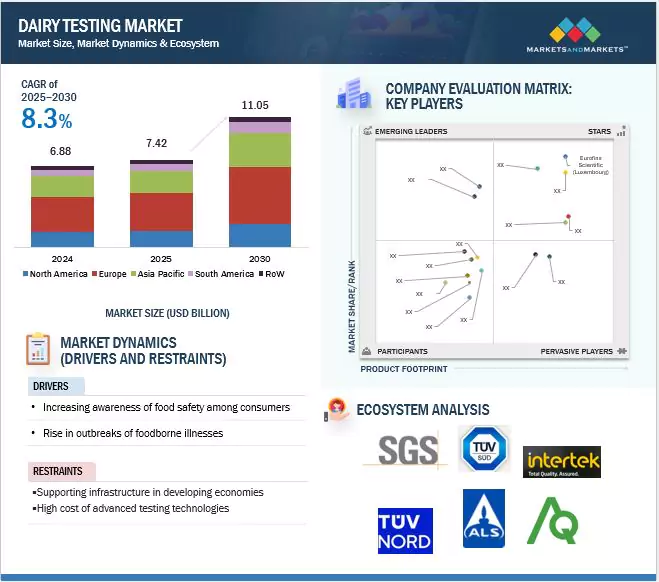

The global dairy testing market is projected to grow from USD 7.42 billion in 2025 to reach USD 11.05 billion by 2030, at a CAGR of 8.3% during the forecast period. The main factors driving growth in the global dairy testing market include increased consumer awareness and stricter safety regulations. These elements not only heighten the need for testing services but also boost the demand for testing kits and other food safety products within the dairy industry. Various innovations and technology implementations using rapid testing instruments and automation have been introduced, which will lead to dairy factories becoming commercially viable.

Dairy Testing Market Drivers: Increase in outbreaks of foodborne illnesses

Dairy testing market growth is mainly driven by an increase in foodborne illnesses. The increasing frequency of foodborne pathogens, such as Salmonella, Listeria, and E. coli, is a major reason why consumers and regulatory bodies are placing greater emphasis on the safety of dairy products. As a result, dairy producers are now required to adopt stricter testing regulations to detect any pathogens, contaminants, or adulterants in their products. Testing is crucial not only for regulatory compliance but also for avoiding costly recalls due to safety-related issues, legal conflicts with consumers, and the brand’s negative impact on its image. Consumers are not only demanding safe, high-quality dairy products, but they are also seeking reliable and innovative testing technologies, which are becoming increasingly essential. At the same time, there is a growing trend toward stricter production guidelines and food safety laws, which further drives the demand for advanced testing solutions in the dairy industry. Therefore, the steadily rising incidence of foodborne diseases is prompting the growth of the market.

Dairy Testing Market Opportunities: Technological Advancements in the Testing Industry

Technological innovation holds great opportunities for the dairy testing market by introducing reliable, accurate methods of testing. The new testing methods, such as rapid testing, automated systems, and the use of portable devices among dairy producers, can help speed up the testing process, thereby reducing the time lag between production and consumption. It is through this that they can ensure the safety of their product to prevent diseases like Salmonella and E. coli from spreading.

New molecular diagnostic platforms, such as PCR (polymerase chain reaction) and biosensor technologies, are becoming more widely adopted compared to older methods. These advancements have significantly improved the sensitivity and specificity of tests, enabling the detection of even the smallest amounts of contaminants. As a result, trust in testing will increase, leading to simpler and less expensive laboratory procedures. This makes testing more accessible, especially for smaller operations.

Based on product type, the milk & milk powder segment is to grow at the highest CAGR during the study period

Based on product type, the milk & milk powder segment is estimated to grow at the highest CAGR during the forecast period. Several driving factors make the milk & milk powder segment dominate the dairy testing market. The demand for milk and milk powder is increasing globally due to rising disposable incomes, surging populations, and the popularity of milk powder in regions with limited access to fresh milk, resulting in higher consumption and a greater need for proper testing. The other important issues are food safety and quality control. There is increased awareness about health as consumers demand safer and better-quality products. Additionally, the development of dairy testing technologies, such as faster and more accurate detection methods for pathogens, allergens, and quality indicators, makes testing more efficient, further encouraging the dominance of the milk & milk powder segment in the market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=240885146

Market in Asia Pacific to experience rapid growth between 2025 and 2030

The Asia Pacific region is anticipated to experience rapid growth between 2025 and 2030 in the global dairy testing market, driven by rapid population growth, increasing urbanization, rising disposable incomes, and an expanding middle class. As more consumers in this region, particularly in countries like China, India, and Southeast Asia, adopt Western dietary habits, dairy consumption is surging. This demand coincides with ever-higher needs in terms of food safety, hygiene, and quality, and is closely followed by the consequent demand in the area of dairy testing. With milk powder being one of the most essential food supply items in most developing economies, because of its long shelf life and easy storage, it fuels demand for safety testing, especially as these products often come with a greater risk of contamination from transport and storage.

Increased exports of dairy products from high-producing countries like India, the US, and China are fueling market growth. Moreover, the increased demand for safe, high-quality dairy products by consumers is making companies in this region invest heavily in food safety testing for compliance with the regulations both within the local country and the rest of the world.

Top 10 Companies in the Dairy Testing Market

- SGS Institut Fresenius (Germany)

- Bureau Veritas (France)

- Eurofins Scientific (Luxembourg)

- Intertek Group plc (UK)

- TÜV SÜD (Germany)

- TÜV NORD GROUP (Germany)

- ALS Limited (Australia)

- AsureQuality (New Zealand)

- Mérieux NutriSciences Corporation (US)

- Romer Labs Division Holding (Austria)

Recent Developments in the Dairy Testing Industry:

- In June 2024, at the Asia Summit on Global Health, SGS, in collaboration with The Hong Kong Polytechnic University’s PocNAT Limited and industry partners such as Maxim’s Group, Hotel ICON, and International Gourmets Food (DCH Group), introduced Gold-LAMP. This portable, ultra-fast nucleic acid testing system is designed to detect pathogens in food and the environment.

- In November 2023, SGS introduced PCR (polymerase chain reaction) testing for pathogen detection in the food industry, offering a faster and more reliable alternative to traditional microbiological methods. PCR enables the rapid identification of specific DNA fragments, reducing turnaround times from 7–10 days to just 2–3 days.

- In April 2023, Intertek announced its acquisition of Controle Analítico, one of the prominent environmental analysis providers in Brazil specializing in water testing. This acquisition enhances Intertek’s Food and Agri Total Quality Assurance (TQA) solutions and strengthens its presence in the environmental testing sector in Brazil. This move expands Intertek’s service offerings and supports its commitment to high-quality testing and assurance across various industries.