New Revenue Pockets:

The global generator sales market is projected to reach USD 34.5 billion by 2030 from an estimated USD 23.1 billion in 2023, at a CAGR of 5.9% during the forecast period. The growth of the generator sales market is driven by growing demand for constinuous power supply and evolving new technologies such as fuel cell generators.

Increasing demand for uninterrupted and reliable power supply, rapid industrialization owing the demand for generators, and rise in the awareness of the benefits offered by fuel cell generators are expected to drive the demand for-backup power generation. The rapidly expanding manufacturing sector, especially in Asia Pacific, has fueled the demand for generators and power generation systems.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=47544335

This report segments the generator sales market based on the fuel type into diesel, gas, LPG, biofuel, coal gas, producer gas, gasoline. During the projected timeframe, the Diesel segment is anticipated to dominate the generator sales market, serving as the primary contributor. This dominance can be attributed to the escalating urbanization and industrialization in emerging economies.

This research report categorizes the generator sales market by fuel type, end user, power rating, application, design, sales channel, and region

On the basis of fuel type:

- Diesel

- Gas

- LPG

- Biofuel

- Coal Gas

- Producer Gas

- Fuel Cell

On the basis of application:

- Standby

- Prime & Continuous

- Peak Shaving

On the basis of end- user industry:

- Industrial

- Utilities/Power Generation

- Oil & Gas

- Chemicals & Petrochemicals

- Mining & Metals

- Manufacturing

- Marine

- Construction

- Others (Agriculture, Transportation, and Aerospace & Defense)

- Commercial

- IT & Telecom

- Healthcare

- Data Centers

- Others (Hotels, Shopping Complexes, Malls, and Public Infrastructure)

- Residential

On the basis of by power rating:

- Up To 50 KW

- Up To 10 KW

- 11–20 KW

- 21–30 KW

- 31–40 KW

- 41–50 KW

- 51–280 KW

- 281–500 KW

- 501–2,000 KW

- 2,001–3,500 KW

- Above 3,500 KW

On the basis of by sales channel:

- Direct

- Indirect

On the basis of by sales channel:

- Stationary

- Portable

On the basis of region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

The generator sales market, by power rating, has been broadly classified into 50 kW, 51–280 kW, 281–500 kW, 501–2,000 kW, 2,001–3,500 kW, and above 3,500 kW. The up to 50 kW is the second fastest growing segment. Generators within this power range typically operate at a consistent engine speed, typically between 1,500 and 3,600 rpm. In particular, generators with power ratings ranging from 5 to 50 kW are commonly employed for personal and residential purposes. Additionally, generators below 50 kW power rating find utility in delivering power backup solutions for small-scale commercial activities, including telecom, retail, and various other sectors.

Key Market Players

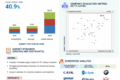

Caterpillar (US), Cummins (US), Rolls-Royce Holdings (UK), Weichai Group (China), Kohler Co. (US), Atlas Copco (Sweden), Denyo (Japan), Wacker Neuson (Germany), Generac (US), Doosan (South Korea), Greaves Cotton Limited (India), Kirloskar Oil Engines Ltd. (India), Siemens (Germany), Aksa Energy (Turkey), Wärtsilä (Finland), Honda (Japan), Briggs & Stratton (US), ABB (Germany), Yanmar (Japan), Cooper Corp (India), Jubaili Bros (UAE), Southwest Products (US), Sterling & Wilson (India), and Siam Telemach (Thailand).

Ask Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=47544335

Asia Pacific is expected to account for the largest market size during the forecast period.

Asia Pacific is expected to be the largest and fastest-growing market due to the high demand for power products in China and India. The generator sales market in Asia Pacific is witnessing rapidly growing population, which drives the need for infrastructure development, industrial expansion, and increased power demand. Generators are essential for meeting the rising electricity needs in residential, commercial, and industrial sectors. Governments across the Asia Pacific region are investing heavily in infrastructure development, including energy, transportation, and telecommunications. These projects require reliable power sources, and generators are often used as temporary or backup power solutions during the construction phase and as standby power for critical infrastructure.