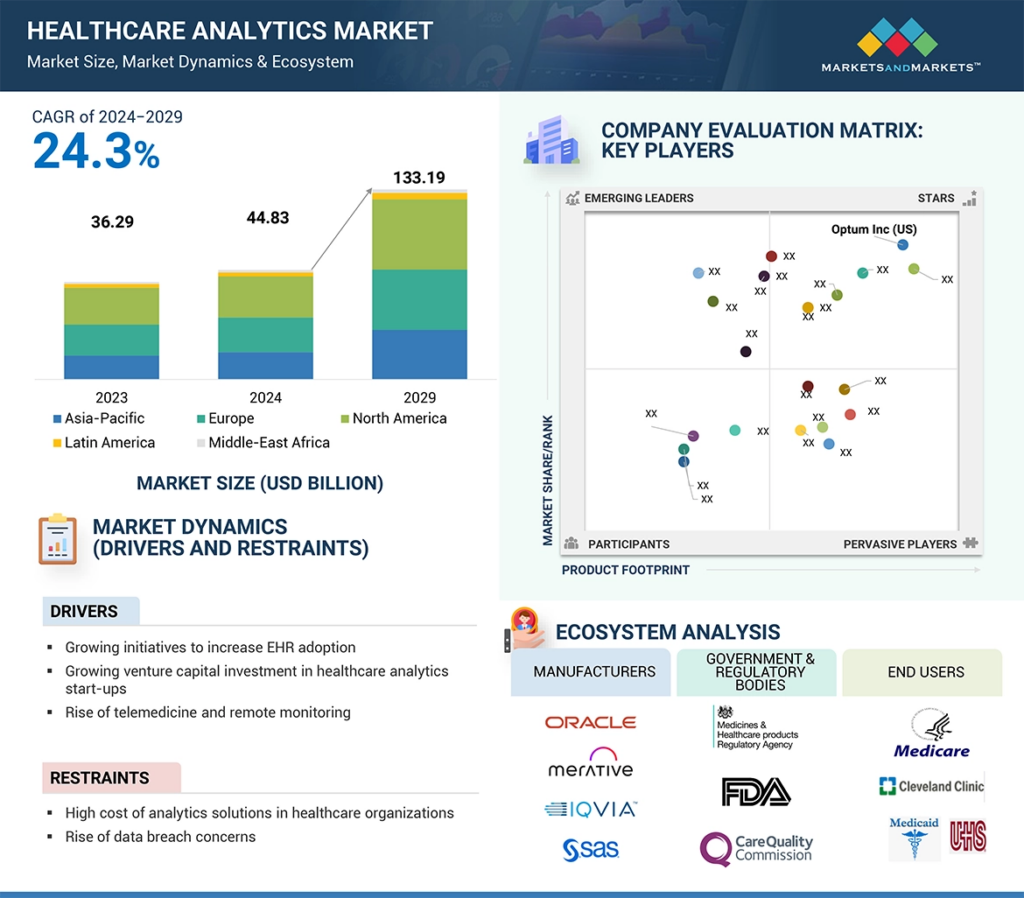

The global Healthcare Analytics market, valued at US$36.29 billion in 2023, is forecasted to grow at a robust CAGR of 24.3%, reaching US$44.83 billion in 2024 and an impressive US$133.19 billion by 2029. The growth of the market is primarily driven by increasing initiatives to boost EHR adoption, growing demand for data-driven decision-making, cost management, and operational efficiency, regulatory mandates aimed at improving value-based care, and rising venture capital investments in healthcare analytics startups. Furthermore, the integration of advanced technological solutions, such as generative AI, into healthcare analytics systems is accelerating market growth. Predictive analytics and machine learning algorithms, for example, can process up to 60 claims per hour, significantly enhancing payer efficiency and improving patient care.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=905

Browse in-depth TOC on “Healthcare Analytics Market”

516 – Tables

505- Figures

410 – Pages

DRIVER: Government initiatives to increase EHR adoption

The EHR Incentive Programs under Medicare and Medicaid provide substantial financial support to eligible professionals (EPs), offering a significant incentive for the adoption and meaningful use of electronic health records (EHR). For instance, under the NY Medicaid EHR Incentive Program, EPs can receive up to USD 63,750 over six years of participation, with an initial payment of USD 21,250 in the first year and USD 8,500 for each of the following five years. Though capped at 2021, these incentives serve as a powerful driver for the widespread adoption of EHR systems.

Moreover, the global shift towards EHRs is transforming healthcare, with over 95% of US hospitals adopting these systems. Countries like Norway and South Korea report EHR adoption rates above 90%, while developing nations like India are seeing growth, currently at around 25%. Government initiatives in these countries are driving EHR adoption and investing in telemedicine to enhance access, especially in rural areas. As more providers implement EHRs, the demand for healthcare analytics solutions rises, allowing for better data interpretation and improved patient outcomes. This interconnected growth propels both EHR systems and analytics forward, leading to greater efficiency in healthcare delivery.

