The global battery production machine industry is evolving rapidly due to growing demand for energy storage systems, electric vehicles (EVs), and portable electronics. As advancements in battery technologies continue, battery production machinery must adapt to meet the increasing need for efficiency, precision, and scalability. The future of the industry will be shaped by cutting-edge innovations, market growth, and the challenges faced by key players in the sector.

Trends Shaping the Future of Battery Production Machine Industry

- Automation and Smart Manufacturing: The integration of Industry 4.0 technologies, including robotics, automation, and IoT, is transforming battery production processes. Automated production lines are improving efficiency, minimizing human error, and enhancing overall output quality. Smart factories are becoming a norm, with sensors and AI-powered systems enabling predictive maintenance and process optimization.

- Sustainability and Eco-friendly Manufacturing: As environmental concerns continue to rise, manufacturers are under pressure to adopt sustainable practices. Battery production machinery is now being designed with energy efficiency and waste reduction in mind. Recycling capabilities, eco-friendly materials, and reduced energy consumption are central to the future of this industry.

- Solid-state Battery Production: Solid-state batteries, which are expected to replace conventional lithium-ion batteries, require specialized machinery for production. The shift towards solid-state technologies presents new opportunities for companies investing in advanced production equipment capable of handling these emerging battery types.

- Modular and Flexible Production Systems: To meet the varying demands of different battery types and sizes, manufacturers are developing modular and flexible production machines. These systems can be easily reconfigured to produce different types of batteries, improving adaptability and reducing production downtime.

Battery Production Machine Market Growth Projection

The battery production machine market is projected to grow significantly in the coming years, driven by increased demand for energy storage systems, particularly in the EV and renewable energy sectors. According to market analysts, the global battery production machine market size is projected to reach USD 37.59 billion in 2029 from USD 13.26 billion in 2024, with a CAGR of 23.2%. This growth is fueled by the rising adoption of electric vehicles, grid energy storage, and portable electronics.

As countries around the world push towards carbon neutrality, investments in battery production facilities are skyrocketing. Government incentives for electric vehicles and renewable energy projects are further accelerating market growth, creating a favorable environment for the expansion of battery production machinery.

Top Companies in Battery Production Machine Industry

Several prominent companies are leading the charge in the battery production machine industry, leveraging innovation to develop cutting-edge solutions:

- Manz AG: A key player in manufacturing equipment for lithium-ion batteries, Manz AG focuses on providing high-tech solutions for battery production lines, including electrode coating and cell assembly machines.

- Wuxi Lead Intelligent Equipment Co., Ltd.: Wuxi Lead is a major manufacturer of intelligent equipment for battery production. They specialize in providing turnkey solutions for battery production lines, including automation and digitalization solutions.

- Hitachi High-Tech: Known for its advanced technological solutions, Hitachi High-Tech provides battery production machinery that integrates automation and precision engineering to improve production speed and accuracy.

- Siemens: With a strong focus on smart manufacturing, Siemens offers automation and digital solutions for the battery production sector. Their technology supports predictive maintenance, operational efficiency, and high-quality production.

- Kataoka Corporation: Specializing in battery assembly equipment, Kataoka Corporation is known for its high-precision machinery, which is crucial for the production of small, efficient batteries used in consumer electronics and electric vehicles.

Regional Analysis

The battery production machine market is expanding across key regions, with growth primarily concentrated in Asia-Pacific, Europe, and North America:

- Asia-Pacific: This region holds the largest market share, driven by the dominance of China, South Korea, and Japan in battery manufacturing. Countries in this region are making significant investments in gigafactories and EV battery production lines. China is the global leader in lithium-ion battery production and continues to expand its production capacity rapidly.

- Europe: Europe is witnessing substantial growth in the battery production machine market due to increased demand for EVs, energy storage, and clean energy initiatives. Germany, in particular, is investing heavily in battery production machinery for its automotive industry. European Union policies aimed at reducing carbon emissions are further boosting the market.

- North America: The U.S. is emerging as a significant player, with numerous investments in battery production facilities to support the growing EV market. American companies are increasingly investing in automation technologies and smart manufacturing to keep up with global competition.

Opportunities in the Battery Production Machine Industry

- Electric Vehicle Demand: As the global EV market continues to grow, the demand for advanced battery production machines will rise. Manufacturers that develop highly efficient and scalable production systems will benefit from this surge in demand.

- Renewable Energy Storage: The need for large-scale battery systems for energy storage, particularly for solar and wind energy projects, presents an opportunity for companies involved in battery production machinery. Energy storage systems are critical to achieving renewable energy goals, driving demand for efficient production machines.

- Government Incentives and Investments: Various governments are providing incentives to support the production of batteries for EVs and renewable energy. This creates opportunities for manufacturers to expand their capacity and develop new production technologies.

