The digital cockpit market size is projected to reach 67 million units by 2030 from 45 million units in 2024, at a CAGR of 7.0%.

The digital cockpit has rapidly gained popularity among consumers owing to the increasing demand for personalization, multi-display solutions, enhanced safety and convenience, and the integration of AI in cockpit features. OEMs continuously work towards enhancing personalization using AI, which adds an enhanced and immersive driving experience for the driver. In AI-based personalization, the vehicle learns the driver’s preferences and changes the information displayed accordingly. Mercedes-Benz MBUX infotainment uses AI and enhances cockpit personalization. Intelligent voice control, ADAS Systems, and multi-display solutions are adding personalization enhancement.

There is a noticeable trend towards multi-display solutions, enabling seamless infotainment, navigation, and vehicle diagnostics integration. Integrating touch, voice, and gesture controls enables intuitive user interactions.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=230221625

“Mid/High-End Cockpit is anticipated to witness growth by 2030.”

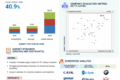

The entry-level cockpit is defined as a cockpit with only a digital infotainment display; on the other hand, a mid/high-end cockpit features two or more 2 screens (infotainment, cluster, co-passenger, rear entertainment, HUD, and others). Multi-display systems will integrate digital displays, Bluetooth, IoT, and voice and gesture controls with smartphones. This blend of network technologies and processing power will enhance seamless infotainment through visual imagery. Globally, the current penetration of mid-end cockpits is ~58%, and that of high-end cockpits is ~16% in 2023 and is expected to grow at a promising growth rate till 2030. Models with mid-end cockpits include the VW Tiguan, Peugeot 2008, Mercedes GLC class, Ford Explorer, Toyota Camry, Honda Accord, and others that feature digital infotainment and cluster display. The high-end cockpit models include the Cadillac Escalade, Mercedes Benz- EQS SUV & EQE, BMW 1 series, BMW iX, and BMW 7 series, which feature integrated display solutions.

“Asia Pacific is expected to be the largest market during the forecast period.”

Asia-Pacific regions hold the major share of the digital cockpit market. China leads the market with ~ a 44% share in the global digital cockpit market. The penetration of the digital cockpit in China was ~68% in 2023 and is expected to reach 93% by 2030, owing to the growing demand for enhanced user experience, ADAS integration, and AI personalization features. In China, models launched with discrete cluster + center console display are ZEEKR 009, new NIO ES6, GAC Hyper GT, Denza N7, Geely Galaxy L6 and ZEEKR 007. Models with the multi-screen display are the Rising F7, 2024 New Voyah Dreamer, Haval Fierce Dragon MAX and Kia EV5 and integrated display are Jiyue 01 and Geely Galaxy E8. The penetration of digital cockpits in APAC (excluding China) is ~35% and is expected to reach ~73% by 2030, owing to the increasing sales of EVs, demand for enhanced safety while driving, and multi-display solutions.

Key Players

The top OEMs in the market are General Motors (USA), Stellantis N. V. (Netherlands), Honda Motors (Japan), Volkswagen (Germany), Ford (USA), Xpeng (China), Zeekr (China), Rivian (US), Tata Motors (India) and so on. These companies adopted new product launches, acquisitions, partnerships, collaborations, and other key strategies to gain traction in the digital cockpit market.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=230221625