increase share in the market.

Akzo Nobel accounted for the major share in the global CUI & SOI coatings market. The company operates in different segments such as decorative paints, performance coatings, and specialty chemicals. The company has its presence in many countries in Europe, North America, APAC, South America, and the Middle East. The company carries out its business activities in 80+ countries across the globe. It has a strong product portfolio. Also, there are 548 offices and manufacturing sites across the world. The company focuses on various organic and inorganic strategies to increase its global presence. It has leveraged its strong financial background and distribution network to expand its business across Europe and various countries across the globe. This will drive the growth of the company and also its CUI & SOI coatings business, globally.

- In June 2021, The company announced the acquisition of Colombia-based paints and coatings company Grupo Orbis.

- In November 2019, AkzoNobel opened a research and innovation hub at its site in Felling, Gateshead, UK, with an investment for product testing in simulations of the world’s most extreme environments.

PPG Industries has the second-largest share in the CUI & SOI coatings market. The company is a manufacturer and distributor of industrial and automotive coatings to various manufacturing companies. The company also manufacturers adhesives & sealants for the automotive industry, metal pretreatments & related chemicals for industrial applications, and packaging coatings for aerosol, food, and beverage container manufacturers. The company’s latest coating systems have proven protection from corrosion under insulation, high temperatures, and fire; PPG Industries has business operations in more than 70 countries across the globe. The company is focusing on organic and inorganic growth strategies, which will enable it to increase its global presence and revenue.

- In February 2020, PPG collaborated with Dow on Sustainable Future Program to reduce carbon impacts. The partnership focuses on advances in anti-corrosion coating products for steel designed to deliver reduced greenhouse gas (GHG) emissions through increased energy efficiency while helping to lessen the high maintenance costs of steel infrastructure.