Preventive maintenance is gaining prominence as planned inspections and medical device maintenance help avoid adverse incidents and medical-device related accidents. Regular maintenance services provided by OEMs, ISOs, or in-house service technicians ensure safe, efficient, and long-lasting use of medical devices. The growing focus on implementing preventive maintenance strategies among healthcare organizations is expected to offer growth opportunities for service providers in the coming years.

This market is expected to reach USD 8.93 Billion by 2022 from USD 6.64 Billion in 2017, at a CAGR of 6.1% during the forecast period. The growth of the market is attributed to rising focus on preventive maintenance.

Read More Details | Download the PDF Brochure@ http://bit.ly/2y0yj26

The objectives of this study are as follows:

- To define, describe, and forecast the European medical equipment maintenance market by device, service, service provider, contract type, end user, and country.

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges).

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the market.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

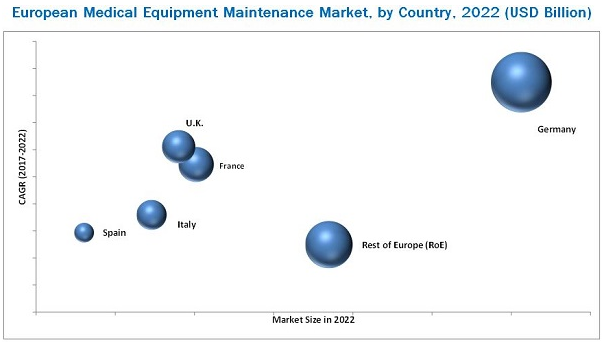

- To forecast the size of the market segments with respect to European countries, namely, Germany, Italy, U.K., France, Spain, and Rest of Europe (RoE).

- To profile key players and comprehensively analyze their product portfolios, market positions, and core competencies.

- To track and analyze competitive developments such as agreements, partnerships, collaborations, mergers & acquisitions, and expansions in the European medical equipment maintenance market

By end user, the European medical equipment maintenance market is segmented into public-sector organizations and private-sector organizations. In 2017, the public-sector organizations’ segment is expected to account for the largest share European medical equipment maintenance market. The dominance of public healthcare in most of the European economies, as well as the increase in value-based procurement of medical equipment are the major factors driving the growth of this end-user segment.

Restraints:

High Initial Cost and Significant Maintenance Expenditure

Opportunities:

Innovation in Service Offerings & Use of IoT

Emergence of ISOS

Challenge:

Survival of Players in A Highly Fragmented and Competitive Market

Market Trends:

Market Consolidation

Preference for Multi-Vendor Contracts

Equipment Maintenance Insurance Tools for Imaging Centers

Read the Detailed Article on “European Medical Equipment Maintenance Market – Forecasts to 2022”, Here..!

The medical equipment maintenance market is highly competitive with the presence of both OEMs and ISOs. GE Healthcare (U.S.), Koninklijke Philips N.V. (Netherlands), Siemens Healthineers (Germany), Toshiba Medical Systems Europe (Germany), and Drägerwerk AG & Co. KGaA (Germany) are some of the leading OEMs; whereas, TBS Group S.p.A. (Italy), Alliance Medical Group (U.K.), Pantheon Group (Italy), Technologie Sanitarie S.p.A. (Italy), Avensys UK Ltd. (U.K.), and Grupo Empresarial Electromédico (Spain) are some of the leading ISOs operating in the European medical equipment maintenance market.

Target Audience for this Report:

- Medical equipment manufacturers and suppliers

- Independent services organizations (ISOs)

- Healthcare institutions (hospitals and outpatient clinics)

- Academic institutes and universities

- Distributors and suppliers of electromedical equipment and services

- Research and consulting firms