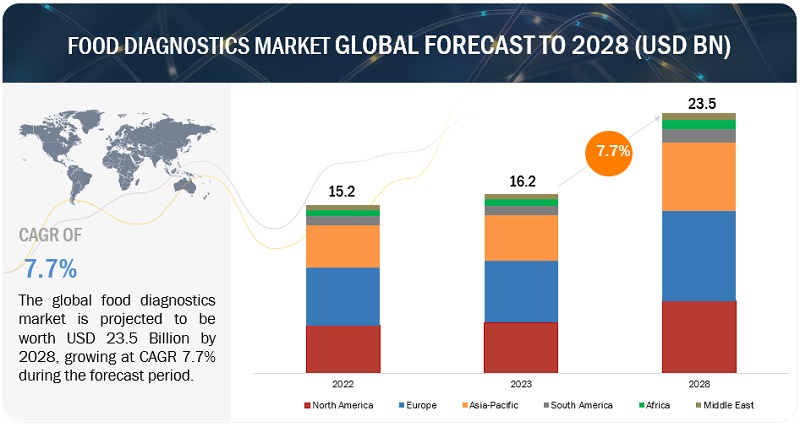

The global food diagnostics market is estimated to be valued at USD 16.2 billion in 2023 and is projected to reach USD 23.5 billion by 2028, at a CAGR of 7.7% from 2023 to 2028. The demand for food diagnostic solutions has surged as consumers and regulatory bodies become more vigilant about food safety and quality. This market is characterized by a wide range of products, including systems, test kits, and consumables, each contributing significantly to its expansion. The growth can be attributed to the need for rapid and accurate detection of allergens, contaminants, pathogens, and adulterants in food products. One of the major factors driving the food diagnostics market is the globalization of the food trade. As the food supply chain extends across international borders, the need for robust diagnostic systems has grown exponentially. Food producers and exporters must comply with various food safety regulations and quality standards in different countries. This has led to increased adoption of advanced diagnostic tools to ensure that products meet diverse and often stringent requirements, fostering market growth.

However, alongside these opportunities, the food diagnostics market also faces challenges due to the differences in food safety and quality laws across countries. Navigating the complex regulatory landscape can be daunting for businesses, and harmonizing global food safety standards remains a significant challenge.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=225194671

Based on food tested, the meat, poultry, and seafood segments are estimated to account for the largest market share of the food diagnostics market.

Foodborne illnesses and contamination outbreaks are a recurring global concern, which often find their origin in these protein-rich categories. Ensuring the safety and quality of meat, poultry, and seafood is crucial to prevent widespread health hazards and maintain consumer confidence. Furthermore, meat, poultry, and seafood play a pivotal role in the food industry, contributing significantly to the market’s revenue. As staples in diets worldwide, they command a substantial portion of consumer expenditure, making their quality and safety of utmost importance. Thus, monitoring these items for pathogens, allergens, chemical residues, and other contaminants is crucial for both consumer safety and the industry’s economic stability.

Globalization of the food supply chain has made it necessary to address international regulations and standards. Compliance with stringent regulations, such as Hazard Analysis and Critical Control Points (HACCP), ISO standards, and national food safety guidelines, is mandatory for manufacturers and exporters. This has driven the need for advanced food diagnostics techniques in meat, poultry, and seafood.

Based on the testing type, the safety segment is anticipated to dominate as well as grow at the highest CAGR in the food diagnostics market.

The safety sub-segment is poised to dominate and experience the highest growth within the testing type segment of the food diagnostics market. Food safety testing is a critical component of the global food industry, ensuring that the products we consume are safe for human consumption. In recent times, it has become even more prioritized than food quality testing, given the increasing concerns over foodborne illnesses and outbreaks. Food safety testing involves various techniques to detect contaminants, pathogens, and chemical residues in food products, protecting consumers from potential health hazards. Contaminants, such as pathogens like Salmonella and E. coli, as well as chemical residues and allergens, can pose severe health risks. Hence, stringent regulatory requirements and increased awareness have propelled the demand for robust testing methods. Moreover, in the era of globalization and complex supply chains, food safety testing has gained prominence to prevent outbreaks, safeguard public health, and maintain the reputation of food manufacturers.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=225194671

By site, the outsourcing facility segment is estimated to dominate as well as grow at the highest CAGR in the food diagnostics market.

Outsourcing facilities refer to third-party laboratories and testing centers that food manufacturers and distributors contract to conduct food safety and quality assessments, instead of relying on in-house testing. Outsourcing facility offers cost-effective solutions for businesses. Establishing and maintaining an in-house testing facility demands significant capital investment, technical expertise, and ongoing operational costs. Outsourcing allows companies to save on these expenditures and allocate resources more efficiently. Additionally, the complexity of food safety regulations and standards has grown significantly in recent years. Outsourcing facilities specialize in staying up to date with these evolving regulations and can provide expertise that is often challenging to maintain inhouse. This ensures that food products are compliant with stringent requirements.

Moreover, outsourcing enhances flexibility and scalability. Food manufacturers can adapt to fluctuations in demand by adjusting the scope of testing services as needed, without the constraints of in-house capabilities. As food safety remains a paramount concern for consumers and regulatory bodies, the convenience, cost-efficiency, and specialized expertise offered by outsourcing facilities make them a preferred choice, thus fueling their substantial growth within the food diagnostics market.

Asia Pacific is estimated to grow at the highest CAGR in the global food diagnostics market.

Asia Pacific region is experiencing a significant population expansion, urbanization, and a rise in disposable income. The region’s rapidly growing population, particularly in countries like China and India, has led to increased food consumption. With this upsurge in demand, the need for effective food safety and quality testing has become paramount. As more people migrate to urban centers, the demand for processed and packaged foods is increasing. This burgeoning demand for food products necessitates stringent quality control and safety measures, which are driving the growth of the food diagnostics market.

Furthermore, the food supply chain in the Asia Pacific is becoming increasingly complex, with globalization and the expansion of international trade. This complexity necessitates comprehensive testing and monitoring throughout the supply chain, from farm to fork. As a result, food diagnostics solutions are gaining importance in ensuring the safety and quality of products.

Leading Food Diagnostics Companies:

Bio-Rad Laboratories Inc. (US), Thermo Fisher Scientific Inc. (US), Shimadzu Corporation (Japan), Neogen Corporation (US), BioMerieux (France), Agilent Technologies Inc. (US), Merck KGaA (Germany), QIAGEN (Germany), Bruker (US), and Danaher (US) are among the key players in the global food diagnostics market. To increase their company’s revenues and market shares, companies are focusing on launching new products, developing partnerships, and acquiring other companies. The key strategies used by companies in the food diagnostics market include geographical expansion to tap the potential of emerging economies, strategic acquisitions to gain a foothold over the extensive supply chain, and new product launches as a result of extensive research and development (R&D) initiatives.