A distributed control system (DCS) is an industrial automation solution widely utilized in process industries. Its main function is to enable plant control through a network of supervisory and control elements distributed throughout the facility. DCS is commonly employed in industries like food & beverages, pharmaceuticals, and petrochemicals, where it efficiently manages manufacturing processes. These industries often involve continuous or complex batch-oriented production methods, and DCS effectively oversees and optimizes these processes for enhanced efficiency and productivity.

The global distributed control system market is estimated to grow from USD 19.9 Billion in 2023 to USD 26.7 billion by 2028; it is expected to record a CAGR of 6.1% during the forecast period.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=239430160

Distributed Control System Market Dynamics

Driver: Growing use of renewable energy for power generation

Restraint: Sluggish response time of distributed control system

Opportunities: Development of power grid market

Challenges: Slowdown in mining industry in Asia Pacific, Americas, and Africa

Company Profiles:

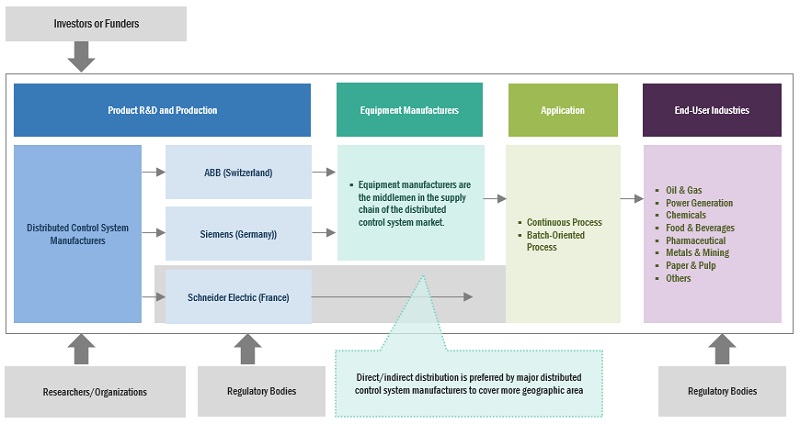

Company profiles give a glimpse of the key players in the market with respect to business overview, financials, product offerings, and recent developments. In this edition of the distributed control system manufacturers such as Siemens (Germany), ABB (Switzerland), Schneider Electric (France), Emerson Electric Co. (US), and Honeywell International Inc. (US) among others, have been profiled as they have emerged as key players in recent months due to various partnerships & collaborations, product launches, contracts & agreements and merger & acquisitions in the distributed control system market. These strategic developments have challenged the status quo of industry leaders, and it was prudent to analyze the changing business landscape.

Recent Market Developments: Recent developments help identify the market trends and growth strategies adopted by market players. In the current analysis, there are new developments in contracts & agreements, investments & expansions, new product launches, partnerships, collaborations, and mergers & acquisitions, which have taken place during 2018–2023.

- In February 2023, ABB has recently launched the ABB Ability Symphony Plus distributed control system (DCS) in order to support digital transformation in the power generation and water industries. The latest Symphony Plus version will further enhance customers digital journey, through a simpler and secure OPC UA1 connection.

- In October 2022, Emerson have signed a five-year agreement with LANXESS, a specialty chemicals company. Emerson will help drive the adoption of advanced automation technologies and enable more efficient project implementation that will allow LANXESS to achieve shorter time-to-market for new products.

- In October 2022, Emerson has introduced a new version of its DeltaV distributed control system (DCS). DeltaV DCS Version 15 assists facilities in digitally transforming operations through increased production optimization and improved operator performance.

- In December 2022, Valmet will deliver the Valmet DNA Automation System (DCS) and the Valmet IQ Quality Control System (QCS) to Schumacher Packaging’s Myszków facility in Poland for the repair of the board machine 2. The aim is to increase the plant’s output efficiency and product quality. The installation is set to begin in May 2023.

- In November 2022, Rockwell Automation launched the FLEXHA 5000TM I/O family, which provides high availability and continues the advancement of the PlantPAx Distributed Control System (DCS). It provides easily integrated design, allowing clients to observe more efficient engineering time, consistent operations, and optimized footprints.

Request Sample Pages of the Report: https://www.marketsandmarkets.com/requestsampleNew.asp?id=239430160

Asia Pacific is expected to be the largest distributed control system market during the forecast period. The Asia Pacific region, comprising major economies such as China, India, Japan, and South Korea, are witnessing significant growth for due to rapid regional industrialization, urbanization, and economic growth, which are leading to the installation of new distributed control systems. Rising investments in power generation industry is expected to support market grow in Asia Pacific as it can attribute to the increasing demand for power from various areas, which in turn increases the demand for the distributed control system. Moreover, the automation is increasing in APAC across various industries because of the rising need for high-quality products and increasing production rates.