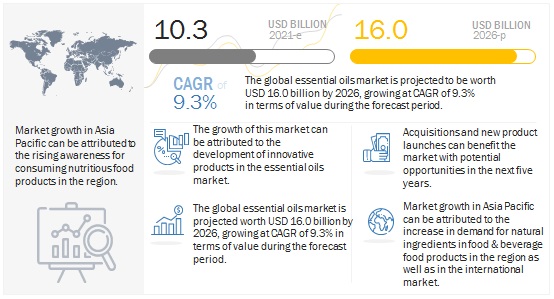

The global essential oils market size is estimated to be valued USD 10.3 billion in 2021 and is expected to reach a value of USD 16.0 billion by 2026, growing at a CAGR of 9.3% in terms of value during the forecast period. In terms of volume, the essential oils market is estimated to account for 253.2 KT in 2021 and is expected to reach at 345.4 KT by 2026, growing at a CAGR of 6.4% during the forecast period. Factors such as an growth in awareness toward preventive healthcare, improvements in the standard of living and rise in double income households, along with increase in demand for aromatherapy are some of the factors driving to the growth of the essential oils market.

Report Objectives:

- To define, segment, and estimate the size of the essential oils market with respect to its type, application, method of extraction, and region

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the complete value chain and influence of all key stakeholders, such as manufacturers, suppliers, and end users.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players and comprehensively analyze their core competencies

- To analyze the competitive developments, such as new product launches, acquisitions, joint ventures, in the essential oils market

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=119674487

Opportunity: Rise in demand for natural ingredients

The demand for “all-natural ingredients” has lately been on the rise mainly due to the growing awareness about the benefits of natural ingredients and the increasing disposable income, which results in people spending more money on expensive natural products. The increasing health consciousness among people fuels this demand further by leading to more liberal spending on good-quality natural products, which would provide long-lasting results.

Several manufacturers across all industries are developing new ways of incorporating natural and healthy ingredients in their formulations for providing maximum benefits to the consumers. ‘Natural claims’ largely influence the purchase of food & beverage and cosmetic applications. Essential oils provide that ‘all natural’ flavor and fragrance across several industries such as food & beverage, cosmetics, feed, and home care, among others, which creates several opportunities for this market.

Challenges: Prevalence of synthetic/adulterated products

There is an important concern of adulteration in essential oils, which has become a major challenge for this market. Not all essential oils are created equal and may contain synthetic adulterants. These adulterated essential oils do not possess the properties of essential oils and merely act as fragrance products.

Clove leaf by type drives the essential oils market during the forecast period

By type, the clove leaf segment is projected to have the highest CAGR during the forecast period. Clove is the dried, unopened flower bud obtained from a middle-sized, evergreen tree. It is found in the Molucca islands in Indonesia. It consists of various nutrients such as protein, volatile oil, non-volatile ether extract (fat), and crude fiber besides mineral matter and vitamins C & A. Globally, India is the largest country to import clove, followed by Singapore and the US. The distillation method of extraction is used to yield a substantial amount of clove leaf oil.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=119674487

Asia Pacific is the fastest-growing market during the forecast period in the global essential oils market

The growth in population, rise in disposable incomes, rapid urbanization in the Asia Pacific region, and an increase in demand for high-quality food & beverage products are the key factors that have encouraged the demand for essential oils. Substantial growth is witnessed in countries, such as China, India, and Japan, due to the increase in the purchasing power of the population and demand for protein-rich meat diets. Moreover, consumers prefer opting for products that have high nutritional content and offer health benefits and exotic taste.

This report includes a study on the marketing and development strategies, along with a study on the product portfolios of the leading companies operating in the essential oils market. It consists of the profiles of leading companies such Cargill, Inc. (US), DuPont (US), Koninklijke DSM N.V. (Netherlands), dôTERRA International LLC (US), Givaudan SA (Switzerland), Young Living Essential Oils (US), The Lebermuth Company, Inc. (US), Symrise (Germany), Sensient Technologies Corporation (US), Essential oils of New Zealand (New Zealand), Firmenich SA (Switzerland), International Flavors & Fragrances Inc. (US), Mane (France), ROBERTET SA (France), Rocky Mountain Oils LLC (US), BIOLANDES SAS (France), Falcon (India), Farroti (Italy), Indian Essential Oils (India), and Ungerer Limited (UK).

Recent Developments:

- In February 2020, IFF completed the previously announced merger of IFF and DuPont’s Nutrition & Biosciences (“N&B”) business, pursuant to a Reverse Morris Trust transaction today. The combined company would continue to operate under the name IFF. Shares of the combined company’s common stock would trade on the New York Stock Exchange under the symbol “IFF.”

- In October 2020, dōTERRA announced several new essential oil products and diffusers, including three new wellness programs designed to help people focus on their specific health goals. The new products were announced in September at Pursue 2020.

- In February 2021, Givaudan acquired Myrissi (France). The acquisition of Myrissi would enable Givaudan’s long-term Fragrance & Beauty strategy; their expertise in AI would support Givaudan in proposing new organoleptic approaches to consumers.