Restraints: Rising data breach concerns

Data breaches pose a significant restraint on the healthcare analytics market, primarily due to the elevated costs and heightened regulatory scrutiny associated with data security failures. With the average price of a healthcare data breach reaching USD 9.77 million in 2024, organizations are compelled to allocate substantial resources towards cybersecurity measures, diverting funds from innovation and analytics initiatives. This financial burden holds back investment in advanced analytical tools and technologies and fosters a culture of risk dislike, hindering the adoption of data-driven decision-making processes.

Request Sample Pages : https://www.marketsandmarkets.com/requestsampleNew.asp?id=905

OPPORTUNITY: increasing adoption of cloud-based analytical solutions

The adoption of cloud-based analytical solutions is creating significant growth opportunities for healthcare analytics. With real-time updates capturing every data change, cloud platforms provide scalable storage, computing power, and advanced machine-learning capabilities, making them ideal for healthcare analytics. As demand for these solutions rises among healthcare organizations, several market players are developing cloud capabilities within their revenue cycle management systems. For instance, Fujitsu’s recent launch of a new cloud-based platform facilitates the secure collection and utilization of health-related data, automating the conversion of medical records to comply with HL7 FHIR standards.

CHALLENGE: Dearth of skilled personnel

A shortage of in-house experts capable of translating large data volumes into actionable insights impedes the adoption of new technologies, potentially limiting the growth of the healthcare analytics market. The skill gap and inadequate data management capabilities limit the sector’s growth. A report by the American Hospital Association indicates a potential shortfall of up to 3.2 million healthcare workers by 2026, worsened by high turnover rates—resignations among healthcare professionals surged from approximately 400,000 per month in 2020 to 600,000 by May 2023. Furthermore, McKinsey projects a shortfall of 200,000 to 450,000 registered nurses for direct patient care by 2025, underscoring the urgent need for skilled professionals.

Global Healthcare Analytics Market Ecosystem Analysis

The healthcare analytics market is highly competitive, with a large number of intermediaries involved. The market includes Healthcare Analytics vendors, ranging from large enterprises to niche players, that develop and provide innovative solutions deriving insights. These vendors navigate regulatory frameworks set by government bodies like the FDA, EMA, and Health Canada, ensuring compliance with standards and guidelines related to data security, interoperability, and patient privacy. Moreover, government bodies such as the Department of Health and Human Services (HHS) and the National Health Service (NHS) influence market dynamics through policy decisions, funding initiatives, and regulatory oversight. Meanwhile, end-users, comprising healthcare providers such as hospitals, clinics, payers demand for Healthcare Analytics solutions to streamline workflow efficiency, and enhance patient care delivery. This interconnected ecosystem relies on collaboration, innovation, and adherence to regulatory requirements to ensure the seamless integration and effective utilization of Healthcare Analytics solutions within the healthcare landscape.

KEY PLAYERS IN THE HEALTHCARE ANALYTICS MARKET INCLUDE

- Merative (US)

- Optum, Inc. (US)

- SAS Institute Inc. (US)

- Oracle (US)

- Citiustech Inc (US)

- Inovalon (US)

- Mckesson Corporation (US)

- MedeAnalytics, Inc. (US)

- Cotiviti, Inc. (US)

- Exlservice Holdings, Inc. (US)

- Wipro (India)

- Apixio. (US)

- Komodo Health, Inc. (US)

- Health Catalyst (US)

- CVS Health (US)

- Veradigm (US)

- Enlitic (US)

- HealthEC LLC (US)

Request 10% Customization: https://www.marketsandmarkets.com/requestCustomizationNew.asp?utm=even&id=905

North America accounts the largest share of Healthcare Analytics market in 2023.

The Healthcare Analytics market is segmented by region into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. In 2023, North America accounted for the largest share of the market as the region is more focused on adopting value-based care delivery models. Healthcare providers and payers in the US are investing significantly in healthcare IT solutions, including analytical solutions. Moreover, increased regional spending on advanced technologies and healthcare expenditures positions this region at the forefront of adopting innovative solutions.

Recent Developments of Healthcare Analytics Market

- In April 2023, Thermo Fisher Scientific Inc. launched Neon NxT Electroporation system used for the enhancement of genome editing. The system is suitable for transfection of challenging cell lines.

- In February 2022, Polyplus acquired e-Zyvec, a provider of DNA design and production services for tailor-made DNA vectors. The acquisition aims to expand the portfolio in DNA vector engineering.