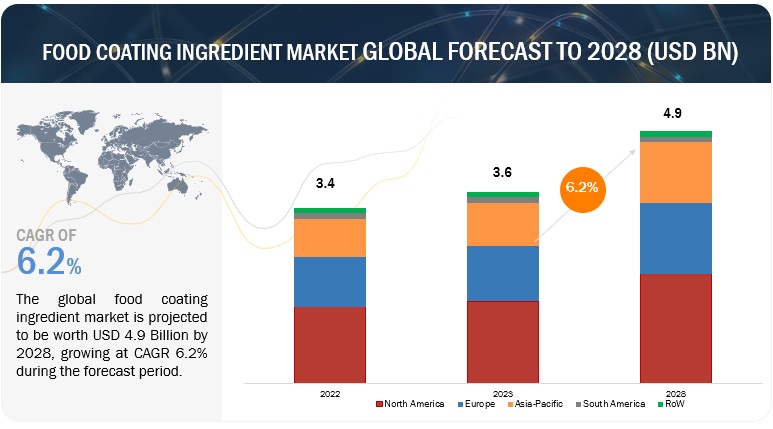

The global food coating ingredients market is estimated at USD 3.6 billion in 2023 and is projected to reach USD 4.9 billion by 2028, at a CAGR of 6.2% from 2023 to 2028. The food coating equipment market is estimated at USD 5.7 billion in 2023 and is projected to reach USD 7.7 billion by 2028, at a CAGR of 6.3% from 2023 to 2028.

The elemental function of coating food is to protect the food from spoilage; but, over the past few decades, food coating has developed an entirely new definition in industrial food processing. Food coating is now carried out to enhance the appearance and impart additional flavors to traditional food products. For these reasons, packaged food manufacturers are taking advantage of food coating ingredients to improve the quality and, at the same time, increase the shelf life of their products. This enables manufacturers to increase sales and reduce waste during distribution and in the supply chain network. Food coating manufacturers are also focusing on the development of healthy and nutritious coating ingredients such as oats, sugar-free ingredients, gluten-free ingredients, and others to tackle the growing concerns of obesity, diabetes, and allergies among consumers.

Food Coating Market Trends

- Health-Conscious Consumer Preferences: Consumers were increasingly seeking healthier food options, leading to a rise in demand for food coatings that are gluten-free, low-fat, and made from natural ingredients. Coatings made from alternative flours (such as chickpea or almond flour) and plant-based proteins were gaining popularity.

- Innovation in Coating Technologies: Food coating manufacturers were investing in research and development to introduce innovative coating technologies. These included advanced coating systems designed to improve texture, flavor, and shelf life while reducing oil absorption during frying.

- Demand for Convenience Foods: The growing demand for convenient food options was driving the market for coated convenience foods such as frozen chicken nuggets, fish sticks, and pre-coated frozen vegetables. Manufacturers were focusing on developing coatings that maintain crispiness after reheating, catering to the needs of busy consumers.

- Expansion in the Snack Industry: The snacking trend was fueling the growth of the food coating market, particularly in the snack food segment. Coatings were being used to enhance the taste and texture of a wide variety of snack products, including chips, pretzels, and popcorn.

- Clean Label Products: Clean label trends were influencing the food coating market, with consumers demanding transparency in ingredient sourcing and processing methods. Manufacturers were responding by offering coatings made from simple, recognizable ingredients with no artificial additives or preservatives.

Food Coating Market Opportunities: Growing investment opportunities to develop new food coating technology

With the increasing influence of globalization, consumers are becoming more aware of various food trends. Concurrently, food manufacturing companies are expanding their operations worldwide, thanks to trade liberalization. This expansion has prompted food manufacturers to explore new and untapped markets. Even domestic players are enhancing their product offerings to keep up with the escalating competition in the market. Notably, manufacturers in China, India, and Japan have developed their own food coating equipment that rivals the quality of imported equipment or the offerings of established market leaders in coating technology. To gain a competitive advantage in both domestic and international markets, companies prioritize innovation in their food coating technology. They employ cutting-edge technologies such as electrostatic coating, which achieves a remarkable 98% coating coverage on all products, surpassing traditional flavoring methods and further enhancing coating efficiency.

To cater to the changing demand from food manufacturers, food coating equipment manufacturers focus on the R&D of various technologies used in equipment. The key features required by food manufacturers include better and more large-scale handling of food products, increasing the shelf life of products, improved production capacity, and reducing the wastage of ingredients.

Technological Advancements: Advancements in food coating technology, such as improved coating formulations, production methods, and equipment, can enhance the efficiency and quality of coated food products, potentially driving market growth.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=168532529

Based on application, confectionery products is projected to witness the highest CAGR in food coating equipment market during the forecast period.

There has been a rising demand for confectionery products in the European region, which presents a mature market for the confectionery industry. Hence, this region is expected to show slow growth as compared to other regions. Confectionery is generally high in calories and carbohydrates but poor in micronutrients. Industry statistics show that, in terms of sales generated, the Western European region dominated the worldwide confectionery sector. Better-for-you products have become more popular as a response to health issues. The clean label movement has impacted the confectionery market because of the demand for colors that are derived naturally. Many food firms have announced plans to reformulate their products to swap out artificial additives and streamline ingredient lists to meet this growing demand. Few companies have made acquisitions, with companies having a strong bakery processing equipment portfolio to enhance their products as well. Gea Group (Germany) has firmly moved into the bakery sector with the acquisition of Comas and Imaforni, the leading suppliers of demanding industrial processing equipment and solutions for the cakes, pies, cookies and biscuits, crackers, and snacks industry.

The North America region accounted for the largest share, in terms of value, of the global food coating ingredients market in 2023.

The food coating ingredient market in North America is witnessing substantial growth, primarily fueled by the thriving food processing industry. Furthermore, the region’s rising health concerns, including obesity and heart ailments, have led to a heightened emphasis on consuming healthy products such as low-sugar breakfast cereals. In response to this demand, food coating ingredient manufacturers have introduced products with reduced sugar content and allergen-free formulations. These factors have provided a significant boost to the North American food coating ingredient industry.

Top Companies in the Food Coating Market

Major key players operating in the food coating market Cargill Incorporated (US), Kerry Group plc. (Ireland), ADM (US), Ingredion (US), Newly weds Food (US), Associated British Foods PLC (UK), Tate & Lyle (UK), Solina (France), Idan Foods (US), POPLA International, Inc. (US).