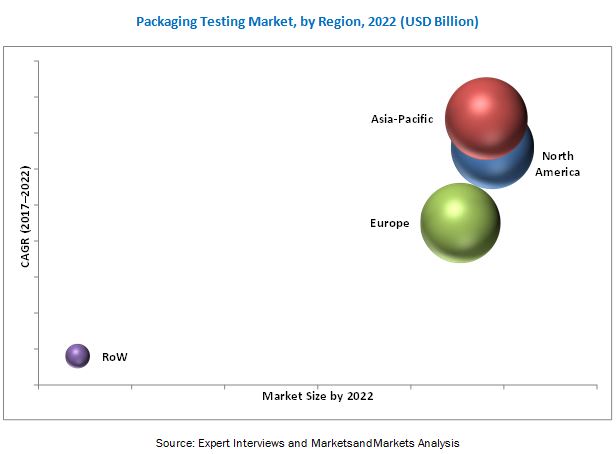

The global packaging testing market has grown exponentially in the last few years. The market size is projected to reach USD 14.64 Billion by 2022, growing at a CAGR of around 12.0% from 2017. Emerging countries such as India, China, Japan, Brazil, and Argentina are the potential primary markets of the industry. Factors such as rising awareness and demand for sustainable packaging, increasing retail industry with increasing demand for packed products, stringent regulatory environment, and the emergence of new technologies are the major driving factors for this market. Moreover, the requirement for longer shelf-life of products helps to drive the growth of the packaging testing industry.

The global market, based on type, is segmented into physical, chemical, and microbiological. The physical segment dominated the market with the largest share in 2016 since the determination of physical properties of a product is an essential application for packaging testing. This is followed by chemical testing of packaging which is conducted for the determination of chemical properties such as corrosion level and overall composition of the material, monitoring product quality, toxic detection, contaminants detection, and to meet other regulatory standards.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=123283179

The packaging testing market, based on material type, is segmented into glass, plastic, paper & paperboard, metal, and others which include wood, polystyrene, bioplastic, cloth, and other flexible packaging. The plastic segment accounted for the largest share of this market in 2016. The paper & paperboard segment is projected to grow at the highest CAGR from 2017 to 2022. The market for paper packaging testing is growing with an increase in the use of paper & paperboard due to their easy and abundant availability, lower cost, and environment-friendly nature.

The global market, based on technology, is segmented into physical tests, spectroscopy & photometric-based, chromatography-based, and others which include chemical test, molecular, and isotope methods. The physical tests segment dominated the market in 2016. The spectroscopy & photometric-based segment is projected to grow at the highest CAGR from 2017 to 2022. Physical tests not only assure reliability, quality, and performance of packaging products but also help improve the efficiency of product performance, thereby resulting in cost savings.

The global market, based on end-use industry, is segmented into food & beverage, agrochemicals, pharmaceuticals, personal care, and others which include various industries such as textile, automobile, transportation, environmental, and other consumer goods. The pharmaceutical segment dominated the market in 2016. The food & beverage segment is projected to grow at the highest CAGR due to an increase in food safety awareness among consumers and growth in the number of packaging and labeling mandates in various regions.

Request for Customization: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=123283179

The requirement for packaging testing has grown in the region in recent years, owing to an increase in consumer awareness in the Asia-Pacific region regarding the safety of packaging for various products, especially food, healthcare, and cosmetics. The growth in this market is fueled by the economic development in countries such as China and India. China is a potential market for packaging testing due to various factors such as the expanding population, rising disposable income levels, growing export of packaging materials, and increasing consumer demand for convenience foods.

This report includes a study of marketing and development strategies, along with the product portfolios of leading companies. It includes the profiles of leading companies such as SGS S.A. (Switzerland), Bureau Veritas SA (France), Intertek Group Plc. (U.K.), Eurofins Scientific SE (Luxembourg), and TÜV SÜD AG (Germany).

Target Audience:

- R&D institutes

- Technology providers

- Packaging testing service providers

- Intermediary suppliers

- Wholesalers

- Dealers

- Consumers

- End users

- Retailers