The COVID-19 pandemic has led to a global healthcare crisis, resulting in widespread economic impact since January 2020. In the optimistic scenario, it could be assumed that the COVID-19 pandemic would create a long-term positive impact on the overall market.

The market was initially negatively impacted by the COVID-19 pandemic. Along with the rest of the world, the pharmaceutical companies shut down their laboratories and industry work was stopped in order to mitigate the pandemic effects. Furthermore, the on-site personnel restrictions had biggest impact on pharmaceutical businesses. Most of the large Pharma companies were completely shut down momentarily. Besides this, the safety restrictions required laboratory areas to implement social distancing, increase disinfecting procedures, require self-monitoring for COVID-19 symptoms and heightened PPE requirements.

Additionally, the clinical sites also experienced reduced enrolment and restricted staff. These challenges combined to reduce anticipated trial sizes and created substantial delays in study timelines. Though, recovery can be seen in most regions, particularly North America and Europe, as services regain normality.

The Asia Pacific market has been sluggish to recover, notably in China and India. In an optimistic scenario, the need for smoother workflows and faster turnaround times could boost the market growth.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=12254971

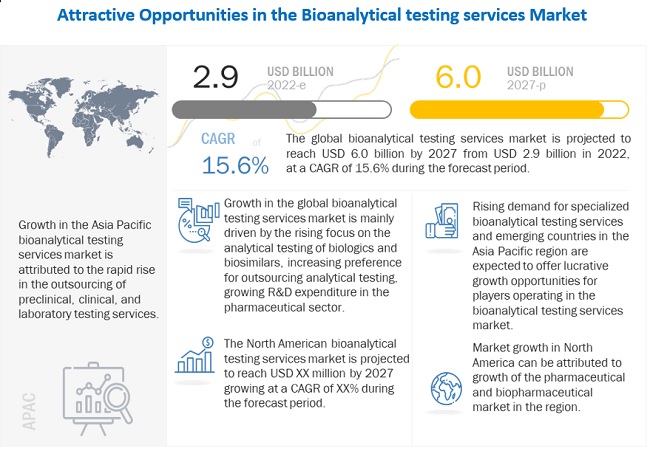

Biologics represent one of the most promising new therapeutic areas and are becoming increasingly important in the pharmaceutical market; around 800 products are in the pipeline at present. One of the key reasons for this is the rising prevalence of chronic diseases. However, considering the high cost of biologics and the rising focus of various governments on reducing healthcare costs, the focus on biosimilars has increased in recent years.

The impending expiry of the patents and exclusivity periods of biologics have also created opportunities for the development of follow-on biologics or biosimilars. According to GaBi, twelve biologics, with global sales of more than USD 67 billion, are scheduled to go off-patent in major markets by 2020, with more biologics likely to follow.

The expected rise in biosimilar R&D will bring with it a growing demand for the associated bioanalytical testing services—compatibility studies for biosimilars, stability testing, product release testing, and protein analysis of biosimilars—to reduce the risks associated with drug development. Moreover, the introduction of biosimilars and the move toward continuous processing are creating the need for more rapid and sensitive analytical techniques.

Pharmaceutical companies have begun outsourcing several R&D functions that are not core to their internal structure. Companies are trying to be more efficient in the drug development process by focusing on their internal core competencies to bring new products to the market in a more cost-effective manner. Cost reductions, efficiency increases, and optimal staffing are some of the key advantages driving the outsourcing of bioanalytical testing for large companies.

In the pharmaceutical sector, the analytical and testing services were the most-outsourced services, followed by solid-dosage form manufacturing, injectable manufacturing, clinical trials, formulation development, and R&D. This trend is backed by an increase in the numbers, capabilities, and volumes of contract research organization and the liking for specific providers over the long-term as opposed to short-term contracts. In the following years, outsourcing as a strategy is anticipated to gain greater notoriety. When coupled with the growth in biologic and biosimilar R&D, this factor is projected to create a very favorable environment for market development.

The outsourcing of bioanalytical testing services supports pharmaceutical companies lessen risks by avoiding large funds in purchasing analytical equipment and maintaining manpower, particularly when development efforts are in the initial stages. The accessibility of specialized analytical testing service providers with key capabilities to deliver optimal results rapidly has led to growing consideration among pharmaceutical businesses to outsource testing services to third-party service providers.

Request To Get Sample Pages @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=12254971

Pharmaceutical and biotechnology companies invest heavily in research to come up with breakthrough molecules. The increasing prevalence of infectious and chronic diseases has led to significant investments in the development of new drugs and vaccines among key pharmaceutical companies such as Novartis, Takeda, Sanofi, Eli Lilly, and Pfizer.

Moreover, the outbreak of the COVID-19 pandemic has increased the focus among pharmaceutical and biopharmaceutical companies to develop effective drugs and vaccines against viral infections. In this scenario, establishing effective workflows and processes to reduce the time and costs involved in drug and vaccine development has gained significance. This, in turn, is favoring the outsourcing of bioanalytical testing to specialized service providers.

According to the ICH Q 10 guidelines, analytical methods are a key part of the pharmaceutical quality system. Implementation of analytical QbD (AQbD) in the manufacturing process ensures product quality and performance. There is a huge difference between the traditional and AQbD approaches of analytical method development. The traditional approach does not use statistical calculations and risk assessment, while the AQbD approach utilizes tools such as CQA, ATP, DoE, and risk assessment, which helps to easily identify the risk initially so that quality can be improved.

Furthermore, a rising number of conferences, symposia, workshops, and training courses, especially in emerging countries, have played a crucial role in creating awareness about the benefits of adopting the QbD approach among pharmaceutical and biopharmaceutical manufacturers and research organizations. The increasing acceptance and adoption of the QbD approach among pharmaceutical and biopharmaceutical companies across the globe are expected to play a key role in the growth of the bioanalytical testing services market in the coming years.

Key players in the Bioanalytical testing services market: Charles River (US), Medpace (US), WuXi AppTec (China), Eurofins Scientific (Luxembourg), IQVIA (US), SGS SA (Switzerland), Laboratory Corporation of America Holdings (US), Intertek Group (UK), Syneos Health (US), ICON (Ireland), Frontage Labs (US), PPD (US), PAREXEL International Corporation (US), Almac Group (UK), Celerion (US), Altasciences (US), BioAgilytix Labs (US), Lotus Labs (India), LGS Limited (UK), Sartorius AG (Germany), CD BioSciences (US), Absorption Systems LLC (US), Pace Analytical Services (US), Bioneeds India Private Limited (India) and Vipragen Biosciences (India).