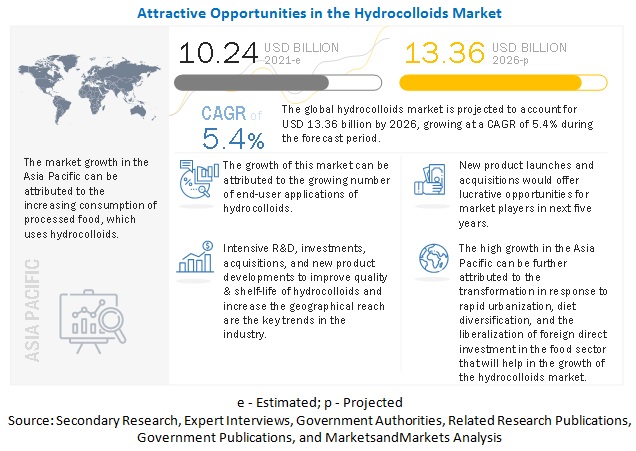

The global hydrocolloids market was valued at USD 9.73 billion in 2020 and is projected to reach USD 13.36 billion by 2026, at a CAGR of 5.4% during the forecast period. Hydrocolloids are widely used in applications, such as bakery, confectionery, meat & poultry, beverages, dairy & frozen products, and others, such as baby food and prepared food. The growth of the hydrocolloids market is driven by the rising demand for healthier and natural food ingredients from the food industry.

The key market drivers are R&D and innovation, consumer preference for functional dairy products, and multifunctionality of hydrocolloids in food & beverage products. However, adherence to international quality standards; regulations regarding food additives, such as stabilizers; and fluctuations in raw material prices pose as market restraints. Changing consumer lifestyles causing a rise in demand for convenience food and immense potential in the emerging markets for hydrocolloids are significant growth opportunities for the market.

Download PDF brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1231

The segmentation considered for this report on hydrocolloids is based on sources, types, applications, functions, and regions that constitute the key markets. Hydrocolloids segmented on the basis of sources include botanical, microbial, animal, seaweed, and synthetic. On the basis of types, hydrocolloids have been segmented into gelatin, pectin, carrageenan, xanthan gum, agar, gum Arabic, locust bean gum, carboxymethyl cellulose, alginates, guar gum, and microcrystalline cellulose. Hydrocolloids segmented on the basis of functions include thickeners, stabilizers, gelling agents, fat replacers, and coating materials. On the basis of applications, the market has been segmented into food & beverages, cosmetics & personal care products, and pharmaceuticals. By region, the hydrocolloids market has been segmented into North America, Europe, Asia Pacific, and the Rest of the World (RoW).

COVID-19 is projected to have a considerable impact on the growth of the hydrocolloids market. In the optimistic scenario, it is assumed that the impact would be positive, and manufacturers are willing to buy different types of hydrocolloids, such as agar, carrageenan, pectin, and gelatin, considering the rise in demand for cosmetics and pharmaceuticals. In addition, as the trade barriers would be relaxed to rebuild economies, trading will be easier.

The gelatin segment dominated the market for hydrocolloids by type in 2020. This is attributed to its varied application across the food industry. It is commonly used in candies, desserts, marshmallows, and ice creams, where it functions as a texturant and gelling agent. However, the market for gelatin is estimated to grow at a slow rate as consumers are drifting toward gelatin substitutes due to the risks of transmitting animal diseases, especially Bovine Spongiform Encephalopathy (BSE). Due to this, the market has been shifting toward some of its alternatives, such as guar, carrageenan, and pectin.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=1231

The North American market accounted for the largest share in 2020. Factors influencing this market dominance include high demand for functional dairy products, convenience foods, higher per capita consumption of baked goods, and the presence of major players here. This market is projected to be driven by the increase in consumer demand for healthy convenience food due to their busy lifestyles. Further, increasing occurrences of obesity and cardiac diseases have led consumers to demand functional food products, thereby driving the market for hydrocolloids.