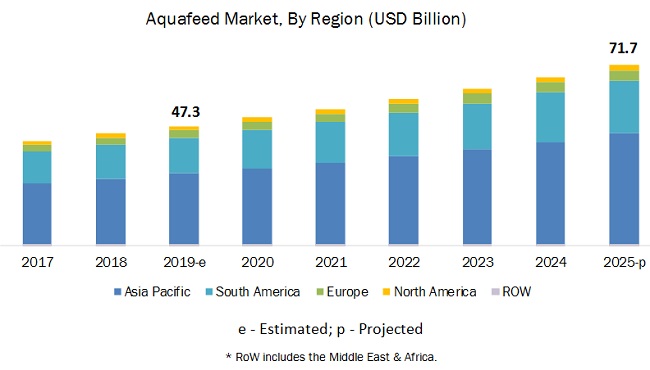

The aquafeed market is estimated to be valued at USD 47.3 billion in 2019 and is projected to reach USD 71.7 billion by 2025, growing at a CAGR of 7.2% during the forecast period. The growth in the global consumption of aquafeed has continued to be significant due to the growing aquaculture industry. Global aquaculture production has grown rapidly during the past decades, contributing significant quantities to the world’s fish and seaweed supply for human and animal consumption.

Aquaculture is an important part of the economic development of many countries and has been received positively by several governments seeking to boost their countries’ economic performance; many policies have been introduced in support of the sector. Across the globe, aquaculture operations have expanded from small pond farms to wide, complex businesses, which produce a large number of aquatic species. Thus, to feed these large reared fish population and maintain their health and growth, a nutritionally balanced diet is required.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1151

On the basis of ingredient, the aquafeed market has been segmented into soybean, corn, fishmeal, fish oil, additives, and others. Fishmeal is projected to be the fastest-growing segment during the forecast period, due to the increase in production of high-value species, which require fishmeal as an important component of their feed. Fishmeal is also among the major aquatic protein and lipid sources available in the animal feed market.

By species, the aquafeed market is segmented into fish, crustaceans, mollusks, and other species. Since fish is the cheapest and most easily digestible animal protein, the consumption of fish is projected to be growing in the future, globally. Therefore, the demand for aquafeed is growing at a significant rate during the projection period. Also, the farming of different types of fish is growing to fill the gap between demand and supply.

The aquaculture industry is increasing due to the various initiatives taken by the governments of the respective countries globally. In India, the Ministry of Agriculture is responsible for the planning, monitoring, and funding of centrally sponsored developmental schemes related to fisheries and aquaculture in all Indian states. It provides an opportunity for the aquaculture industry of India to focus on enhancing the aquaculture sector in the country. The United Nations Food and Agriculture Organization (FAO) estimated that about 75% of the global commercial fish stocks were fished or caught, as opposed to the sustainable yield in 2014. The various programs of the United States Agency for International Development (USAID), such as USAID-funded Ba Nafaa project in West Africa, the USAID-funded Fisheries Improved for Sustainable Harvest (FISH) Project in the Philippines, the Management of Aquatic Ecosystems through Community Husbandry (MACH) project in Bangladesh, the SUCCESS fisheries management programs in three West African countries, and the Global FISH Alliance in the spiny lobster fishery of Honduras, have improved the productivity of fisheries globally. The initiatives mentioned above provide support and flexibility to manufacturers in the aquafeed industry and provide them the opportunity to expand in the market.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=1151

Key questions addressed by the report:

- Which region will account for the highest share in the aquafeed market?

- How would the fluctuations in ingredient prices impact the growth of the aquafeed market globally?

- What is the level of support offered by governments across these countries to aquafeed manufacturers?

- Which are the key players in the market and how intense is the competition?