New Revenue Pockets:

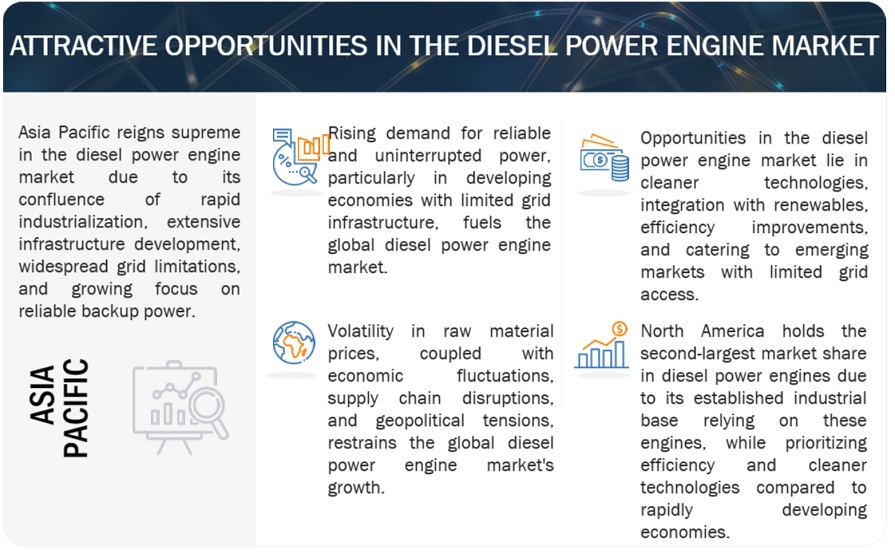

The global diesel power engine market is projected to reach USD 25.2 billion by 2029, showing a growth from the estimated USD 20.1 billion in 2024, with a compound annual growth rate (CAGR) of 4.5% from 2024 to 2029. The diesel power engine market is evolving, and several new revenue pockets are emerging, driven by advancements in technology, shifting market demands, and regulatory changes. These new opportunities present significant growth potential for companies operating in the diesel power engine industry. One of the most promising new revenue pockets is the renewable diesel sector. Renewable diesel, derived from renewable sources such as animal fats, vegetable oils, and waste cooking oils, is chemically similar to traditional diesel but offers a significantly reduced carbon footprint. With increasing regulatory pressure to reduce greenhouse gas emissions, renewable diesel is gaining traction as a cleaner alternative to conventional diesel. Governments and industries are investing heavily in renewable diesel production facilities, creating a growing demand for diesel engines that are compatible with this fuel. Companies that can innovate and produce engines optimized for renewable diesel will likely capture substantial market share in this burgeoning sector.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=65999135

Another emerging revenue pocket is the hybrid diesel-electric engine market. As the world moves towards more sustainable and energy-efficient solutions, hybrid diesel-electric systems are becoming increasingly popular, particularly in the transportation and construction sectors. These systems combine the power and reliability of diesel engines with the efficiency and environmental benefits of electric power. Hybrid systems are particularly advantageous in applications requiring high power output and flexibility, such as in commercial vehicles, heavy machinery, and marine vessels. The development and deployment of hybrid diesel-electric engines present a lucrative opportunity for market players, as industries seek to reduce fuel consumption and emissions without compromising performance. The expansion of microgrids and distributed energy systems also offers a new revenue pocket for diesel power engines. Microgrids, which are localized energy systems capable of operating independently from the main grid, are gaining popularity due to their reliability and resilience, particularly in remote or off-grid areas. Diesel generators play a crucial role in these systems by providing backup power and enhancing energy security. As more communities, industries, and institutions adopt microgrid solutions, the demand for efficient, reliable, and low-emission diesel engines will increase. Companies that can offer advanced diesel power solutions tailored to the needs of microgrids will find significant growth opportunities in this sector.

The mining industry, particularly in regions with limited access to electricity, represents another lucrative revenue pocket for diesel power engines. Diesel engines are widely used in mining operations for powering heavy machinery, vehicles, and auxiliary equipment. As global demand for minerals and metals continues to rise, particularly for those critical to the renewable energy sector (such as lithium, cobalt, and rare earth elements), the mining industry is set to expand. This expansion will drive demand for high-performance, durable diesel engines capable of operating in harsh and remote environments. Companies that can provide robust and efficient diesel solutions for the mining industry will benefit from this growing market. Furthermore, the increasing focus on infrastructure development in emerging markets presents a significant opportunity for the diesel power engine market. Countries in Asia, Africa, and Latin America are investing heavily in infrastructure projects, including roads, bridges, airports, and ports, to support economic growth and urbanization. Diesel engines are essential in construction machinery and equipment used in these large-scale projects. The demand for reliable and powerful diesel engines will rise in tandem with infrastructure development activities, creating new revenue streams for manufacturers and suppliers. In addition, the marine sector offers potential new revenue pockets for diesel power engines, particularly as the shipping industry seeks to comply with stringent international regulations on emissions. The International Maritime Organization (IMO) has set ambitious targets to reduce greenhouse gas emissions from ships, driving the adoption of cleaner technologies and fuels. Advanced diesel engines that meet IMO’s Tier III standards for NOx emissions and other environmental regulations are in high demand. Companies that can develop and supply low-emission, high-efficiency diesel engines for the maritime industry will find significant opportunities in this sector.

