The growing population is one of the major factors contributing to the increased demand for food. This, in turn, has led to an increase in the area harvested for important food crops such as rice, soybean, barley, and wheat, especially in the developing regions. For instance, according to the FAO, the production of corn is projected to increase by nearly 600% to reach 1.2 billion MT by 2027. A majority of this production is expected to arise from countries such as China and Brazil. Increase in the harvested area would further lead to increased use of agricultural equipment. Thus, the demand for agricultural equipment is projected to grow, especially in developing countries, in the next decade.

Farm mechanization reduces the drudgery associated with traditional farming methods and contributes to increased land productivity, enhances the timely preparation of land, and reduces the cost of production. Tractors are one of the major agriculture equipment used globally. Different types of implements are attached to tractors during various phases of farming, which efficiently reduces the production cost and time. Thus, the demand for tractor-mount equipment has been increasing, globally.

What are the driving factors for the growth of the tractor implements market?

- Increased need to reduce post-harvest on-field losses

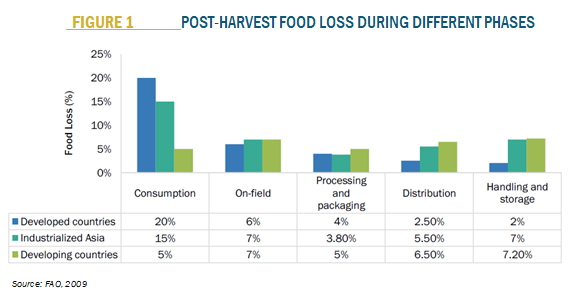

According to the FAO, 1.3 billion tons of food is wasted per year. There is a need to reduce such waste so that it would optimize the availability of food and enhances food security. The reduction in food waste will also improve the real income level for all the consumers, along with increasing the income of the producers. Post-harvest food loss is one of the major reasons for food loss. Post-harvest food loss can be defined as the measure of qualitative and quantitative loss of food from harvesting to consumption.

According to the FAO (2009), in developed countries, the major reason for food waste is the consumption pattern of the population. Whereas in developing countries, a large amount of food was wasted on the field and at the time of handling and storage. The use of adequate machinery and proper tractor-implement combination, according to the phase of cultivation, would help in reducing the loss of waste at the time of harvesting or post harvesting. Thus, the benefit of using mechanized implements on fields with the aim of reducing food waste drives the market for farm equipment as well as tractor-mounted equipment

- Shortage of manpower due to high labor cost

Due to urbanization and the development of more and more industries in the urban areas, the rural labor is getting attracted by the new work opportunities developed for them, which offers higher wages as compared to the wages paid in agricultural farms. As the labor supply for agricultural practices has decreased, the hired farmworkers charge a higher amount. According to the data by the USDA, it has been observed that the rate of hourly wages by the farmworkers is increasing per year. For instance, the hourly wage for directly hired farmworkers in the US was USD 12.09 in 2011, which has reached USD 13.32 in 2017.

According to the International Crops Research Institute for the Semi-Arid Tropics (ICRISAT), the Indian agricultural sector has also experienced a large drop in agriculture and farm labor availability, even though it is one of the major contributors for GDP growth of the country. The agricultural workforce in the country in 2004-2005 was 259 million; which had experienced a drop of 30.57 million to reach 228 million in 2011-2012. This significant drop was because of the higher opportunities in the non-farm sector—such as manufacturing—that supports the labor force with higher wages and regular incomes. The high wages for laborers in the manufacturing sector encouraged the farm laborers to increase their prices. The situation resulted in technological integration in the agricultural field so that the shortage of human labor can be compensated by the introduction of machinery.

Based on region, the tractor implements market is segmented into North America, Europe, Asia Pacific, South America and Rest of the World. Asia Pacific accounted for the largest market size in 2017 and is projected to grow at the highest CAGR of 6.40% during the forecast period. Growth in the agricultural sectors of countries such as India, Japan, and China has been promoting the growth of the market in the region.

The tractor implements market is mainly consolidated, with many global players holding a significant share of the market. Companies such as Deere & Company (US), Kubota Corporation (Japan), AGCO (US), Mahindra & Mahindra (India), SDF (Italy), and Kuhn Group (France) have shown immense interest to introduce and manufacture various tractor implements that are offered to farmers to speed up their operational activities.