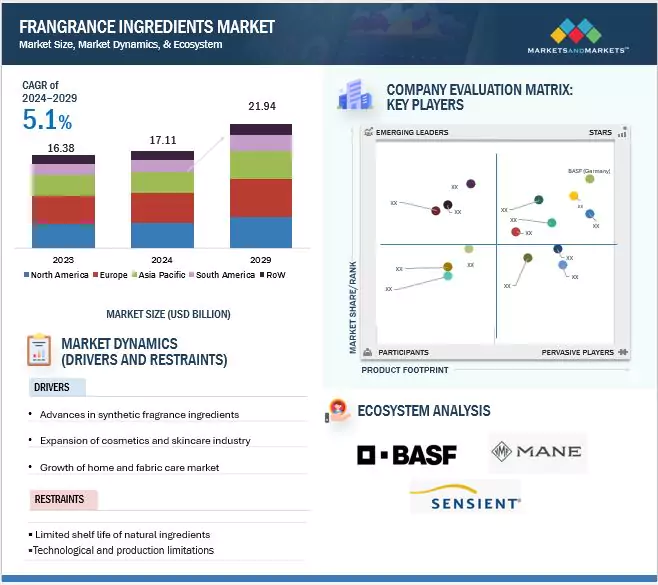

The global fragrance ingredients market is estimated at USD 17.11 billion in 2024 and is projected to reach USD 21.94 billion by 2029, at a CAGR of 5.1% from 2024 to 2029. As consumer priorities shift towards products with fragrances, fragrance ingredients gain traction. This alignment with preference drives demand among individuals seeking good-smelling products. The rise in demand for personal care products, cosmetics, food and beverage, etc. accelerates the growth of fragrance ingredients.

Fragrance plays a crucial role, not only in enhancing product appeal but also in masking less desirable odors from fatty acids, oils, and surfactants typically found in formulations. Essential oils, such as citrus, lavender, eucalyptus, tea tree, and other floral oils, are highly valued as they provide natural aromas, act as preservatives, and offer skin benefits. Ingredients like linalool, geraniol, limonene, citronellol, and citral are widely appreciated in cosmetics, with a noticeable industry shift toward minimally processed natural options over synthetic chemicals, which are increasingly scrutinized for potential health risks.

Fragrance Ingredients Market Drivers: Advances in synthetic fragrance ingredients

The high cost of natural essences has led 95% of perfume makers to mix synthetic ingredients with essential oils to reduce expenses. Over the past decade, the demand for synthetics has surged, causing a sharp decline in the quality of pure “attars” and natural essences. Furthermore, the improper preservation of reserves in the upper Himalayas has led to a 60-70% loss of natural resources, exacerbating the need for synthetic alternatives. This trend, as reported by Hindustan Times on November 13, 2024, significantly boosts the fragrance ingredients market by increasing the reliance on synthetic components to meet growing demand.

Fragrance Ingredients Market Opportunities: Shift toward interactive content to boost user engagement and experience

Technology has become integral to every phase of perfume manufacturing, enhancing everything from the creation of fragrance concepts to production and packaging. Innovations in technology improve communication, streamline processes, increase precision, and help ensure the quality and safety of perfumes.

Several recent advancements highlight this trend:

- Osmo, a Google spin-off, has developed AI to create aroma molecules for fragrances. By combining machine learning, data science, olfactory neuroscience, psychophysics, electrical engineering, and chemistry, Osmo offers a multidisciplinary approach to fragrance creation.

- Givaudan’s Myrissi AI technology predicts the emotional perception of fragrances. This innovation is part of Givaudan’s broader 2025 strategy to enhance customer-centered digital solutions and further personalize fragrance experiences.

- Givaudan also introduced the Well&Be multisensorial fragrance well-being platform, which integrates neuroscience, consumer intelligence, and AI technologies. The platform aims to connect the emotional layers of fragrance with well-being, catering to the evolving needs of diverse and health-conscious consumers.

These technological advancements not only contribute to the development of more personalized and effective fragrance solutions but also shape the future of the fragrance industry by blending sensory science with cutting-edge digital innovations.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=105416890

Based on the application, the personal care segment is estimated to account for the largest market share of the fragrance ingredients market.

Under current regulations, any product applied to the human body to enhance attractiveness is classified as a cosmetic. This includes fragrance products like perfume, cologne, and aftershave, as well as other body care items containing fragrance ingredients, such as shampoos, shower gels, shaving creams, and body lotions. Interestingly, even “unscented” products can contain small amounts of fragrance to mask undesirable odors from other ingredients without imparting a strong scent.

Fragrance-containing products that are applied to the body with therapeutic intentions—such as relieving muscle pain, soothing headaches, aiding sleep, or treating specific conditions—are classified as drugs or as both cosmetics and drugs, depending on their claims. In addition, many fragranced products that aren’t directly applied to the body, like laundry detergents, fabric softeners, dryer sheets, and room or carpet fresheners, fall under the jurisdiction of the Consumer Product Safety Commission (CPSC), given their household application and safety considerations.

The APAC market is projected to grow the fastest in the fragrance ingredients market.

In recent years, Chinese-style fragrances have gained significant popularity among consumers, celebrated for the unique sensory experience and cultural allure they provide. These fragrances, deeply rooted in traditional Chinese scent formulas, have been reimagined and modernized through the use of advanced technology, making them more accessible and appealing to contemporary tastes.

The segment of Chinese-style incense has particularly emerged as one of the fastest-growing categories within the broader fragrance market. By updating and refining ancient fragrance formulas, brands have successfully bridged the gap between tradition and modern preferences, leading to wider market acceptance. As a result, this revitalized category has experienced a surge in sales, driven by growing interest in the rich cultural heritage and calming, exotic aromas these fragrances evoke. This trend reflects a broader consumer desire for unique, culturally resonance experiences, contributing to the expansion of the market for Chinese-style fragrances and incense products.

Leading Fragrance Ingredients Manufactures

Key players operating in the fragrance ingredients market include BASF (Germany), MANE SA (France), dsm-firmenich (Switzerland), Givaduan (Switzerland), International Flavors and Fragrances (US), Sensient Technologies (US), Takasago International Corporation (Japan), Robertet Fragrances, Inc. (France), Kao Chemicals (Japan), and Symrise (Germany). These players in this market are focusing on increasing their presence through expansion and collaboration. These companies have a strong presence in North America, Asia Pacific, and Europe.