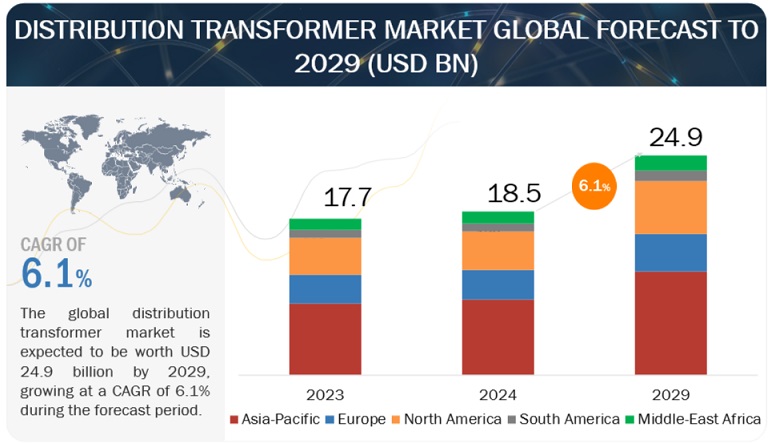

According to a research report “Distribution Transformer Market by Mounting (Pad, Pole, Underground), Phase (Three and Single), Power Rating (Up to 0.5 MVA, 0.5-2.5 MVA, 2.5-10 MVA, Above 10 MVA), Insulation(Oil Immersed, Dry), End User and Region – Global Forecast to 2029″, the market size for distribution transformers is projected to reach approximately USD 24.9 billion by the year 2029, as compared to the estimated value of USD 18.5 billion in 2024, at a Compound Annual Growth Rate (CAGR) of 6.1% over the forecast period. The global distribution transformer market is fueled by a confluence of factors driving growth and shaping industry trends. The need for reliable and efficient power delivery necessitates investments in expanding power grids to reach new consumers and upgrading aging infrastructure. This translates to a demand for new distribution transformers across various regions. As the global population rises and economies develop, the overall demand for electricity is steadily increasing. This necessitates an expansion of distribution networks and transformers to cater to the growing power needs of residential, commercial, and industrial sectors.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=85091015

The trend towards urbanization, particularly in developing regions, leads to a surge in new residential and commercial buildings. Additionally, rising living standards globally translate to increased appliance ownership and higher power consumption, driving the demand for distribution transformers. The growing focus on renewable energy like solar and wind power requires grid modernization and smart transformers to manage the inherent variability of these sources. This integration creates a demand for technologically advanced transformers equipped with sensors and communication capabilities. Environmental concerns are prompting a shift towards energy-efficient solutions in the power sector. Manufacturers are developing new distribution transformers with lower energy losses and improved environmental footprints, creating a demand for these advanced models. These drivers, combined with the need for replacing aging transformers and the increasing adoption of smart grid technologies, are shaping the global distribution transformer market towards a future focused on efficiency, reliability, and sustainability.

Industrial segment, by End User, to hold the second-largest market in distribution transformer market.

The industrial segment secures the second-largest market share within the distribution transformer market by end user segment, driven by several key factors. Industrial facilities are powerhouses, consuming significant amounts of electricity to operate machinery, production lines, and various industrial processes. These facilities require high-capacity distribution transformers (often exceeding 10 MVA) to efficiently step down the voltage from the medium voltage grid to usable levels for their equipment. The sheer volume of electricity utilized by the industrial sector translates to a substantial demand for distribution transformers. Industries encompass a wide range of activities, each with specific power requirements. Distribution transformers cater to these diverse needs. For instance, heavy manufacturing might necessitate high-power transformers, while automation and control systems in factories might require transformers with specific voltage regulation capabilities. This diversity in industrial applications fuels the demand for a wide range of distribution transformer types and capacities. Many industrial facilities, particularly in established economies, might have aging distribution infrastructure, including transformers nearing the end of their lifespan. Replacing these transformers with newer, more efficient models presents a significant market opportunity within the industrial segment.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=85091015

Up to 0.5 MVA segment, by Power Rating, to be the third-largest market segment.

The 0.5 MVA segment captures a significant market share within the power rating segment of the distribution transformer market for several compelling reasons. 0.5 MVA transformers occupy a sweet spot, offering a balance between capacity and affordability. They are suitable for a diverse range of applications, including supplying power to mid-sized commercial buildings like office complexes, shopping centers, or hotels, catering to multi-unit residential buildings like apartment complexes or condominiums, providing power to small industrial facilities with moderate power requirements. This versatility allows them to address the needs of various end users, contributing to their significant market share. Compared to higher-capacity transformers (above 10 MVA), 0.5 MVA models are more economical. For applications where the power demand doesn’t necessitate a high-capacity transformer, a 0.5 MVA model offers a cost-effective solution while delivering sufficient power for the needs. This economic advantage makes them an attractive choice for many end users. The 0.5 MVA rating represents a well-established standard within the distribution transformer market. Manufacturers often produce a wider range of models within this segment compared to higher or lower ratings. This standardization and readily available options make them a convenient choice for many utilities and end users.

Middle East & Africa to emerge as the third-largest distribution transformer market.

The Middle East & Africa (MEA) region holds the third-largest market share in the global distribution transformer market due to a confluence of factors driving significant growth potential. Many countries such as the UAE, Saudi Arabia, South Africa in the MEA region are undergoing rapid infrastructure development initiatives. This includes expanding power grids to reach previously un-electrified areas, improving existing infrastructure, and establishing new industrial zones. These projects necessitate a substantial number of distribution transformers for efficient power delivery. The MEA region is experiencing rapid urbanization, with a rising population migrating to cities. This urbanization fuels the need for new residential and commercial buildings, all requiring distribution transformers to function. Additionally, the overall population growth translates to an increased demand for electricity, further propelling the market for transformers. Governments in the MEA region are increasingly recognizing the importance of reliable electricity access for economic development and improving living standards. This is leading to increased investments in the power sector, including grid expansion projects and electrification initiatives in rural areas. These investments directly stimulate the demand for distribution transformers. Many MEA countries are actively pursuing economic diversification plans, with a focus on developing their industrial sectors. This industrial growth will lead to an increased demand for high-capacity transformers to cater to the power requirements of new factories and production facilities.

Ask Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=85091015

Key Players

Key players in the global distribution transformer market include Hitachi Energy Ltd. (Switzerland), Eaton Corporation (Ireland), Schneider Electric (France), Siemens Energy (Germany), Toshiba Energy Systems & Solutions Corporation (Japan), Mitsubishi Electric Corporation (Japan), Hyosung Heavy Industries Co., Ltd. (South Korea), CG Power and Industrial Solution Ltd. (India), and Hammond Power Solutions (Canada).