Challenges Facing the Battery Production Machine Industry

- High Capital Investment: Battery production machines require significant capital investments, which can be a barrier for small and medium-sized enterprises (SMEs). Establishing high-tech production lines, especially for new battery technologies, comes with substantial costs.

- Raw Material Supply Chain Issues: The availability and cost of key raw materials, such as lithium, cobalt, and nickel, can significantly affect the battery industry. Production machinery may need to adapt to future battery chemistries that reduce reliance on these materials.

- Technological Complexity: Battery production machinery must continually adapt to new technologies, such as solid-state batteries or next-generation lithium-ion cells. The complexity of designing flexible and scalable machinery that meets evolving industry demands is a challenge for manufacturers.

Battery Production Machine Industry Segmentation

The battery production machine industry is segmented by machine type, application, and end-use:

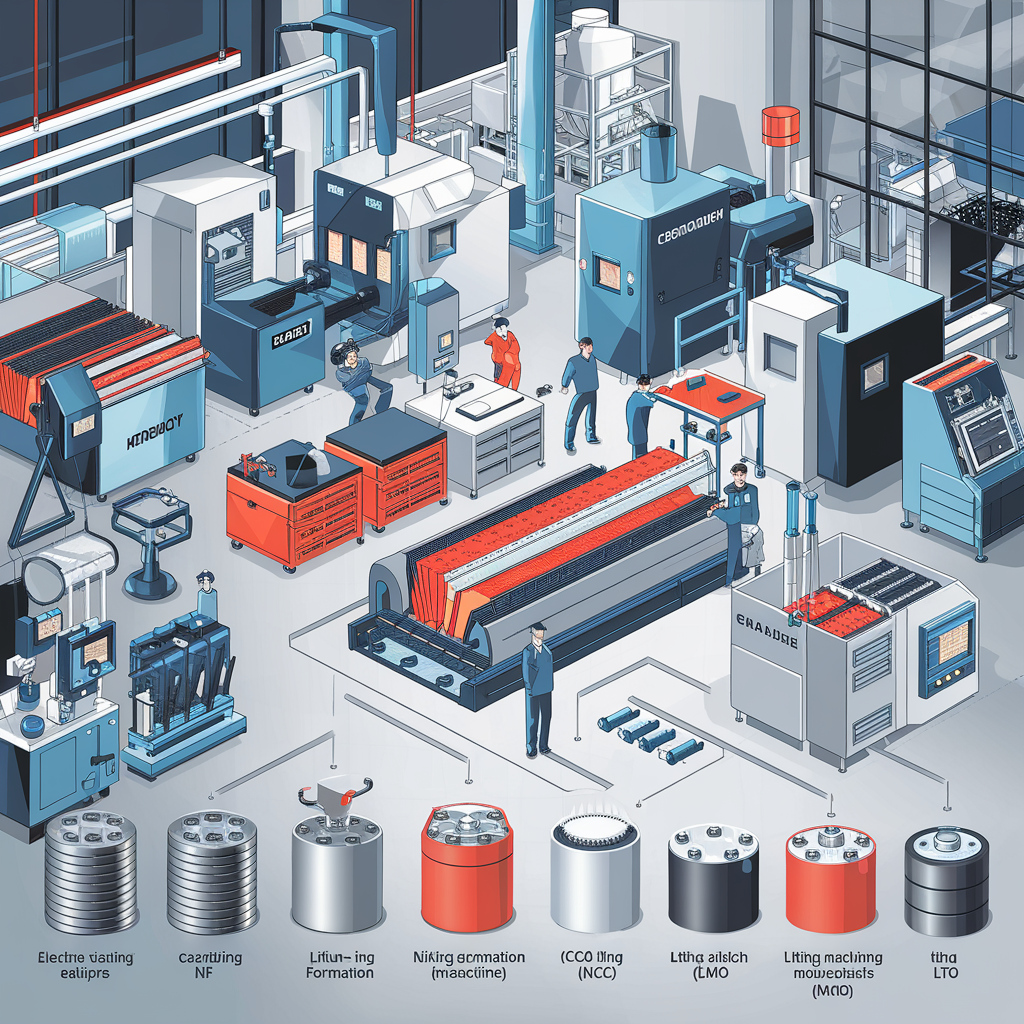

- By Machine Type: Machines for electrode manufacturing, cell assembly, module/pack assembly, and formation & testing.

- By Application: Lithium-ion batteries, solid-state batteries, lead-acid batteries, and other battery types.

- By End-use: Electric vehicles, consumer electronics, renewable energy storage, industrial applications, and grid energy storage.

The future of the battery production machine industry is promising, with advancements in automation, eco-friendly production, and the development of new battery technologies driving the market forward. Growth opportunities are vast, especially in electric vehicles and renewable energy storage. However, manufacturers must navigate challenges such as high capital investment, raw material constraints, and the need for ongoing innovation. The companies that successfully adapt to these trends will shape the future of the industry and capitalize on the growing global demand for batteries.