The Prime segment holds the third-largest market share in the global diesel power engine market due to its critical role in providing continuous and reliable power across various industries. Prime power solutions are designed to supply electricity for extended periods, making them indispensable in settings where consistent power is paramount. One of the primary reasons for the significant market share of the Prime segment is its extensive application in industries that require uninterrupted power. Manufacturing plants, mining operations, and oil and gas facilities often operate in remote locations where grid power is unavailable or unreliable. In these environments, diesel engines serve as the primary source of electricity, ensuring that operations can continue smoothly without the risk of power outages. The robust performance and reliability of diesel engines in harsh conditions make them the preferred choice for these critical applications. Another factor contributing to the prominence of the Prime segment is the rising demand for reliable power in emerging markets. As developing countries continue to industrialize and urbanize, the need for stable and continuous power grows. In many of these regions, the existing power infrastructure is inadequate to meet the increasing demand, leading to frequent power disruptions. Diesel power engines, used as primary power sources, provide a dependable solution to bridge the gap between demand and supply, supporting economic growth and development. The Prime segment also benefits from advancements in diesel engine technology. Modern diesel engines are more efficient, environmentally friendly, and capable of operating for longer periods with minimal maintenance. Innovations such as improved fuel injection systems, advanced turbocharging, and enhanced emission controls have significantly boosted the performance and environmental credentials of diesel engines. These technological advancements have made diesel engines more attractive for prime power applications, driving their adoption across various industries. Furthermore, the Prime segment’s market share is bolstered by the increasing prevalence of microgrids and distributed energy systems. In many parts of the world, particularly in remote or rural areas, microgrids offer a viable solution for reliable and independent power supply. Diesel engines play a crucial role in these systems, providing the primary power generation capacity. As the adoption of microgrids expands, the demand for diesel engines in prime power applications continues to rise, reinforcing the segment’s market position.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=65999135

The 720-1000 RPM segment holds the second-largest market share in the diesel power engine market due to several key factors that make it a highly preferred choice across various industries and applications. This segment’s prominence is driven by its optimal balance between power output, fuel efficiency, and operational stability, which caters to a broad range of industrial needs. One of the primary reasons for the significant market share of the 720-1000 RPM segment is its suitability for heavy-duty and high-demand applications. Engines operating within this RPM range are typically used in industries such as marine, mining, and construction, where robust and reliable power is crucial. The 720-1000 RPM engines provide a substantial amount of torque and power, making them ideal for powering large machinery, vessels, and equipment that require consistent and dependable performance under strenuous conditions. Moreover, the 720-1000 RPM diesel engines are known for their durability and longevity. Operating at a lower RPM compared to high-speed engines (above 1000 RPM), these engines experience less wear and tear over time. This leads to reduced maintenance requirements and longer operational lifespans, which are highly valued in industries where downtime can be costly and disruptive. The lower operational speeds also contribute to better fuel efficiency, as engines in this segment consume less fuel to produce the same amount of power compared to their higher RPM counterparts. In addition to the marine industry, the 720-1000 RPM segment finds extensive use in power generation applications. Diesel generators operating within this RPM range are commonly employed for prime and standby power solutions in various settings, including remote locations, data centers, and critical infrastructure facilities. These generators are valued for their ability to deliver stable and continuous power output, ensuring uninterrupted operations during power outages or in areas where grid power is unreliable. The combination of fuel efficiency, reliability, and robust power output makes the 720-1000 RPM diesel engines an attractive option for power generation needs.

The Residential segment holds the forth largest market share the global diesel power engine market. Residential applications typically require less power compared to industrial, commercial, or utility needs. Homes utilize diesel generators for backup power or limited primary power in off-grid situations, relying on smaller, lower-output engines. Due to the lower power requirements, the residential segment purchases a smaller volume of diesel engines compared to other segments. While the number of individual homeowner users might be high, the total engine power output and overall market share are likely lower. Unlike industries or utilities that might require continuous operation, residential usage tends to be for backup power during outages. This translates to less frequent engine operation and lower overall fuel consumption within the residential segment. In some regions with improving grid infrastructure or government incentives, renewable energy solutions like solar panels with battery storage are becoming increasingly attractive options for homeowners. This can further limit the market share of diesel engines in the residential segment. Power utilities require large, high-power output engines for continuous electricity generation. Industries demand reliable engines for powering machinery and production lines. The combined engine power needs and purchase volume within these segments likely outweigh the residential market share. Therefore, while the residential segment plays a role in the global diesel power engine market, its focus on smaller engines, lower overall power consumption, and potential shift towards alternative solutions likely position it as the segment with the smallest market share compared to Power Utilities, Industrial, and Commercial segments.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=65999135

South America region holds fifth largest market share in the global diesel power engine market. Several South American economies are experiencing significant growth, leading to increased demand for reliable power sources. Many South American countries have underdeveloped or limited grid infrastructure, particularly in remote areas. Diesel generators provide essential primary power for communities and businesses in these locations. As South American economies expand, industrial activity and urbanization are on the rise. These sectors rely on diesel engines for power generation, particularly for backup power during grid disruptions. South America is rich in natural resources, and the mining sector heavily utilizes diesel engines to power operations in often off-grid locations. Compared to alternative power solutions like large-scale solar or wind farms, diesel generators offer a more affordable and readily available option for many South American applications. Their reliability and ease of deployment make them a practical choice for various power needs. While there’s growing interest in renewable energy in South America, large-scale integration with existing grids is still under development. Diesel engines continue to bridge the gap, providing reliable power until renewable infrastructure matures. In conclusion, South America’s developing economies, limited grid infrastructure, and focus on affordability and reliability make it a significant market for diesel power engines. However, the market is also likely to evolve as environmental concerns and renewable energy integration gain traction.